The Money Question

The Future of Banking: Will We Even Need Banks in 20 Years?

As fintech, blockchain, and digital currencies revolutionize financial services, will traditional banks become obsolete? Explore the future of banking and what it means for consumers and businesses.

Introduction

Banking has been a cornerstone of modern economies for centuries, but technology is rapidly reshaping the industry. Many are questioning whether traditional banks will still be necessary in the next two decades with the rise of fintech, blockchain, central bank digital currencies (CBDCs), and decentralized finance (DeFi). Will brick-and-mortar banks become obsolete? Or will they adapt to a new financial landscape? This article explores the forces driving change in banking, the potential risks, and what the future may hold.

The Forces Driving Change in Banking

- The Rise of Fintech

Fintech companies have disrupted the financial sector by offering innovative services that banks once exclusively provided. Mobile banking apps, peer-to-peer lending platforms, robo-advisors, and payment processing solutions have transformed how individuals and businesses handle money. Services like PayPal, Venmo, Square, and Revolut have demonstrated that many traditional banking functions can be executed without legacy institutions.

- Blockchain and Decentralized Finance (DeFi)

Blockchain technology has introduced decentralized finance (DeFi), enabling peer-to-peer transactions without intermediaries. Platforms like Uniswap, Aave, and MakerDAO allow users to borrow, lend, and trade digital assets without relying on traditional banks. If DeFi continues to grow and overcome regulatory challenges, it could significantly reduce the role of banks.

- Central Bank Digital Currencies (CBDCs)

Governments worldwide are exploring CBDCs, digital versions of fiat currency issued directly by central banks. Unlike cryptocurrencies, CBDCs are government-backed, ensuring stability while offering the benefits of digital payments. CBDCs could allow individuals to hold digital money directly with central banks if widely adopted, bypassing commercial banks entirely.

- Artificial Intelligence and Automation

AI-driven financial services are enhancing customer support, fraud detection, credit assessment, and investment management. Chatbots, algorithmic trading, and AI-powered risk analysis reduce the need for human intervention in banking. With continued advancements, AI could make many traditional banking jobs obsolete while improving efficiency and accessibility.

- Big Tech’s Entry into Finance

Companies like Apple, Google, Amazon, and Facebook (Meta) have already entered the financial space with digital wallets, payment systems, and lending services. Apple Pay, Google Pay, and Meta’s financial ambitions demonstrate how technology firms could eventually offer full-fledged banking services, potentially challenging traditional banks.

- Regulatory and Consumer Trust Issues

While technological advancements are reshaping finance, trust and regulation remain significant hurdles. Consumers still rely on traditional banks for security, deposit insurance, and fraud protection. Governments and financial regulators must determine how to oversee new financial models, ensuring consumer protection while fostering innovation.

Will Traditional Banks Survive or Transform?

While banks face mounting challenges, they are not entirely doomed. Instead, they may evolve into more digital, leaner entities that integrate fintech solutions. Some possible future scenarios include:

- Hybrid Banking Models: Traditional banks may partner with fintech firms to offer seamless digital services while maintaining their regulatory advantages.

- Specialized Banking Services: Banks could focus on high-value services like wealth management, business lending, and advisory roles, areas where human expertise remains critical.

- Infrastructure Providers: Banks may shift towards backend infrastructure, supporting fintech and DeFi platforms instead of directly serving customers.

- Regulatory Collaborators: As compliance requirements grow, banks could leverage their regulatory expertise to help new financial technologies navigate legal frameworks.

The Risks and Challenges Ahead

Despite the excitement around financial innovation, several risks and challenges remain:

- Regulatory Uncertainty: DeFi and crypto face significant regulatory scrutiny, which could limit their growth.

- Cybersecurity Threats: Digital banking solutions are vulnerable to hacking and fraud.

- Financial Exclusion: Not everyone can access digital services, making physical banking essential for some populations.

- Economic Stability Risks: If traditional banks decline too quickly, it could disrupt economic stability and financial markets.

What Should Consumers Do to Prepare for the Future of Banking?

- Adopt Digital Banking Tools: Get familiar with fintech apps, mobile banking, and digital wallets.

- Educate Yourself on Blockchain and DeFi: Understand how decentralized finance works and assess potential risks.

- Diversify Financial Holdings: Keep assets in different forms, including cash, digital currencies, and traditional investments.

- Stay Informed on Regulations: Monitor financial regulations to understand how they may impact your money.

- Enhance Financial Literacy: Learn about best practices for personal finance, investment strategies, and digital security.

Conclusion: A Banking Revolution is Coming

The banking industry is undergoing a transformation unlike anything seen before. While traditional banks may not disappear entirely, their role in finance is likely to shift dramatically. As fintech, DeFi, and CBDCs continue to evolve, consumers and businesses must stay informed and adaptable to navigate this changing landscape. The future of banking may be digital, decentralized, and radically different from what we know today.

Frequently Asked Questions (FAQs)

- Will banks exist in 20 years?

- While traditional banks may not disappear entirely, they will evolve into more digital and specialized entities.

- What is DeFi, and can it replace banks?

- DeFi (Decentralized Finance) is a financial system built on blockchain that enables peer-to-peer transactions without intermediaries. While it can reduce reliance on banks, regulatory challenges and security concerns may limit its widespread adoption.

- How do CBDCs impact banks?

- CBDCs could reduce the need for commercial banks by allowing individuals to hold digital currency directly with central banks.

- Are fintech companies safer than banks?

- Fintech companies offer convenience and innovation but may not always have the same regulatory protections as banks, such as deposit insurance.

- What role will AI play in banking?

- AI will enhance fraud detection, customer support, risk assessment, and automation, making banking services more efficient and accessible.

- How secure is digital banking?

- While digital banking is generally secure, cybersecurity risks such as hacking and fraud remain concerns. Strong passwords and two-factor authentication are recommended.

- Can I invest in DeFi safely?

- DeFi investments carry risks, including smart contract vulnerabilities and regulatory uncertainty. Using secure platforms and hardware wallets can help mitigate risks.

- Will physical bank branches disappear?

- While the number of physical branches may decline, some will likely remain to serve customers who require in-person banking services.

- How will big tech companies impact banking?

- Companies like Apple, Google, and Amazon may offer financial services that compete with traditional banks, potentially reshaping the industry.

- How should I prepare for the future of banking?

- Staying informed, diversifying financial holdings, and adopting digital banking tools will help you adapt to the evolving financial landscape.

Affiliate Marketing Disclosure

Some links in this article may be affiliate links, meaning we may earn a commission if you purchase through them. This comes at no additional cost to you and helps support our content.

How Tariffs and Trade Wars Affect You: The Hidden Costs of Protectionism

Introduction

Tariffs and trade wars have been a recurring theme in global economics, shaping policies, industries, and everyday prices. While they are often introduced to protect domestic industries, their unintended consequences can ripple through the economy, affecting consumers, businesses, and financial markets alike. This article explores how tariffs impact your wallet, job security, and investment portfolio while analyzing the broader economic effects of trade wars.

What Are Tariffs?

A tariff is a tax imposed on imported goods and services. Governments use tariffs to control trade between nations, protect certain domestic industries from foreign competition, or generate revenue. There are different types of tariffs, including:

- Ad valorem tariffs: A percentage of the item’s value.

- Specific tariffs: A fixed amount per unit of a good.

- Retaliatory tariffs: Imposed in response to another country’s trade barriers.

How Tariffs Work

When a country imposes tariffs on imports, the cost of these goods rises. For example, if the U.S. places a 25% tariff on steel imports, domestic companies purchasing foreign steel must pay 25% more. These costs are usually passed down to consumers through higher prices on steel products, such as cars and appliances.

The Effects of Tariffs on Consumers

- Higher Prices on Everyday Goods

Since many consumer products rely on imported raw materials or are manufactured overseas, tariffs lead to increased prices. Goods affected include:

- Electronics

- Automobiles

- Clothing and footwear

- Household appliances

- Reduced Consumer Choice

When tariffs make foreign goods more expensive, consumers may have fewer options. If imports become unaffordable, companies might reduce their offerings, limiting available choices.

- Inflationary Pressures

Tariffs contribute to inflation by increasing the costs of goods and services. Businesses facing higher costs due to tariffs may raise prices, leading to widespread economic inflation.

The Impact on Businesses

- Increased Production Costs

Industries that rely on imported raw materials, such as manufacturing and construction, face higher production costs when tariffs are imposed. This forces businesses to either absorb these costs (reducing profit margins) or pass them on to consumers (raising prices).

- Supply Chain Disruptions

Many businesses operate in a globalized economy with complex supply chains. Tariffs disrupt these networks, making it more expensive or difficult to source materials and components from international suppliers.

- Job Losses in Affected Industries

While tariffs may protect specific domestic jobs, they can also lead to layoffs in other sectors. For example, when the U.S. imposed tariffs on Chinese goods, some American companies reliant on Chinese imports reduced their workforce due to higher costs.

Global Economic Consequences

- Retaliation and Trade Wars

When one country imposes tariffs, others often respond with their own tariffs, escalating into a trade war. This tit-for-tat approach can reduce international trade and slow economic growth.

- Impact on Financial Markets

Trade tensions create uncertainty in financial markets, leading to stock volatility. Investors react to tariff announcements, affecting market confidence and stock prices.

- Shifts in Global Trade Alliances

Prolonged trade conflicts can push countries to seek new trade partners, reducing economic reliance on previous allies. This shift can permanently alter global trade dynamics.

How You Can Prepare for Economic Shifts Caused by Tariffs

- Diversify Your Investments

Investing in diverse assets, including international markets, can help mitigate risks associated with trade wars.

- Support Domestic Alternatives

If imported goods become too expensive, consider buying from domestic companies that are less affected by tariffs.

- Adjust Your Budget

Expect potential price increases and plan accordingly by cutting unnecessary expenses or finding cost-effective alternatives.

10 Frequently Asked Questions (FAQs)

- How do tariffs benefit the economy?

Tariffs can protect domestic industries by making foreign competition more expensive, potentially creating jobs in protected sectors.

- Do tariffs always lead to higher prices for consumers?

While not always, tariffs typically raise prices as businesses pass increased costs onto consumers.

- Can tariffs reduce unemployment?

Tariffs may protect jobs in some industries, but they can also cause job losses in sectors dependent on international trade.

- What is a trade war?

A trade war occurs when two countries impose tariffs and trade restrictions against each other, leading to economic conflict.

- How do tariffs affect small businesses?

Small businesses reliant on imported goods may face higher costs, potentially forcing them to raise prices or cut expenses.

- Can tariffs lead to inflation?

Yes, tariffs increase the cost of imported goods, contributing to overall inflation.

- How do countries retaliate against tariffs?

Countries often impose counter-tariffs, restrict imports, or seek alternative trade partners.

- What industries benefit from tariffs?

Industries protected by tariffs, such as steel or agriculture, may benefit in the short term by reducing foreign competition.

- Do tariffs impact global trade agreements?

Yes, tariffs can strain international trade relations and lead to renegotiations of trade agreements.

- How can consumers mitigate the effects of tariffs?

To protect their purchasing power, consumers can switch to domestic alternatives, budget for higher prices, or invest in diverse financial assets.

Conclusion

While tariffs are often implemented to protect domestic industries, their broader consequences can include higher prices, job losses, and economic uncertainty. Individuals can make informed financial decisions to mitigate their impact by understanding how tariffs affect consumers and businesses.

Affiliate Marketing Disclosure

This article contains affiliate links, meaning we may earn a commission if you purchase through recommended links. This helps support our work at TheMoneyQuestion.org at no extra cost to you.

The National Debt in 2025: Should We Worry?

Introduction

The U.S. national debt has been a topic of heated debate for decades, and as we move into 2025, concerns are mounting. With rising government spending, economic uncertainties, and political gridlock, many Americans are asking: Should we be worried about the national debt in 2025?

In this in-depth analysis, we’ll explore:

- The current state of the national debt

- Key drivers of debt growth

- Economic implications

- Expert opinions on sustainability

- Potential solutions

By the end, you’ll have a clearer understanding of whether the national debt is a looming crisis or a manageable challenge.

The Current State of the National Debt in 2025

As of early 2025, the U.S. national debt is over $35 trillion, up from approximately $34 trillion in 2024. This staggering figure represents the cumulative result of decades of budget deficits, where federal spending exceeds revenue.

Key Statistics:

- Debt-to-GDP Ratio: ~130% (up from ~120% in 2020)

- Annual Deficit (2025): ~$1.7 trillion

- Interest Payments: ~$1 trillion annually (surpassing defense spending)

The Congressional Budget Office (CBO) projects that without significant policy changes, debt levels will continue rising, potentially exceeding 150% of GDP by 2035.

What’s Driving the National Debt in 2025?

Several factors contribute to the growing debt burden:

- Entitlement Spending

Social Security, Medicare, and Medicaid programs account for roughly 50% of federal spending. With an aging population, these costs are increasing faster than tax revenues.

- Rising Interest Rates

The Federal Reserve’s rate hikes to combat inflation have increased borrowing costs. The U.S. now spends more on interest payments than on education or transportation.

- Tax Cuts and Revenue Shortfalls

The 2017 Tax Cuts and Jobs Act reduced corporate tax rates, shrinking federal revenue. While proponents argue it spurred growth, critics say it widened deficits.

- Emergency Spending

Crises like COVID-19, Ukraine aid, and climate-related disasters have led to massive spending bills, adding trillions to the debt.

- Political Gridlock

Partisan divides make it challenging to pass long-term fiscal reforms, leaving debt accumulation unchecked.

Economic Implications of Rising Debt

- Slower Economic Growth

High debt can crowd out private investment, reducing productivity and wage growth. The CBO warns that unchecked debt could lower GDP by 4% by 2050.

- Inflation Risks

If the government monetizes debt (prints money to cover deficits), it could trigger higher inflation, eroding savings and purchasing power.

- Reduced Fiscal Flexibility

With more revenue going toward interest payments, the U.S. has less capacity to respond to future crises (recessions, wars, pandemics).

- Global Confidence Concerns

If investors lose faith in U.S. debt sustainability, they may demand higher interest rates, worsening the debt spiral.

Is the National Debt Sustainable? Expert Views

Optimists Say:

- “The U.S. can handle higher debt because it borrows in its own currency.” (Modern Monetary Theory advocates)

- “Growth and inflation will reduce debt burdens over time.” (Some economists)

Pessimists Warn:

- “Unsustainable debt leads to fiscal crises or austerity.” (CBO, IMF)

- “Interest costs could soon exceed $2 trillion annually.” (Peter G. Peterson Foundation)

Middle-Ground Perspective:

- “Debt is manageable but requires reforms soon.” (Bipartisan Policy Center)

Potential Solutions to Curb the Debt

- Spending Reforms

- Adjust entitlement benefits (e.g., raising retirement age, means-testing)

- Reduce defense and discretionary spending

- Revenue Increases

- Higher taxes on corporations & top earners

- Close tax loopholes

- Economic Growth Policies

- Invest in infrastructure and education to boost productivity

- Encourage innovation (AI, green energy)

- Bipartisan Fiscal Commission

A debt ceiling deal with spending caps could enforce discipline.

Conclusion: Should You Worry About the National Debt in 2025?

The national debt is a serious long-term challenge but not an immediate crisis. While the U.S. can sustain higher debt levels than most countries, inaction risks economic instability.

Key Takeaways:

✅ Debt is growing faster than the economy.

✅ Interest costs are becoming a significant budget burden.

✅ Reforms are needed to avoid future austerity or crisis.

The real question isn’t whether the debt is “too high” but whether policymakers will act before it’s too late.

FAQs About the National Debt in 2025

- What is the current U.S. national debt?

As of 2025, it exceeds $35 trillion.

- How does the national debt affect me?

Higher debt can lead to higher taxes, inflation, or reduced public services.

- Who owns the U.S. debt?

About 70% is held domestically (Social Security, Federal Reserve, investors), and 30% by foreign governments (Japan, China).

- Can the U.S. default on its debt?

Technically, yes, but it’s unlikely because the U.S. can print dollars. Political fights over the debt ceiling create risks.

- What happens if the debt keeps growing?

It could lead to higher interest rates, slower growth, or a fiscal crisis.

- Does debt hurt the stock market?

Indirectly—if interest rates rise sharply, markets could decline.

- Has the U.S. ever paid off its debt?

Only once, in 1835, under President Andrew Jackson.

- What’s the difference between debt and Deficit?

A deficit is the annual shortfall, while debt is the total owed over time.

- Can economic growth reduce debt?

Yes, if GDP grows faster than debt, the debt-to-GDP ratio improves.

- What can individuals do?

Stay informed, advocate for fiscal responsibility, and plan for possible tax changes.

Final Thoughts: The national debt is a complex issue, but the U.S. can navigate it with informed policies. Stay tuned to TheMoneyQuestion.org for more insights!

Disclosure & Affiliate Marketing Note

This post may contain affiliate links. If you click through and make a purchase, we may earn a commission at no extra cost. We only recommend products/services we believe in.

Bitcoin vs Fiat Currency: Which Will Dominate the Future of Money?

Introduction

The debate between Bitcoin vs fiat currency is among the most contentious in modern finance. The world’s first decentralized digital currency, Bitcoin, promises a future free from government control and inflation. Meanwhile, fiat currencies—issued and regulated by central banks—remain the backbone of global economies.

But which system will ultimately prevail? Will Bitcoin replace traditional money, or will fiat currencies adapt and maintain dominance? In this post, we’ll examine the strengths and weaknesses of both, their long-term viability, and what the future may hold.

Understanding Fiat Currency

What Is Fiat Money?

Fiat currency is government-issued money not backed by a physical commodity like gold. Its value comes from trust in the issuing government and its legal tender status. Examples include the US Dollar (USD), Euro (EUR), and Japanese Yen (JPY).

Pros of Fiat Currency

- Widespread Acceptance – Fiat is universally accepted for goods, services, and taxes.

- Government Backing – Central banks can implement monetary policies to stabilize economies.

- Stable (When Managed Well) – Inflation is controlled (in theory) by responsible fiscal policies.

Cons of Fiat Currency

- Inflation Risk – Governments can print unlimited money, leading to devaluation (e.g., hyperinflation in Zimbabwe or Venezuela).

- Centralized Control – Vulnerable to corruption, mismanagement, and political interference.

- Dependence on Trust – If faith in a government erodes, so does the currency’s value.

Understanding Bitcoin

What Is Bitcoin?

Bitcoin (BTC) is a decentralized digital currency created in 2009 by an anonymous entity, Satoshi Nakamoto. It operates on blockchain technology, enabling peer-to-peer transactions without intermediaries.

Pros of Bitcoin

- Decentralization – No single entity controls Bitcoin, reducing manipulation risk.

- Limited Supply – Only 21 million BTC will ever exist, making it deflationary.

- Transparency & Security – Blockchain ensures immutable transaction records.

- Borderless Transactions – Enables fast, low-cost global transfers.

Cons of Bitcoin

- Volatility – Prices fluctuate dramatically, deterring everyday use.

- Scalability Issues – High transaction fees and slow processing during peak times.

- Regulatory Uncertainty – Governments may impose restrictions.

- Energy Consumption – Mining requires significant electricity.

Bitcoin vs. Fiat: Key Comparisons

Factor Bitcoin Fiat Currency

Control Decentralized Centralized (Government & Banks)

Supply Fixed (21 million BTC) Unlimited (Printing possible)

Transaction Speed Slower (10 min/block) Instant (Digital payments)

Inflation Deflationary (Scarce supply) Inflationary (Money printing)

Adoption Growing, but limited Universal

Security Highly secure (Blockchain) Vulnerable to fraud/hacking

Can Bitcoin Replace Fiat?

Arguments For Bitcoin Dominance

- Hedge Against Inflation – With central banks printing trillions, Bitcoin’s scarcity makes it attractive.

- Financial Sovereignty – There is no need for banks; individuals control their wealth.

- Growing Institutional Adoption – Companies like Tesla and MicroStrategy hold BTC.

Arguments Against Bitcoin Dominance

- Volatility Hinders Daily Use – Merchants prefer stable pricing.

- Government Resistance – States won’t easily relinquish monetary control.

- Technological Barriers – Not everyone can securely store crypto.

A Hybrid Future?

Rather than a winner-takes-all scenario, we may see coexistence:

- Bitcoin as “Digital Gold” – A store of value alongside fiat.

- CBDCs (Central Bank Digital Currencies) – Governments may adopt blockchain-like systems.

FAQs: Bitcoin vs. Fiat Currency

- Is Bitcoin better than fiat currency?

It depends. Bitcoin offers decentralization and scarcity, while fiat provides stability and widespread acceptance.

- Can Bitcoin become the world’s primary currency?

Possible but unlikely soon due to volatility, scalability, and regulatory hurdles.

- Why do governments oppose Bitcoin?

It challenges their monetary control and enables tax evasion.

- Will CBDCs replace Bitcoin?

No—CBDCs are centralized, whereas Bitcoin is decentralized.

- Is Bitcoin inflation-proof?

Yes, due to its fixed supply, unlike fiat, which can be printed endlessly.

- How does Bitcoin’s energy use compare to fiat systems?

Bitcoin mining consumes significant energy, but traditional banking also has a large carbon footprint.

- Can Bitcoin transactions be reversed?

No—once confirmed, they’re irreversible.

- What happens if Bitcoin replaces fiat?

Governments would lose monetary policy control, leading to economic shifts.

- Why is Bitcoin volatile?

Limited liquidity, speculation, and market sentiment drive price swings.

- Should I convert all my money to Bitcoin?

No—diversification is key due to Bitcoin’s risk.

Conclusion

The battle between Bitcoin and fiat currency isn’t a zero-sum game. While Bitcoin offers a revolutionary alternative, fiat remains deeply entrenched in global finance. The most probable outcome is a financial ecosystem where both coexist—Bitcoin as a decentralized store of value and fiat as a medium of exchange.

Which side are you on? Share your thoughts in the comments!

Affiliate Marketing Disclosure

This post may contain affiliate links. If you use these links to buy products, we may earn a commission at no extra cost to you. We only recommend services we trust.

How Inflation Affects Your Savings and Purchasing Power in 2025

Introduction

Inflation is an economic phenomenon that impacts everyone, but its effects on savings and purchasing power are often misunderstood. Over time, rising prices erode the value of money, making it crucial to understand how inflation works and how to protect your financial future.

In this post, we’ll explore:

- What inflation is and how it’s measured

- The direct impact of inflation on savings

- How purchasing power declines over time

- Strategies to safeguard your money against inflation

- FAQs and key takeaways

By the end, you’ll have actionable insights to mitigate inflation’s effects on your finances.

What Is Inflation?

Inflation is the sustained increase in the general price level of goods and services in an economy over time. Each currency unit buys fewer products when inflation rises, reducing its purchasing power.

How Is Inflation Measured?

Governments and central banks track inflation using key indices:

- Consumer Price Index (CPI) – Measures price changes for a basket of consumer goods and services (e.g., food, housing, transportation).

- Producer Price Index (PPI) – Tracks price changes at the wholesale level.

- Core Inflation – Excludes volatile items like food and energy to assess long-term trends.

The Federal Reserve targets a 2% annual inflation rate, believing it supports economic growth without destabilizing prices. However, unexpected spikes (like those seen in 2021-2023) can severely impact savings and spending.

How Inflation Erodes Your Savings

- Reduced Real Returns on Cash Savings

Money held in traditional savings accounts earns interest. Still, if inflation outpaces this rate, your real return (interest minus inflation) turns negative.

Example:

- Savings account interest: 1%

- Inflation rate: 4%

- Real return: -3% (losing purchasing power)

- Fixed-Income Investments Lose Value

Bonds and CDs (certificates of deposit) provide fixed returns. If inflation rises, their real value declines.

Example:

- A 10-year bond yields 3%, but inflation averages 5%.

- Investors effectively lose 2% annually in purchasing power.

- Stagnant Wages vs. Rising Costs

If salaries don’t keep up with inflation, disposable income shrinks, forcing households to cut back or dip into savings.

The Decline of Purchasing Power Over Time

Purchasing power measures how much a unit of currency can buy. Inflation diminishes it, making everyday expenses more burdensome.

Historical Example: The U.S. Dollar

- 1980: $100 could buy ~30 movie tickets.

- 2024: $100 buys ~5 movie tickets.

This demonstrates how inflation silently reduces what your money can buy.

Rule of 72: Estimating Inflation’s Impact

Divide 72 by the inflation rate to see how long prices will double.

- At 3% inflation, prices double in 24 years.

- At 6% inflation, prices double in 12 years.

This underscores why long-term savers must account for inflation.

How to Protect Your Savings from Inflation

- Invest in Inflation-Protected Securities

- TIPS (Treasury Inflation-Protected Securities) adjust with inflation.

- I-Bonds offer interest rates tied to CPI.

- Diversify into Stocks & Real Assets

- Equities (Stocks): Historically outpace inflation over time.

- Real Estate: Property values and rents often rise with inflation.

- Commodities (Gold, Silver, Oil): Tangible assets hedge against currency devaluation.

- High-Yield Savings & CDs

While not perfect, online banks offer higher interest rates than traditional accounts, reducing inflation’s bite.

- Reduce Debt with Fixed Rates

If you hold a fixed-rate mortgage, inflation erodes the real value of your debt over time.

- Increase Earnings & Side Hustles

Raising income through career growth or side gigs helps offset rising costs.

FAQs: Inflation & Your Money

- Does inflation affect everyone equally?

No. Retirees on fixed incomes and low-wage earners are hit hardest, while borrowers with fixed-rate debt may benefit.

- Can inflation ever be good?

Moderate inflation (2-3%) encourages spending and investment. Hyperinflation (50%+ monthly) is destructive.

- How does the Fed control inflation?

The Federal Reserve adjusts interest rates and money supply to curb or stimulate inflation.

- Should I keep cash during high inflation?

Only for emergencies. Excess cash loses value—consider inflation-resistant investments instead.

- What’s the best long-term inflation hedge?

Historically, a diversified portfolio (stocks, real estate, commodities) preserves wealth best.

Final Thoughts

Inflation is an unavoidable economic force, but understanding its effects empowers you to take proactive steps. Investing wisely, diversifying assets, and staying informed can protect your savings and maintain purchasing power over time.

Disclosure

The Money Question may earn affiliate commissions from links in this post. We only recommend products we trust.

Universal Basic Income: Pros, Cons, and Its Impact on the Economy

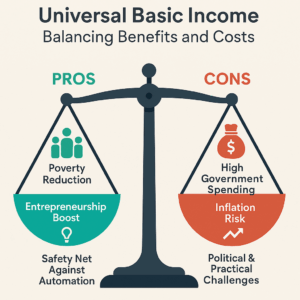

Universal Basic Income: A Bold Economic Safety Net or a Costly Gamble?

Explore how Universal Basic Income could reduce poverty, spur entrepreneurship, and respond to automation — but face soaring costs, inflation risks, and political hurdles.

Introduction

Universal Basic Income is a revolutionary economic concept gaining traction worldwide. It proposes that every citizen receives a fixed, unconditional sum of money regularly, regardless of employment status. Proponents argue it could reduce poverty, simplify welfare systems, and adapt to automation-driven job losses. Critics warn of high costs, potential disincentives to work, and inflationary risks.

In this article, we’ll explore:

- What Universal Basic Income is and how it works

- The pros and cons of Universal Basic Income

- Its potential economic impact

- Real-world Universal Basic Income experiments and results

- FAQs and key takeaways

By the end, you’ll understand whether Universal Basic Income could be a viable solution for modern economies.

What Is Universal Basic Income (UBI)?

Universal Basic Income is a government-funded program that provides all citizens (or residents) regular, unconditional cash payments. Unlike traditional welfare, Universal Basic Income has no means-testing or work requirements. Key features include:

- Universal – Every eligible person receives it.

- Unconditional – No restrictions on how it’s spent.

- Regular – Typically distributed monthly.

How Would Universal Basic Income Be Funded?

Potential funding mechanisms include:

- Higher taxes (income, wealth, or VAT increases)

- Cutting existing welfare programs

- Printing money (risks inflation)

- Automation/AI taxes (on companies replacing workers with robots)

Pros of Universal Basic Income

- Poverty Reduction & Financial Security

- Provides a financial floor, reducing extreme poverty.

- Helps the unemployed, gig workers, and those in unstable jobs.

- Simplified Welfare System

- Replaces complex, bureaucratic welfare programs with direct cash transfers.

- Reduces administrative costs and fraud risks.

- Encourages Entrepreneurship & Creativity

- With basic needs covered, people may take risks (e.g., starting businesses, pursuing education, or starting creative ventures).

- Studies (e.g., Finland’s UBI trial) show improved mental health and well-being.

- Adaptation to Automation & Job Displacement

- As AI and robots replace jobs, UBI could act as a safety net.

- Prevents mass unemployment crises.

- Reduced Income Inequality

- Direct cash transfers help balance wealth distribution.

- Could decrease reliance on predatory loans and debt cycles.

Cons of Universal Basic Income

- High Cost & Funding Challenges

- A $1,000/month UBI for all U.S. adults would cost $3 trillion annually (nearly the entire federal budget).

- Requires major tax reforms or spending cuts.

- Potential Work Disincentives

- Critics argue free money could reduce motivation to work.

- Some studies (e.g., Alaska’s Permanent Fund Dividend) show minimal labour market impact, but long-term effects are unclear.

- Inflation Risk

- If demand surges (due to increased purchasing power), prices could rise, negating UBI’s benefits.

- It must be carefully balanced with monetary policy.

- Possible Reduction in Specialized Welfare

- Replacing targeted aid (e.g., disability, housing subsidies) with UBI might leave vulnerable groups worse off.

- Political & Public Resistance

- Many oppose “free money” on ideological grounds.

- Implementation requires bipartisan support, which is challenging.

Universal Basic Income’s Economic Impact

- Consumer Spending & Economic Growth

- More disposable income → higher consumption → economic stimulation.

- It could boost small businesses and local economies.

- Labor Market Effects

- Positive: Workers may seek better jobs rather than staying in exploitative roles.

- Negative: Some may exit the workforce, shrinking the labour supply.

- Government Budget & Taxation

- Requires massive fiscal restructuring.

- This could lead to higher taxes on corporations and high earners.

- Inflation & Monetary Policy

- If not properly managed, excess money supply could devalue the currency.

- Central banks may need to adjust interest rates accordingly.

Real-World Universal Basic Income Experiments

Several countries and cities have tested UBI with mixed results:

Experiment Findings

Finland (2017-2018) Improved well-being, no significant work disincentive.

Stockton, California (2019-2021) Reduced financial stress and increased full-time employment.

Kenya (Give Directly, ongoing) Boosted entrepreneurship and asset ownership.

Alaska (Permanent Fund Dividend since 1982) No major labour market disruption; popular but not a full UBI.

Most trials show positive short-term effects, but long-term sustainability remains uncertain.

Conclusion

In most serious political and economic proposals for a UBI, the model is not a full replacement for all welfare programs. The consensus among many UBI advocates is that the UBI would likely replace a large chunk of cash-transfer and income-support programs, but that highly-targeted benefits like disability assistance, specialized health care, and potentially housing support would need to be retained to avoid financially harming the most vulnerable citizens.

FAQs About Universal Basic Income

- Has any country fully adopted UBI?

As of late 2025, no country has fully implemented a nationwide UBI system that meets all the criteria (recurring, unconditional cash payments to all individual citizens). However, many countries and regions have explored the concept through:

- Pilot Programs and Trials (e.g. Finland, Canada, Kenya, various cities in the U.S. and Europe) to test the effects of a basic income on specific populations.

- Targeted Guaranteed Basic Income (GBI) programs for certain vulnerable groups, such as the one in Wales for young people leaving care.

- National cash Transfer programs that have some UBI-like features, such as Iran’s national cash transfer to all citizens that replaced subsidies (though this was a replacement for subsidies) or the Alaska Permanent Fund in the U.S., which gives annual dividends from oil revenues to all residents.

- Would UBI replace all welfare programs?

The idea of a UBI replacing all welfare programs is a central and highly debated point in the UBI discussion. There are two main philosophical models for how UBI would interact with existing welfare:

- The Replacement Model (“Big UBI), where UBI is set high enough to cover basic needs and would fully replace nearly all existing means-tested welfare programs (like unemployment insurance, food assistance, housing benefits and most cash transfers)

- The Complementary Model (The “Partial UBI” or UBI+) Here, UBI is set as a moderate, modest level (often below the poverty line) and would supplement the existing welfare system.

- How much would UBI cost taxpayers?

Estimates vary, but funding would likely require higher taxes on corporations, top earners, or new revenue streams. The cost of UBI to taxpayers is one of the most contentious points of the debate, and the answer is highly dependant on two key factors:

- The Gross Cost vs The Net Cost ( the biggest source of confusion)

- The Specific Design of the UBI (the payment amount and how it is funded)

- Would UBI cause inflation?

The consensus among economists is that UBI itself is not inherently inflationary or deflationary; its impact depends entirely on how it is funded and the current state of the economy. If not balanced with productivity growth, yes. Proper monetary policy would be crucial.

- Do people work less under UBI?

The overall effect on the labour market is generally small, but it does cause shifts in who works and why. Most experiments show no significant drop in employment, with some shifting to better jobs or education.

- Could UBI reduce homelessness?

Yes, UBI or targeted guaranteed income programs have shown promise in reducing housing instability and homelessness, particularly when paired with housing service. The core mechanism is addressing the income side of the housing crisis.

Homelessness is fundamentally a lack of housing, but it’s often caused by a lack of money. By providing an unconditional cash floor, UBI helps to stabilize people’s finances, allowing them to afford or save for housing.

- Is UBI socialist?

The question of whether UBI is socialist is complex, as UBI is a policy that is not confined to a single ideology and has been championed by thinkers from across the entire political spectrum. It’s debated—some see it as a market-friendly safety net, others as a redistribution policy.

- How would UBI affect gig workers?

UBI would likely have a profound and positive impact on gig workers by addressing the core issues of financial shortfalls, lack of benefits and low wages. It could provide stability for gig workers facing irregular income.

- Would UBI discourage education?

Unlikely, research and evidence from various pilot programs and studies on UBI suggest that it does not discourage education. In fact, many studies have shown the opposite: UBI can be a powerful tool to promote and support educational attainment and

skills training.

- What’s the biggest obstacle to UBI?

The biggest obstacle to implementing Universal Basic Income is not a single issue, but a combination of political, economic and social challenges. However, if one were to be identified as the most significant, it would be the immense cost and the resulting political feasibility of funding it.

Final Thoughts

Universal Basic Income presents a bold solution to modern economic challenges, from automation to inequality. While trials show promise, large-scale implementation remains complex. If balanced correctly, UBI could reshape economies—but without careful planning, it risks fiscal strain and unintended consequences.

For more on Universal Basic Income, check out the following:

Internal Link:

External Links:

- OECD: Basic Income Policy Option – 2017

- World Bank: Exploring Universal Basic Income

- KELA: Finland’s Basic Income Experiment 2017-2018

Disclosure

Affiliate Link Disclosure: TheMoneyQuestion.org may earn a small commission if you make a purchase through one of the links in this article. However, we only recommend products and services that we believe will add value to your financial journey.

Content Disclaimer: The information in this article is for informational purposes only and is not intended to substitute for the advice of a licensed or certified attorney, accountant, financial advisor, or other certified financial professionals. Always seek professional advice before making financial decisions.

Minimum Wage Increases: Do They Create Jobs or Cause Unemployment?

Introduction

The debate over minimum wage increases is among the most contentious topics in economics and public policy. Proponents argue that raising the minimum wage boosts workers’ incomes, reduces poverty, and stimulates economic growth. Opponents, however, claim that higher wages lead to job losses, increased automation, and business closures.

In this article, we’ll examine the evidence on both sides, analyze real-world case studies, and explore whether minimum wage hikes create jobs or cause unemployment.

The Case for Minimum Wage Increases

- Minimum Wage Increases: Do They Create Jobs or Cause Unemployment?

Higher Earnings and Reduced Poverty

Studies show that increasing the minimum wage lifts workers out of poverty. According to a 2019 report by the Economic Policy Institute (EPI), a $15 minimum wage by 2025 would benefit over 32 million workers in the U.S.

A 2021 study published in the Quarterly Journal of Economics found that minimum wage increases significantly reduced poverty rates without causing substantial job losses.

- Increased Consumer Spending

Low-wage workers spend more of their income, leading to greater economic activity. The Federal Reserve Bank of Chicago found that a $1 minimum wage increase boosts household spending by about $700 per quarter.

- Lower Employee Turnover

Higher wages reduce turnover rates, saving businesses recruitment and training costs. A Harvard Business Review study found that companies paying above-market wages experienced 20% lower turnover.

- Job Creation Through Demand Growth

Some economists argue that higher wages increase demand for goods and services, leading to job growth. The Center for Economic and Policy Research (CEPR) suggests that modest wage hikes have neutral or slightly positive employment effects.

The Case Against Minimum Wage Increases

- Potential Job Losses

Classical economic theory suggests that artificially raising wages reduces employment opportunities. A 2014 Congressional Budget Office (CBO) report estimated that a $10.10 federal minimum wage could eliminate 500,000 jobs.

- Automation and Reduced Hiring

Businesses may replace workers with automation to offset higher labour costs. A National Bureau of Economic Research (NBER) study found that a $1 minimum wage increase leads to a 0.43% decline in low-skill employment due to automation.

- Small Business Struggles

Small businesses, particularly in low-margin industries like restaurants, may cut hours or shut down. A University of Washington study on Seattle’s $15 minimum wage found that hours worked by low-wage employees dropped by 6-7%.

- Regional Cost-of-Living Variations

A one-size-fits-all federal minimum wage may not account for regional economic differences. The American Enterprise Institute (AEI) argues that a $15 wage could devastate rural economies where living costs are lower.

Real-World Case Studies

- Seattle’s $15 Minimum Wage Experiment

Seattle’s phased minimum wage increase to $15 provided mixed results:

- Positive: Workers who kept jobs saw higher earnings.

- Negative: Some businesses reduced hiring, and low-skilled workers faced fewer opportunities.

- Germany’s National Minimum Wage (2015)

Germany introduced a €8.50 minimum wage in 2015. Studies by the German Institute for Economic Research (DIW) found:

- No significant job losses.

- Wage growth for low-income workers.

- UK’s National Living Wage

The UK’s gradual increases to a “National Living Wage” (currently £11.44 in 2024) showed:

- Increased earnings without significant unemployment spikes.

- There is some small business strain, but overall, economic resilience exists.

Conclusion: Do Minimum Wage Hikes Create or Kill Jobs?

The evidence supports the theory that moderate minimum wage increases (adjusted for inflation and regional costs) do not cause significant job losses but may lead to reduced hours or automation in some sectors. However, drastic hikes (like a sudden jump to $15 in low-cost areas) risk harming small businesses and low-skilled workers.

Policymakers should consider indexing wages to inflation, regional adjustments, and phased implementations to balance worker benefits with economic stability.

FAQs on Minimum Wage Increases

- Does raising the minimum wage always cause unemployment?

Not necessarily. Studies show modest increases often have minimal employment effects, but extreme hikes can lead to job cuts.

- How does the minimum wage affect small businesses?

Some small businesses may struggle with higher labour costs, leading to reduced hiring or price increases.

- Do higher wages lead to more automation?

Yes, some businesses invest in automation to offset rising labour costs.

- What is the “ripple effect” of minimum wage hikes?

Workers earning slightly above the new minimum may also demand raises, increasing overall wage growth.

- Does a higher minimum wage reduce poverty?

Yes, studies show it lifts many workers out of poverty, though some may lose hours or jobs.

- Why do some economists oppose minimum wage increases?

They argue it distorts labour markets, leading to job losses, especially for low-skilled workers.

- What’s the best way to implement a minimum wage increase?

Phased, regionally adjusted increases with inflation indexing are most effective.

- Has any country successfully implemented a high minimum wage?

Yes, countries like Australia and Germany have high minimum wages and strong employment rates.

- Do minimum wage hikes cause inflation?

They can contribute to localized inflation, but the overall impact is usually small.

- What are alternatives to minimum wage increases?

Alternative alternatives include expanding the Earned Income Tax Credit (EITC) or universal basic income (UBI).

Affiliate Marketing Disclosure

TheMoneyQuestion.org participates in affiliate marketing programs, meaning we may earn commissions on purchases made through our links. This helps support our research and content creation at no extra cost to you.

Final Thoughts

The minimum wage debate is complex, with valid arguments on both sides. While well-structured increases can improve living standards, policymakers must balance worker needs with economic realities.

What’s your take? Should the minimum wage be raised nationally, or should it vary by region? Let us know in the comments!

Who Pays For Bank Bailouts? The True Cost to Taxpayers and Consumers

Who Pays For Bank Bailouts? The True Cost to Taxpayers and Consumers

Introduction

Bank bailouts are a contentious topic, often sparking debates about financial responsibility, economic stability, and fairness. When banks fail, governments frequently step in to prevent a broader financial crisis—but who ultimately foots the bill? The answer is usually taxpayers and consumers, either directly or indirectly.

In this post, we’ll explore:

- What bank bailouts are and why they happen

- The real cost to taxpayers and consumers

- Historical examples of major bailouts

- Alternatives to bailouts and their feasibility

- How bank bailouts impact everyday financial decisions

By the end, you’ll understand the hidden costs of bank bailouts and what they mean for your wallet.

What Is a Bank Bailout?

A bank bailout occurs when a government or financial institution provides financial support to a failing bank to prevent its collapse. This can take several forms:

- Direct cash injections (e.g., the U.S. Troubled Asset Relief Program, or TARP, in 2008)

- Government-backed loans at favourable rates

- Nationalization (where the government takes control of the bank)

- Debt guarantees (ensuring creditors won’t lose money)

Bailouts are typically justified as necessary to prevent economic contagion—where one bank’s failure triggers a chain reaction, leading to widespread financial instability.

Who Really Pays for Bank Bailouts?

While governments claim bailouts are a temporary measure, the costs are often passed down to:

- Taxpayers

Most bailouts are funded by public money, meaning taxpayers bear the burden. For example:

- The 2008 U.S. financial crisis saw $700 billion in taxpayer funds used to rescue banks.

- The UK’s bailout of RBS (Royal Bank of Scotland) cost taxpayers £45 billion.

Even when governments eventually recoup some funds (as with TARP), taxpayers still cover interest costs, administrative expenses, and losses from failed repayments.

- Consumers

Banks often raise fees, reduce interest on savings, or tighten lending to recover losses post-bailout. This means:

- Higher loan rates for mortgages and credit cards

- Lower savings yields (as banks prioritize profitability)

- Increased banking fees (e.g., overdraft charges)

- Future Generations

When governments borrow to fund bailouts, national debt increases, leading to:

- Higher future taxes

- Reduced public spending on infrastructure, healthcare, and education

Historical Examples of Bank Bailouts

- The 2008 Financial Crisis (U.S. & Global)

- TARP (Troubled Asset Relief Program): $700 billion in taxpayer funds used to stabilize banks, insurers (AIG), and automakers.

- UK’s Bailout of RBS and Lloyds: £137 billion spent to prevent systemic collapse.

- The Savings and Loan Crisis (1980s-1990s, U.S.)

- Cost taxpayers $124 billion.

- European Debt Crisis (2010s)

- Ireland’s bailout of Anglo-Irish Bank: Cost €29.3 billion, leading to years of austerity.

Are There Alternatives to Bank Bailouts?

Instead of taxpayer-funded rescues, some propose:

- Bail-Ins

- Banks use their own assets or convert debt to equity rather than relying on public funds.

- Example: In Cyprus’s 2013 crisis, depositors with over €100,000 took losses.

- Stronger Regulation & Capital Requirements

- Higher reserve ratios to ensure banks can withstand shocks.

- Stress tests to identify vulnerabilities early.

- Letting Banks Fail (Market Discipline)

- Moral hazard (banks taking excessive risks knowing they’ll be bailed out) could be reduced.

- Example: Lehman Brothers’ 2008 collapse—though chaotic, it forced reforms.

How Bank Bailouts Affect You

Even if you don’t work in finance, bailouts impact:

- Your taxes (funding bailouts means less money for public services).

- Your savings and loans (banks may offer worse rates to recoup losses).

- Economic inequality (bailouts often benefit wealthy investors over ordinary citizens).

Conclusion: Who Really Bears the Cost?

Bank bailouts are sold as necessary to prevent economic disaster, but the true cost falls on taxpayers and consumers. While some argue they’re unavoidable, alternatives like bail-ins, stricter regulations, and market discipline could reduce reliance on public funds.

The next time a bank fails, ask: Should taxpayers pay, or should the financial sector bear its own risks?

FAQs About Bank Bailouts

- Do taxpayers always pay for bank bailouts?

Mostly yes—either directly (via government funds) or indirectly (through higher banking costs).

- Have any banks repaid bailout money?

Some have (e.g., U.S. banks repaid TARP funds with interest), but many bailouts result in net losses.

- What’s the difference between a bailout and a bail-in?

A bailout uses public money; a bail-in forces banks to use their own funds or impose losses on creditors.

- Why can’t we just let banks fail?

Fear of systemic collapse—but some argue short-term pain could lead to long-term stability.

- Do bailouts encourage reckless banking?

Yes, via moral hazard—banks may take bigger risks knowing they’ll be rescued.

- Which was the most expensive bailout in history?

The 2008 U.S. financial crisis, with $700 billion in TARP funds plus trillions in Fed support.

- How do bailouts affect inflation?

If governments print money to fund bailouts, it can devalue currency and fuel inflation.

- Are credit unions and small banks bailed out too?

Rarely—most bailouts focus on “too big to fail” institutions.

- Can individuals claim compensation from bailouts?

No—taxpayers bear costs without direct reimbursement.

- What can I do to protect my money from bailout risks?

- Diversify savings (use credit unions, ETFs, or non-bank investments).

- Support financial reform (advocate for stricter banking regulations).

Disclosure & Affiliate Note

Disclosure: This post may contain affiliate links. If you make a purchase through these links, we may earn a commission at no extra cost to you. We only recommend products/services we believe in.

10 Budgeting Tips to Save Money and Achieve Financial Freedom

10 Budgeting Tips to Save Money and Achieve Financial Freedom

Achieving financial freedom is a goal for many, but it can often feel challenging. With effective budgeting strategies, however, you can gain control over your finances, save money, and work towards a future of financial independence. Budgeting is not about sacrificing your lifestyle but making purposeful choices with your money to align with your aspirations. This post will discuss 10 practical budgeting tips to help you save money, reduce financial stress, and ultimately attain financial freedom. Let’s explore these strategies together!

1. Track Your Spending

The foundation of any successful budget is understanding where your money goes. Start by tracking each and every expense for at least a month. Use budgeting apps such as YNAB (You Need A Budget), or even a simple template on a spreadsheet to categorize your spending. These tools can automatically sync with your bank accounts and credit cards, making it easy to see where your money is going.

According to a study by the National Endowment for Financial Education, 70% of people who track their spending regularly feel more in control of their finances. This sense of control can be empowering, helping you make informed decisions about where to allocate your money.

2. Create a Realistic Budget

Once you’ve tracked your spending, create a budget that reflects your income, expenses, and financial goals. A simple approach to budgeting is to use the 50/30/20 rule:

- 50% of your total income goes to necessities (for example, rent, utilities, groceries).

- 30% goes to wants ( entertainment, dining out).

- 20% goes to savings and debt reduction.

Your budget should be a living document rather than a fixed plan. It’s essential to revisit and modify your budget regularly to reflect changes in your financial situation. Life events such as job changes, unexpected expenses, or shifts in your financial goals can all necessitate adjustments. Set a routine, monthly or quarterly, to review your budget, assess your spending patterns, and make any necessary changes. This proactive approach will enable you to keep control and firm your finances, ensuring your budget remains in sync with your present situation.

3. Set Clear Financial Goals

Ensure you have set clear and measurable goals to help you stay motivated and stick to your budgeting plan. Whether it’s debt repayment (paying off student loans or credit cards), saving for a large purchase (buying a car or a down payment on a home), or building up an emergency fund, having defined goals adds direction and purpose to give your budgeting efforts.

For example, if you want to save $10,000 for an emergency fund in two years, break it down into smaller monthly savings targets ($10,000 for an emergency fund in two years, break it down into smaller monthly savings targets ($417 per month). You’ll feel a sense of accomplishment as you reach each milestone, which can keep you motivated and on track.

4. Cut Unnecessary Expenses

Examine your spending patterns and pinpoint places where you can reduce expenses. Typical areas of overspending often include unused subscription services, frequent dining out, and impulsive buys. According to a study by McKinsey & Company, the typical American allocates more than $2,000 yearly to non-essential purchases.

Think about cancelling any subscriptions you rarely use, opting to prepare meals at home more regularly, and creating shopping lists to help curb impulsive purchases. Even small things, like packing a lunch daily rather than eating take-out, can lead to substantial savings over time.

5. Automate Your Savings

Automating your savings is a simple and effective method of saving money. You can set up automated transfers from your every day checking account to a separate savings account with each paycheck. This will help you save consistently without requiring conscious effort.

Studies by the Consumer Federation of America indicate that individuals who automate their savings achieve their financial objectives more successfully. If you’re just starting, it’s okay to begin with a small amount— even setting aside $50 each month can accumulate significantly over time due to the power of compound interest.

6. Pay Off High-Interest Debt

Debt with high interest rates, such as credit card debts, can hinder your financial objectives. It’s essential to prioritize paying off these debts as swiftly as possible. Two commonly used approaches include:

1. Debt Snowball Method: To gain momentum and motivation, tackle the smallest debt balances first.

2. Debt Avalanche Method: Initially, focus on repaying debts with the higher interest rates to minimize the amount of interest paid over time.

Research from Harvard Business Review suggests that the debt snowball method can be particularly motivating, as seeing the small victories can drive continued progress.

7. Build an Emergency Fund

An emergency fund is a form of financial safety net that helps you avoid adding debt when you are hit with the unexpected, like loss of employment, car repairs or medical bills. It’s advisable to save enough to cover three to six months’ living expenses in a designated, easy-to-access account.

Bankrate conducted a survey revealing that merely 39% of Americans could manage a $1,000 emergency with their savings. An emergency fund offers reassurance and a sense of security, ensuring you are ready for unexpected costs while safeguarding your long-term financial objectives.

8. Use Cash or Debit for Daily Expenses

Credit cards can be beneficial for establishing credit and earning rewards; however, they often encourage overspending. To prevent accumulating debt, consider getting in the habit of using cash or a debit card for everyday purchases, as this limits your spending to what you have available.

Research from MIT indicates that individuals spend nearly twice as much when using credit cards as cash. You’ll become more aware of your spending habits by opting for cash or debit.

9. Review and Adjust Your Budget Regularly

Your budget should be flexible enough to adapt to changes in your financial circumstances. It’s a good practice to review your budget monthly to ensure you’re on track and make any necessary adjustments. For example, consider increasing your savings or debt repayment contributions if you get a raise.

When unexpected expenses, such as medical bills or car repairs, take the time to reassess your budget and prioritize your expenditures. You may need to limit spending on non-essential items like dining out or entertainment, reallocating those funds to cover the unforeseen costs. If required, you can tap into your emergency fund, but create a plan to replenish it as soon as possible.

10. Invest in Your Future

Consider investing to build wealth once you’ve established a strong financial base. Investing allows your money to grow over time, whether you choose a 401(k), IRA, or other investment options.

Research from Vanguard indicates that a well-diversified portfolio, typically composed of 60% stocks and 40% bonds, can yield an average annual return of approximately 7-8%. With the power of compound interest, even small and regular contributions can accumulate significantly over the years.

Staying Motivated to Stick to Financial Goals Long-term

What are some effective long-term strategies to maintain motivation while pursuing my financial goals?

Maintaining motivation involves a blend of mindset adjustments and practical approaches:

1. Celebrate Achievements: Recognize and celebrate your progress, whether paying off a credit card, settling a loan, or reaching a savings milestone.

2. Visualize Your Objectives: Consider creating a vision board or utilizing apps like Dreamfora to keep your aspirations visible and top of mind.

3. Monitor Your Progress: Utilize budgeting tools such as Personal Capital or YNAB to track your advancement and see how far you’ve come.

4. Seek an Accountability Partner: Share specific financial goals and objectives with a trusted friend or family member who can provide support and encouragement, acting as both a mentor and motivator.

5. Treat Yourself: Establish small rewards for hitting certain milestones, allowing yourself to enjoy a favourite activity as a celebration.

Frequently Asked Questions (FAQs) About Budgeting

1. What is the best budgeting method for beginners?

The 50/30/20 rule is a great starting point for beginners. It’s simple, flexible, and helps you balance needs, wants, and savings.

2. How much should I save each month?

As a starting point, aim to save at least 20% of your income. Your savings goal will vary based on your financial goals and expenses.

3. How do I stick to a budget?

Track your spending regularly, set realistic goals, and use tools like budgeting apps to stay accountable.

4. What’s the difference between needs and wants?

Needs are essential for living, including food, shelter, and healthcare. Wants, on the other hand, are things that enhance our lives but are not necessary for survival, such as dining out, entertainment, or luxury items.

5. How can I save money on a tight budget?

Focus on cutting unnecessary expenses, cooking at home, and using cash or debit to avoid overspending.

6. Should I pay off debt or save first?

It’s best to do both simultaneously. Start by contributing to a small emergency fund monthly, then focus on paying off high-interest debt.

7. How much should I have in an emergency fund?

Aim for three to six months’ worth of living expenses to cover unexpected costs.

8. What’s the fastest way to pay off debt?

Either the debt snowball or debt avalanche method will work, depending on what motivates you more.

9. Can I budget without giving up my favourite things?

Yes! Budgeting is about balance. Allocate a portion of your income to discretionary items so you can enjoy life while saving.

10. How often should I review my budget?

Review your budget monthly to ensure you’re on track and make adjustments as needed.

Final Thoughts

Budgeting is a powerful tool that can help you save money, reduce stress, and achieve financial freedom. You can take control of your financial future by tracking your spending, setting clear, measurable goals, and making intentional choices with your money. Remember, financial freedom isn’t about being rich—it’s about having the resources and flexibility to live life on your terms.

Start implementing these budgeting tips today, and you’ll be on your way to achieving your financial objectives.

Affiliate Marketing Disclosure:

This post may contain affiliate links, which means we may receive a commission if you click a link and purchase something that we have recommended. While clicking these links won’t cost you any extra money, they help keep this site running and provide valuable content to our readers. We only recommend products and services that we genuinely believe in. Thank you for your support!

Tariffs: A Comprehensive Guide to How They Work and Who Ultimately Pays

Introduction

Tariffs have been a hot topic in global trade discussions for centuries. Understanding tariffs is crucial whether you own a business, a consumer, or someone interested in economics. They influence the prices of goods, impact international relations, and can even shape entire economies. But what exactly are tariffs, how do they work, and who ultimately pays for them? This guide will explain everything you need to know about tariffs, their implications, and their real-world effects.

What Are Tariffs?

Tariffs are taxes imposed by a government on imported goods and services. They are designed to achieve several objectives, such as protecting domestic industries, generating revenue, or retaliating against trade practices deemed unfair. Tariffs can be determined as specific (a fixed fee per unit) or ad valorem (a percentage of the item’s value).

How Do Tariffs Work?

- Imposition: A government decides to impose a tariff on specific goods. For example, the U.S. might impose a 25% tariff on steel imports from China.

- Collection: When the goods arrive at the border, the importer must pay the tariff to the customs authority.

- Impact: The cost of imported goods increases, leading to higher consumer prices, changes in supply chains, or shifts in trade patterns.

Types of Tariffs

- Protective Tariffs: Aimed at shielding domestic industries from foreign competitors by making imported goods more expensive.

- Revenue Tariffs: Designed primarily to generate income for the government.

- Retaliatory Tariffs: Imposed in response to another country’s trade policies, often as a form of economic sanction.

The Economic Impact of Tariffs

On Domestic Industries

Tariffs can give domestic producers a competitive edge by making imported goods more expensive. This can lead to increased production, higher employment, and more significant investment in local industries. However, reduced competition can also lead to inefficiencies and a lack of innovation.

On Consumers

Consumers often bear the brunt of tariffs through higher prices. For example, if a tariff is imposed on imported electronics, the cost of smartphones, laptops, and other gadgets may rise. This can reduce purchasing power and overall consumer welfare.

On International Trade

Tariffs can lead to trade wars, where countries retaliate with their tariffs or use them as a negotiation tool to obtain non-trade concessions. This can disrupt global supply chains, reduce international trade volumes, and lead to economic instability. For instance, the U.S.-China trade war saw both countries imposing tariffs on billions of dollars worth of goods, affecting global markets.

Who Ultimately Pays for Tariffs?

While importers technically pay tariffs, the cost is often passed down the supply chain, ultimately landing on consumers. Businesses may absorb some of the costs initially, but to maintain profit margins, they typically raise prices. In some cases, tariffs can also lead to job losses in industries that rely on imported materials.

Case Studies

- The Smoot-Hawley Tariff Act (1930): This U.S. legislation raised tariffs on over 20,000 imported goods, significantly decreasing international trade and exacerbating the Great Depression.

- U.S.-China Trade War (2018-present): Tariff impositions have increased costs for businesses and consumers in both countries, disrupting supply chains and creating economic uncertainty.

Conclusion

Tariffs are a complex and multifaceted tool in international trade. While they can protect domestic industries and generate revenue, they also have significant downsides, including higher consumer prices and potential trade wars. Understanding how tariffs work and their broader economic impact is necessary for making informed decisions, whether you’re a business owner, consumer, or investor.

By understanding the intricacies of tariffs, you can make better decisions to navigate the complexities of global trade, resulting in more informed economic choices. Stay tuned to TheMoneyQuestion.org for more insights and analysis on critical financial topics.

Disclosure Note

This post may contain affiliate links. If you click on an affiliate link and purchase, we may receive a small commission at no extra cost. This helps support our work and allows us to continue providing valuable content. Thank you for your support!