Universal Basic Income: Pros, Cons, and Its Impact on the Economy

AFFILIATE DISCLOSURE:

This article contains affiliate links. We may receive a commission for purchases made through these links, at no extra cost to you. We only recommend products and services we believe will genuinely help you achieve your financial goals.

Universal Basic Income: A Bold Economic Safety Net or a Costly Gamble?

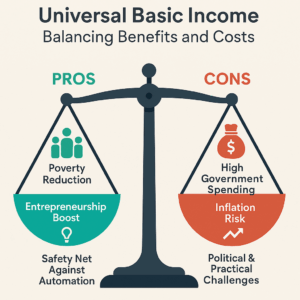

Explore how Universal Basic Income could reduce poverty, spur entrepreneurship, and respond to automation — but face soaring costs, inflation risks, and political hurdles.

Introduction

Universal Basic Income is a revolutionary economic concept gaining traction worldwide. It proposes that every citizen receives a fixed, unconditional sum of money regularly, regardless of employment status. Proponents argue it could reduce poverty, simplify welfare systems, and adapt to automation-driven job losses. Critics warn of high costs, potential disincentives to work, and inflationary risks.

In this article, we’ll explore:

- What Universal Basic Income is and how it works

- The pros and cons of Universal Basic Income

- Its potential economic impact

- Real-world Universal Basic Income experiments and results

- FAQs and key takeaways

By the end, you’ll understand whether Universal Basic Income could be a viable solution for modern economies.

What Is Universal Basic Income (UBI)?

Universal Basic Income is a government-funded program that provides all citizens (or residents) regular, unconditional cash payments. Unlike traditional welfare, Universal Basic Income has no means-testing or work requirements. Key features include:

- Universal – Every eligible person receives it.

- Unconditional – No restrictions on how it’s spent.

- Regular – Typically distributed monthly.

How Would Universal Basic Income Be Funded?

Potential funding mechanisms include:

- Higher taxes (income, wealth, or VAT increases)

- Cutting existing welfare programs

- Printing money (risks inflation)

- Automation/AI taxes (on companies replacing workers with robots)

Pros of Universal Basic Income

- Poverty Reduction & Financial Security

- Provides a financial floor, reducing extreme poverty.

- Helps the unemployed, gig workers, and those in unstable jobs.

- Simplified Welfare System

- Replaces complex, bureaucratic welfare programs with direct cash transfers.

- Reduces administrative costs and fraud risks.

- Encourages Entrepreneurship & Creativity

- With basic needs covered, people may take risks (e.g., starting businesses, pursuing education, or starting creative ventures).

- Studies (e.g., Finland’s UBI trial) show improved mental health and well-being.

- Adaptation to Automation & Job Displacement

- As AI and robots replace jobs, UBI could act as a safety net.

- Prevents mass unemployment crises.

- Reduced Income Inequality

- Direct cash transfers help balance wealth distribution.

- Could decrease reliance on predatory loans and debt cycles.

Cons of Universal Basic Income

- High Cost & Funding Challenges

- A $1,000/month UBI for all U.S. adults would cost $3 trillion annually (nearly the entire federal budget).

- Requires major tax reforms or spending cuts.

- Potential Work Disincentives

- Critics argue free money could reduce motivation to work.

- Some studies (e.g., Alaska’s Permanent Fund Dividend) show minimal labour market impact, but long-term effects are unclear.

- Inflation Risk

- If demand surges (due to increased purchasing power), prices could rise, negating UBI’s benefits.

- It must be carefully balanced with monetary policy.

- Possible Reduction in Specialized Welfare

- Replacing targeted aid (e.g., disability, housing subsidies) with UBI might leave vulnerable groups worse off.

- Political & Public Resistance

- Many oppose “free money” on ideological grounds.

- Implementation requires bipartisan support, which is challenging.

Universal Basic Income’s Economic Impact

- Consumer Spending & Economic Growth

- More disposable income → higher consumption → economic stimulation.

- It could boost small businesses and local economies.

- Labor Market Effects

- Positive: Workers may seek better jobs rather than staying in exploitative roles.

- Negative: Some may exit the workforce, shrinking the labour supply.

- Government Budget & Taxation

- Requires massive fiscal restructuring.

- This could lead to higher taxes on corporations and high earners.

- Inflation & Monetary Policy

- If not properly managed, excess money supply could devalue the currency.

- Central banks may need to adjust interest rates accordingly.

Real-World Universal Basic Income Experiments

Several countries and cities have tested UBI with mixed results:

Experiment Findings

Finland (2017-2018) Improved well-being, no significant work disincentive.

Stockton, California (2019-2021) Reduced financial stress and increased full-time employment.

Kenya (Give Directly, ongoing) Boosted entrepreneurship and asset ownership.

Alaska (Permanent Fund Dividend since 1982) No major labour market disruption; popular but not a full UBI.

Most trials show positive short-term effects, but long-term sustainability remains uncertain.

Conclusion

In most serious political and economic proposals for a UBI, the model is not a full replacement for all welfare programs. The consensus among many UBI advocates is that the UBI would likely replace a large chunk of cash-transfer and income-support programs, but that highly-targeted benefits like disability assistance, specialized health care, and potentially housing support would need to be retained to avoid financially harming the most vulnerable citizens.

FAQs About Universal Basic Income

- Has any country fully adopted UBI?

As of late 2025, no country has fully implemented a nationwide UBI system that meets all the criteria (recurring, unconditional cash payments to all individual citizens). However, many countries and regions have explored the concept through:

- Pilot Programs and Trials (e.g. Finland, Canada, Kenya, various cities in the U.S. and Europe) to test the effects of a basic income on specific populations.

- Targeted Guaranteed Basic Income (GBI) programs for certain vulnerable groups, such as the one in Wales for young people leaving care.

- National cash Transfer programs that have some UBI-like features, such as Iran’s national cash transfer to all citizens that replaced subsidies (though this was a replacement for subsidies) or the Alaska Permanent Fund in the U.S., which gives annual dividends from oil revenues to all residents.

- Would UBI replace all welfare programs?

The idea of a UBI replacing all welfare programs is a central and highly debated point in the UBI discussion. There are two main philosophical models for how UBI would interact with existing welfare:

- The Replacement Model (“Big UBI), where UBI is set high enough to cover basic needs and would fully replace nearly all existing means-tested welfare programs (like unemployment insurance, food assistance, housing benefits and most cash transfers)

- The Complementary Model (The “Partial UBI” or UBI+) Here, UBI is set as a moderate, modest level (often below the poverty line) and would supplement the existing welfare system.

- How much would UBI cost taxpayers?

Estimates vary, but funding would likely require higher taxes on corporations, top earners, or new revenue streams. The cost of UBI to taxpayers is one of the most contentious points of the debate, and the answer is highly dependant on two key factors:

- The Gross Cost vs The Net Cost ( the biggest source of confusion)

- The Specific Design of the UBI (the payment amount and how it is funded)

- Would UBI cause inflation?

The consensus among economists is that UBI itself is not inherently inflationary or deflationary; its impact depends entirely on how it is funded and the current state of the economy. If not balanced with productivity growth, yes. Proper monetary policy would be crucial.

- Do people work less under UBI?

The overall effect on the labour market is generally small, but it does cause shifts in who works and why. Most experiments show no significant drop in employment, with some shifting to better jobs or education.

- Could UBI reduce homelessness?

Yes, UBI or targeted guaranteed income programs have shown promise in reducing housing instability and homelessness, particularly when paired with housing service. The core mechanism is addressing the income side of the housing crisis.

Homelessness is fundamentally a lack of housing, but it’s often caused by a lack of money. By providing an unconditional cash floor, UBI helps to stabilize people’s finances, allowing them to afford or save for housing.

- Is UBI socialist?

The question of whether UBI is socialist is complex, as UBI is a policy that is not confined to a single ideology and has been championed by thinkers from across the entire political spectrum. It’s debated—some see it as a market-friendly safety net, others as a redistribution policy.

- How would UBI affect gig workers?

UBI would likely have a profound and positive impact on gig workers by addressing the core issues of financial shortfalls, lack of benefits and low wages. It could provide stability for gig workers facing irregular income.

- Would UBI discourage education?

Unlikely, research and evidence from various pilot programs and studies on UBI suggest that it does not discourage education. In fact, many studies have shown the opposite: UBI can be a powerful tool to promote and support educational attainment and

skills training.

- What’s the biggest obstacle to UBI?

The biggest obstacle to implementing Universal Basic Income is not a single issue, but a combination of political, economic and social challenges. However, if one were to be identified as the most significant, it would be the immense cost and the resulting political feasibility of funding it.

Final Thoughts

Universal Basic Income presents a bold solution to modern economic challenges, from automation to inequality. While trials show promise, large-scale implementation remains complex. If balanced correctly, UBI could reshape economies—but without careful planning, it risks fiscal strain and unintended consequences.

For more on Universal Basic Income, check out the following:

Internal Link:

External Links:

- OECD: Basic Income Policy Option – 2017

- World Bank: Exploring Universal Basic Income

- KELA: Finland’s Basic Income Experiment 2017-2018

Disclosure

Affiliate Link Disclosure: TheMoneyQuestion.org may earn a small commission if you make a purchase through one of the links in this article. However, we only recommend products and services that we believe will add value to your financial journey.

Content Disclaimer: The information in this article is for informational purposes only and is not intended to substitute for the advice of a licensed or certified attorney, accountant, financial advisor, or other certified financial professionals. Always seek professional advice before making financial decisions.

Leave a Reply