Economic History & Future Predictions

The Gold Standard Debate: Should We Return to Backed Money?

AFFILIATE DISCLOSURE:

This article contains affiliate links. We may receive a commission for purchases made through these links, at no extra cost to you. We only recommend products and services we believe will genuinely help you achieve your financial goals.

Explore the gold standard debate — should modern economies return to gold-backed money, or is fiat currency the better path forward?

Introduction: Why The Gold Standard Debate Still Matters Today

If there’s one topic that never seems to lose its shine in economic circles, it’s the gold standard debate. From YouTube finance influencers to policymakers and everyday savers, many are asking: Should we bring back money backed by gold?

The question isn’t just about nostalgia for shiny coins or distrust in “paper money.” It cuts to the heart of how value is created, stored, and protected in our financial system. In an age of inflation fears, digital currencies, and mounting government debt, people are searching for a system that feels real again — one grounded in something tangible.

So, should we go back to the gold standard? Or has the world moved beyond it for good?

Let’s unpack the history, arguments, and real-world implications — and see how this debate connects directly to your financial life today.

️ What Was the Gold Standard?

The gold standard was a monetary system where a country’s currency was directly tied to a specific amount of gold. For example, under the U.S. gold standard of the early 20th century, $35 equaled one ounce of gold. That meant every dollar in circulation could theoretically be exchanged for gold held in government vaults.

This system limited how much money could be created. The government couldn’t print more money unless it had more gold to back it up. Supporters say that kept inflation low and disciplined public spending.

Types of Gold Standards:

- Classical Gold Standard (1870–1914): Money was fully convertible to gold, and global trade was stable.

- Gold Exchange Standard (1925–1931): Countries held foreign currencies (like U.S. dollars or British pounds) backed by gold.

- Bretton Woods System (1944–1971): The U.S. dollar was pegged to gold, and other nations pegged their currencies to the dollar.

When President Richard Nixon ended dollar convertibility to gold in 1971, the world entered the era of fiat money — currency not backed by a commodity, but by government decree and economic trust.

⚖️ Fiat Money vs. Gold-Backed Money: What’s the Real Difference?

The debate often boils down to control versus stability.

Feature Gold-Backed Money Fiat Money

Value Basis Linked to a physical commodity (gold) Based on government trust and regulation

Money Supply Control Limited by gold reserves Determined by central banks

Inflation Control Naturally constrained Requires policy discipline

Economic Flexibility Restricted (limited stimulus) Highly flexible

Historical Stability Long-term stable prices Prone to inflation and crises

Crisis Response Slow — limited tools Quick — central banks can print money

Fiat systems allow nations to respond to crises like COVID-19 or financial crashes by injecting liquidity. But critics argue this power often leads to debt bubbles, currency devaluation, and inequality.

“Gold Standard vs. Fiat Money Comparison Template”

Use this simple template to compare how each system affects you personally.

Reflect and fill in your own observations.

Category Gold Standard System Fiat System (Today’s Money) Your Reflection

Money Creation Backed by physical gold reserves Created digitally or through lending _______________

Inflation Impact Historically low Often higher, depends on policy _______________

Savings Power Stable value over time Subject to erosion by inflation _______________

Debt and Borrowing Limited government borrowing High debt flexibility _______________

Economic Growth Slower but steadier Faster but volatile _______________

Financial Stability Hard money discipline Dependent on trust and regulation _______________

Personal Comfort Level Tangible security Policy-driven confidence _______________

Tip: Use this template as part of your personal financial education journal — track how your beliefs about money evolve as you understand the system better.

The Case For the Gold Standard

Advocates believe that returning to gold-backed money could restore trust and discipline in the economy. Here are the key arguments:

1. Inflation Control

Because money creation would be limited by gold reserves, governments couldn’t inflate away debt or overspend.

2. Fiscal Discipline

The gold standard forces governments to live within their means — reducing reckless deficit spending and long-term debt accumulation.

3. Stable Value

Over centuries, gold has retained its value better than any fiat currency. This stability can restore confidence for savers and investors.

4. Global Trust

A universal gold-based system could stabilize international exchange rates and reduce speculative currency wars.

As economist Milton Friedman once said:

“Inflation is taxation without legislation.”

The gold standard, in theory, prevents that kind of hidden tax.

The Case Against the Gold Standard

Critics argue that while gold may shine, it can also trap economies in rigidity.

1. Limited Flexibility

In times of crisis, such as the Great Depression, the gold standard prevented central banks from increasing the money supply to revive the economy.

2. Deflation Risk

When money supply can’t expand, prices fall — leading to wage cuts, job losses, and economic stagnation.

3. Resource Dependence

Economic growth would depend on mining more gold — not innovation or productivity.

4. Unequal Gold Distribution

Countries rich in gold (like the U.S. post–World War II) would dominate, leaving others vulnerable to external shocks.

5. Not Fit for the Digital Age

Modern economies rely on electronic transfers, derivatives, and dynamic credit systems — not physical metal locked in vaults.

A Balanced View: Could a Partial Gold Standard Work?

Some economists propose a hybrid system — where currencies are partially backed by gold, digital assets, or a commodity basket.

This could combine the stability of hard assets with the flexibility of fiat systems.

For example:

- The International Monetary Fund (IMF) has explored “Special Drawing Rights” (SDRs) as a diversified reserve currency.

- Central banks could issue digital currencies (CBDCs) with fractional gold backing to maintain public confidence.

Such innovations could represent a “Gold Standard 2.0” — not a step backward, but an evolution toward responsible money creation.

Trending Question: Would Returning to the Gold Standard Stop Inflation?

This is one of the most common questions driving the gold standard debate with strong arguments on both sides.

In theory, yes — tying money to gold would limit inflation by limiting the money supply and imposing fiscal discipline. But in practice, it is not guaranteed to stop inflation and could limit economic growth and increase unemployment during downturns resulting in economic instability and a loss of monetary policy flexibility to manage it.

The U.S. Congressional Research Service (CRS) notes that the Great Depression worsened because the gold standard restricted government action (source: crsreports.congress.gov).

Meanwhile, the Federal Reserve explains that fiat flexibility has helped stabilize output and prices since 1971 (federalreserve.gov).

So, while gold backing could discipline policy, it’s not a magic cure. The real solution lies in responsible governance, not just shiny metal.

What It Means for You: How This Debate Impacts Your Finances

Even if we never return to a gold standard, understanding this debate helps you make smarter decisions.

✅ 1. Inflation Awareness

Knowing how fiat systems work helps you protect your savings with inflation-hedged assets (like TIPS, real estate, or diversified ETFs).

✅ 2. Diversified Investing

Gold can be part of a balanced portfolio — not because of nostalgia, but as a hedge against monetary uncertainty.

✅ 3. Debt Perspective

In fiat systems, debt is a feature, not a flaw. Understanding this lets you navigate credit systems and government borrowing logically.

✅ 4. Critical Thinking

When politicians or influencers promise “sound money” through gold, you’ll be able to ask: How would that affect jobs, liquidity, and growth?

To deepen your understanding:

Internal Links (TheMoneyQuestion.org)

- Who Really Controls the Money? A Look at Central Banks

- The Debt Myth: Why Government Borrowing Isn’t Like a Household Budget

External Links

-

Federal Reserve History – The End of the Gold Standard https://www.federalreservehistory.org/essays/gold-standard

Overview from the Federal Reserve on why the U.S. ended gold convertibility in 1971 and the long-term economic implications. -

Congressional Research Service (CRS) – Returning to the Gold Standard: Historical and Policy Perspectives

https://crsreports.congress.gov/product/pdf/R/R43890

A nonpartisan U.S. government analysis explaining the potential effects of reinstating a gold-backed monetary system. -

Investopedia – What Is the Gold Standard?

→ https://www.investopedia.com/terms/g/goldstandard.asp

Educational reference summarizing the gold standard’s history, advantages, and disadvantages in accessible language.

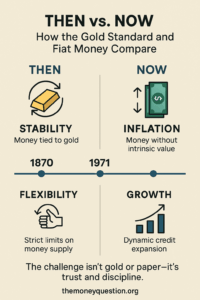

“Then vs. Now: How the Gold Standard and Fiat Money Compare”

Sections:

- Visual timeline (1870 → 1971 → Today)

- Icons for stability, inflation, flexibility, and growth

- Key takeaway: “The challenge isn’t gold or paper — it’s trust and discipline.”

- Add footer: themoneyquestion.org

Key Takeaways

- The gold standard offered stability, but limited flexibility.

- Fiat money offers flexibility, but risks inflation and overspending.

- The best system may blend discipline with innovation.

- Understanding money’s foundation empowers smarter financial choices.

Conclusion: Beyond the Gold Standard Debate

The gold standard debate isn’t just academic — it’s about who controls money, and how that control affects your life.

Whether we back currency with gold, digital code, or trust, the key issue remains accountability.

If citizens understand money creation, demand transparency, and make informed personal choices, the system becomes stronger — whatever form it takes.

Gold isn’t the answer. But the discipline it represents might be the one lesson modern money still needs.

FAQs: The Gold Standard Debate

1. What was the purpose of the gold standard?

The gold standard aimed to ensure monetary stability by tying each unit of currency to a fixed quantity of gold. This limited governments from creating money arbitrarily and helped control inflation. It also made international trade smoother because exchange rates were predictable and trusted.

2. Why did the U.S. abandon the gold standard?

The U.S. left the gold standard in 1971 when President Nixon ended convertibility to preserve economic flexibility. Global trade imbalances and postwar spending made it impossible to maintain fixed gold prices. Moving to fiat money allowed the government and Federal Reserve to respond more effectively to inflation, unemployment, and recession pressures.

3. Would a return to gold stop inflation permanently?

A gold-backed system could reduce inflation by limiting the money supply, but it wouldn’t eliminate it entirely. Prices also depend on productivity, wages, and global demand. Historically, gold standards have sometimes caused deflation, which can be just as harmful as inflation.

4. Is gold-backed money safer than fiat money?

Gold-backed money can feel safer because its value is linked to a tangible asset rather than government trust. However, this safety comes at the cost of flexibility — governments can’t easily stimulate growth or respond to crises. Fiat systems rely on policy discipline instead of metal reserves for stability.

5. Can digital currencies be gold-backed?

Yes, several new technologies allow for digital currencies partially backed by gold. Central Bank Digital Currencies (CBDCs) or stablecoins could use gold reserves to ensure value stability while allowing digital efficiency. This hybrid model combines traditional trust with modern innovation.

6. What caused the Great Depression under the gold standard?

During the Great Depression, the gold standard limited how much money governments could create to boost their economies. As prices and wages fell, deflation deepened the downturn. Countries that left the gold standard earlier — like the U.K. — recovered faster than those that stayed tied to it.

7. Does any country use the gold standard today?

No major economy operates on the gold standard today; all use fiat money issued by central banks. However, countries like Switzerland and Singapore maintain strong gold reserves as part of their financial security strategy. Gold remains an important reserve asset, even without direct convertibility.

8. Should investors buy gold now?

Gold can be a good diversification tool, especially during times of inflation or market uncertainty. Financial advisors often recommend allocating 5–10% of your portfolio to gold or similar assets. It’s not about betting on a gold standard comeback — it’s about hedging against fiat volatility.

9. What are the pros of fiat money?

Fiat money gives governments and central banks the flexibility to manage the economy, fund public programs, and respond to crises. It allows for credit expansion and innovation, which drive growth. The challenge is maintaining discipline so that flexibility doesn’t lead to runaway inflation.

10. What’s the biggest takeaway from the gold standard debate?

The real question isn’t whether we should return to gold — it’s whether we can create a responsible and transparent monetary system. Sound money depends more on good governance and informed citizens than on any metal. Understanding both systems empowers you to make better financial and policy judgments.

Affiliate Disclosure

Some links on this page may be affiliate links. This means we may earn a small commission at no extra cost to you if you purchase through them.

Disclaimer: The content provided is for informational purposes only and is not a substitute for professional financial or legal advice.

A Brief History of Money and Banking

AFFILIATE DISCLOSURE:

This article contains affiliate links. We may receive a commission for purchases made through these links, at no extra cost to you. We only recommend products and services we believe will genuinely help you achieve your financial goals.

Discover how money and banking evolved—from ancient trade to banking in the Middle Ages—and what it reveals about today’s financial system.

Introduction: The Long Journey of Money and Banking

Money didn’t start as coins, paper, or digital code. It began as trust. From seashells and salt to gold coins and digital ledgers, the story of money is really a story about how humans organize trust, power, and value.

In this post, we’ll explore banking in the Middle Ages, the roots of modern finance, and what these historical lessons can teach you about money management today.

By the end, you’ll understand:

-

How early banking systems laid the groundwork for today’s economy

-

Why medieval innovations like bills of exchange changed everything

-

How understanding the past can help you make smarter financial decisions today

Before the Banks: Barter and Early Exchange

Long before credit cards and online transfers, humans relied on barter—trading goods and services directly.

But barter was inefficient. A farmer with wheat might not need a fisherman’s catch. This “double coincidence of wants” problem forced societies to find a common medium of exchange—something durable, portable, and universally accepted.

The Birth of Commodity Money

-

Early forms of money included cattle, shells, salt, silver, and gold.

-

By 2500 BCE, the Sumerians recorded transactions on clay tablets, one of the earliest examples of accounting.

-

The Code of Hammurabi (circa 1750 BCE) outlined interest rates and loan contracts, showing how old money management really is.

Money simplified trade, but it also required new systems of record-keeping, lending, and regulation—the precursors of banking.

Temples, Merchants, and the First “Banks”

Before there were bankers, there were priests. In Mesopotamia, temples held grain and precious metals for safekeeping. People deposited their valuables, and the temple lent resources to others—collecting interest as profit.

This early system mirrored modern banking principles:

-

Deposits: People entrusted goods to a trusted intermediary.

-

Loans: Those resources were lent to others.

-

Interest: The intermediary profited by lending at a higher rate.

By the time of ancient Greece and Rome, moneylenders—called trapezitai in Greek—handled deposits, loans, and currency exchange. In Rome, bankers (argentarii) even recorded transactions in ledgers similar to modern account books.

The Collapse of Rome and the Dormant Centuries

When the Roman Empire fell in the 5th century, Europe’s trade networks disintegrated. Roads decayed, cities emptied, and coins became scarce. The idea of “banking” all but disappeared.

But not everywhere.

In the Islamic world, scholars preserved and expanded financial knowledge. Islamic banking principles—rooted in partnerships and profit-sharing rather than interest—thrived from Baghdad to Cordoba.

These ideas would later influence European banking practices during the Middle Ages.

Banking in the Middle Ages: The Birth of Modern Finance

Banking in the Middle Ages—marks a turning point in financial history.

Between the 11th and 15th centuries, European commerce revived, trade routes reopened, and merchants needed safer, faster ways to move money across distances. Carrying gold was dangerous and inefficient, so they turned to paper instruments, early credit systems, and trusted financial intermediaries.

The Italian Banking Renaissance

The story begins in Italy, the heart of medieval trade. Cities like Venice, Florence, and Genoa became bustling hubs of commerce—and innovation.

Key Developments:

-

Bills of Exchange: Merchants could pay with paper instead of coins. These acted like early checks, allowing someone to deposit money in one city and withdraw it in another.

-

Merchant Banks: Families like the Medici of Florence created banking houses that offered currency exchange, loans, and investment services.

-

Double-Entry Bookkeeping: A revolutionary accounting method (first codified by Luca Pacioli in 1494) made it easier to track profits and losses accurately.

This was the dawn of financial literacy. Banking became systematic, and the word “bank” itself derived from banca—the Italian word for “bench,” where moneylenders once did business.

Faith, Trust, and Regulation in Medieval Finance

In the Middle Ages, money was not just economics—it was morality.

The Catholic Church forbade usury (charging interest), believing it sinful to profit from lending. But trade demanded credit, so bankers found creative ways around the rule—charging “fees” or “exchange rates” instead of explicit interest.

Meanwhile, trust became the currency of commerce. Banks held vast power but depended on reputation. A single rumor could trigger a medieval bank run, collapsing fortunes overnight—just as it can today.

Case Study: The Medici Bank

The Medici Bank (1397–1494) is often considered the blueprint of modern banking.

Founded by Giovanni di Bicci de’ Medici, it grew into a financial empire spanning Europe. The Medici family financed kings, popes, and trade expeditions—while pioneering practices like:

-

Branch banking (offices across cities)

-

Letters of credit (predecessors to modern wire transfers)

-

Partnership management structures

However, political entanglements and risky loans eventually led to the bank’s downfall—a timeless reminder that over-leverage and corruption destroy even the strongest institutions.

The Birth of National Banks

As Europe entered the Renaissance, monarchs realized they needed centralized systems to finance wars and trade. This led to additional developments to money and banking as financiers adapted to changing requirements of users of the financial system.

The Bank of Amsterdam (1609) became one of the first public banks, followed by the Bank of England (1694), which introduced the concept of fractional reserve banking—holding only a fraction of deposits in reserve while lending out the rest.

This innovation fueled economic growth but also created systemic risk, linking credit cycles, inflation, and government debt in ways that shape our world today. This led to developments in record keeping, credit assessment

From Paper to Policy: The Age of Central Banking

As trade globalized, so did money. Governments standardized currencies, issued banknotes, and began regulating credit and interest.

By the 19th century, central banks—like the Bank of France and later the U.S. Federal Reserve (1913)—emerged to stabilize economies, issue currency, and manage crises.

Yet, the roots of their power trace directly back to banking in the Middle Ages, when trust, record-keeping, and liquidity management first became financial science.

How Historical Banking Shapes Your Finances Today

Understanding this history isn’t just trivia—it’s empowerment.

Many modern banking practices—credit scoring, interest, savings accounts, and loans—stem from ideas refined over centuries. Knowing this can help you:

-

Make smarter borrowing decisions

-

See how banks manage (and sometimes manipulate) money supply

-

Recognize how trust and regulation shape financial stability

For instance, just as medieval merchants diversified trade routes, modern investors diversify portfolios. The principles endure even as the tools evolve.

Controversial Question: Should We Return to Gold-Backed Money?

One trending debate asks: “Would a return to gold-backed money restore financial stability?”

The gold standard, once common after the Renaissance, tied currency value to physical gold. Some argue it prevents inflation; others say it limits economic flexibility.

History shows that while gold systems created stability, they also restricted growth—especially in times of crisis. The flexibility of credit and monetary policy (originating from medieval and Renaissance banking) enabled societies to rebuild after wars, pandemics, and depressions.

Takeaway: Stability requires trust, not just metal. Sound governance matters more than what backs the currency.

Downloadable Freebies

1. Timeline of Money & Banking Evolution Worksheet

Visualize the transformation of trade and finance—from bartering to digital currency.

➡️ Download the Timeline Worksheet here (insert download link on site)

2. Money Systems Through History Cheat Sheet

A one-page quick reference summarizing key milestones, from Mesopotamian temples to crypto economies.

➡️ Download the Cheat Sheet here

Internal Links

To deepen your understanding, explore related posts on TheMoneyQuestion.org:

-

The Gold Standard Debate: Should We Return To Backed Money? (Coming Soon)

- The End of Fractional Reserve Banking? Here’s What We Know

External Sources

Conclusion: The Past Is the Blueprint for the Future

The story of money and banking is the story of civilization itself. From the grain banks of Mesopotamia to the Medici in Florence, from paper notes to digital ledgers, one thing remains constant: money is a system of trust.

Understanding banking in the Middle Ages shows that our financial system—while complex—is built on simple human principles of trust, record-keeping, and mutual benefit.

Whether you’re managing a household budget or analyzing global finance, knowing where money came from helps you navigate where it’s going.

FAQs

1. What was banking in the Middle Ages like?

It revolved around merchant families, bills of exchange, and trust-based credit systems—especially in Italy and Northern Europe. It was a time of significant innovation, though practices were constrained by religious prohibitions.

2. Who were the first bankers?

This question depends on how broadly you define “banking”, as the practice evolved over thousands of years. Temples in Mesopotamia (~2000BC), The Knights Templar (12th – 13th Century), and merchants in Renaissance Italy (14th – 15th Century) are considered the world’s earliest bankers.

3. What replaced barter systems?

Commodity money—like silver, gold, and salt—eventually evolved into coins and paper money.

4. Why was usury banned in medieval Europe?

The Church viewed charging interest as immoral, though trade required credit, leading to workarounds. Bankers found ways to circumvent this ban by:

- imposing a “fine” for late repayment, with the understanding that the debtor would always pay late.

- using contracts like the bill of exchange and adjusting the exchange rate to incorporate an implicit interest payment.

5. Who invented double-entry bookkeeping?

Luca Pacioli formalized it in 1494; this system remains the foundation of modern accounting.

6. What led to the fall of the Medici Bank?

Political risk, bad loans, and mismanagement caused its collapse.

7. How did banking spread beyond Italy?

Through trade networks into France, England, and the Low Countries, setting the stage for national banks.

8. What was the first central bank?

- The world’s oldest surviving central bank, and the one widely recognized as the first, is the Sveriges Riksbank (the Swedish Riksbank). It was founded in Sweden in 1668. The Bank of England (1694) is often credited as the second central bank.

9. How did medieval banking influence today’s system?

- Medieval banking, primarily led by Italian merchant families and religious orders, provided the foundational tools and concepts that are indispensable to the modern financial system. The core contribution was the shift from a physical, coin-based economy to a credit-based, document-driven system.

10. What can modern savers learn from history?

Here are four major lessons drawn from past financial crises, economic downturns and centuries of human behaviour:

- Everyone should have a Cash Emergency Fund. Failure to have access to cash make people more vulnerable to events like The Great Depression, the 2008 financial crisis and the COVID-19 economic shock.

- Diversification across different asset classes, geographic regions and industries is a must so no single event can wipe out your entire portfolio.

- Avoid overleveraging and speculation. Be cautious with debt, especially consumer debt.

- Pay yourself first. This is the ancient discipline of thrift. Make saving automatic and non-negotiable.

Affiliate Disclosure

This post may contain affiliate links. If you purchase through these links, TheMoneyQuestion.org may earn a small commission—at no extra cost to you.

Content is for informational purposes only and not a substitute for advice from certified financial professionals.

The 2008 Financial Crisis vs Today: Are We Heading For Another Financial Meltdown?

AFFILIATE DISCLOSURE:

This article contains affiliate links. We may receive a commission for purchases made through these links, at no extra cost to you. We only recommend products and services we believe will genuinely help you achieve your financial goals.

Is another financial crisis looming? Compare the 2008 meltdown to today’s economic risks—rising debt, Inflation, and market volatility. Learn how to protect your finances and what warning signs to watch.

Introduction

The 2008 financial crisis was one of the worst economic disasters in modern history, triggered by reckless lending, a housing bubble, and the collapse of major financial institutions. Over a decade later, concerns are rising again—soaring Inflation, mounting debt, and geopolitical instability have many asking: Are we heading for another financial meltdown?

In this in-depth analysis, we’ll compare the 2008 crisis to today’s economic landscape, examine key risk factors, and explore how investors can safeguard their wealth.

The 2008 Financial Crisis: A Quick Recap

The 2008 crisis was primarily caused by:

- Subprime Mortgage Lending – Banks issued high-risk loans to borrowers with poor credit, betting on ever-rising home prices.

- Securitization & Derivatives – Toxic mortgage-backed securities (MBS) and credit default swaps (CDS) spread risk across the global financial system.

- Bank Failures & Bailouts – Lehman Brothers collapsed, while institutions like AIG and Citigroup required massive government rescues.

- Global Recession – Stock markets crashed, unemployment spiked, and economies worldwide entered prolonged downturns.

The aftermath led to stricter regulations like the Dodd-Frank Act and higher capital requirements for banks. But have these measures made the financial system safer today?

Today’s Economic Landscape: Key Risk Factors

- Soaring National & Consumer Debt

- U.S. National Debt: Over **34trillion∗∗(vs. 34trillion∗∗(vs. 10 trillion in 2008). (U.S. Treasury)

- Consumer Debt: Credit card debt hit $1.13 trillion in 2024, with rising delinquencies. (Federal Reserve)

- Inflation & Central Bank Policies

- Post-pandemic Inflation peaked at 9.1% in 2022, the highest in 40 years.

- The Federal Reserve raised interest rates aggressively, but cuts may come in 2024—will this reignite Inflation?

- Commercial Real Estate (CRE) Crisis

- Remote work has devastated office space demand.

- Over $1.5 trillion in CRE loans will mature by 2025—many at higher rates. (Moody’s Analytics)

- Banking Sector Vulnerabilities

- The 2023 collapse of Silicon Valley Bank (SVB) and Signature Bank exposed risks in regional banks.

- Rising loan defaults could trigger another liquidity crisis.

- Geopolitical Risks & Market Volatility

- Wars, trade tensions, and supply chain disruptions add uncertainty.

- Stock markets remain near all-time highs—could a correction be coming?

Key Differences Between 2008 and Today

Factor2008 CrisisToday’s Risks

Trigger housing collapse, subprime mortgages, Inflation, debt bubbles, and CRE weaknesses.

Banking Health Weak capital reserves, Lehman collapsed. Stronger, but regional banks were vulnerable.

Regulations Loose pre-2008, tightened after Some rollbacks, but stricter oversight.

Government Role Massive bailouts (TARP) Fed balance sheet still inflated

Are We Heading for Another Meltdown?

While today’s risks differ from 2008, warning signs exist:

✅ Debt levels are unsustainable (government, corporate, and consumer).

✅ Commercial real estate could spark bank failures.

✅ Inflation remains a threat if the Fed cuts rates prematurely.

However, banks are better capitalized, and regulators are more vigilant. A full-scale 2008-style crash seems less likely—but a severe recession or market correction is possible.

How to Protect Your Finances

- Diversify Investments – Avoid overexposure to stocks; consider bonds, gold, and real estate.

- Reduce High-Interest Debt – Pay down credit cards and refinance loans.

- Build an Emergency Fund – Aim for 3-6 months of living expenses.

- Monitor the Fed’s Moves – Interest rate changes will impact markets.

10 Related FAQs

- What caused the 2008 financial crisis?

The collapse of subprime mortgages, banks’ excessive risk-taking, and Lehman Brothers’ failure triggered the meltdown.

- Could a bank collapse like 2008 happen again?

While major banks are stronger, regional banks (like SVB in 2023) remain vulnerable.

- How does today’s Inflation compare to 2008?

Inflation was moderate in 2008 (~5.6% peak), while 2022 saw 9.1%—the highest since 1981.

- Is the housing market in a bubble now?

Home prices have surged, but stricter lending standards make a 2008-style crash unlikely.

- What’s the most significant financial risk today?

Soaring national debt, commercial real estate defaults, and geopolitical instability.

- Should I move my money to cash?

Holding some cash is wise, but long-term investors should stay diversified.

- Are stocks overvalued now?

Some analysts warn of high P/E ratios, but timing the market is risky.

- How can I prepare for a recession?

Reduce debt, increase savings, and avoid panic-selling investments.

- Will Bitcoin protect me in a crisis?

Crypto is volatile—gold and Treasury bonds are safer hedges.

- What’s the best investment during Inflation?

Real estate, commodities (gold, oil), and inflation-protected securities (TIPS).

SEO Keywords & Hashtags

Keywords:

- 2008 financial crisis vs today

- Are we in a financial bubble?

- Next economic crash prediction

- How to prepare for a recession

- Inflation and debt crisis

Hashtags:

#FinancialCrisis #EconomicCollapse #Inflation #StockMarket #Investing

Final Thoughts: While another 2008-style meltdown isn’t guaranteed, economic risks are rising. Stay informed, diversify your assets, and avoid panic-driven decisions.

Affiliate Marketing Disclosure

This post may contain affiliate links. If you make a purchase through these links, we may earn a commission at no extra cost to you. We only recommend products/services we believe in. Thank you for supporting our work!

The Rise of Economic Populism: What It Means for Money and Markets

AFFILIATE DISCLOSURE:

This article contains affiliate links. We may receive a commission for purchases made through these links, at no extra cost to you. We only recommend products and services we believe will genuinely help you achieve your financial goals.

Economic populism is reshaping global finance and markets. In this deep dive into the financial consequences of rising populist movements, discover its impact on monetary policy, inflation, and investment strategies.

Introduction

Economic populism has surged in recent years, fueled by widespread dissatisfaction with economic inequality, globalization, and perceived government inaction. From the United States to Europe and Latin America, populist leaders are gaining traction by advocating policies that challenge traditional economic frameworks. But what does this mean for money and markets? In this article, we explore the rise of economic populism, its influence on monetary policy, and how investors and everyday consumers can prepare for the financial shifts ahead.

Understanding Economic Populism

Economic populism is a political approach that prioritizes the interests of the general public over elite economic institutions. It often manifests in policies such as:

- Increased government spending

- Protectionist trade policies

- Wealth redistribution through taxation

- Central bank intervention

While these policies resonate with voters frustrated by wage stagnation and financial instability, they also introduce significant changes to the global economic system.

Key Features of Economic Populism

- Expansionary Fiscal Policies – Populist governments often prioritize large-scale spending programs, from infrastructure investments to direct cash transfers.

- Monetary Policy Interventions: Central banks may be pressured to maintain low interest rates, print more money, or directly fund government initiatives.

- Regulatory Overhauls – Populists frequently advocate breaking up large corporations, limiting financial speculation, or nationalizing industries.

- Trade Protectionism – Tariffs, import restrictions, and withdrawal from global trade agreements are common populist tactics.

The Impact on Money and Markets

1. Inflation and Currency Devaluation

One of the most significant risks of economic populism is inflation. Increased government spending without adequate revenue sources often leads to budget deficits. If a country resorts to money printing to finance these deficits, inflation can spiral, weakening the purchasing power of its currency. Examples include:

- Argentina’s persistent inflation crisis is due to populist policies.

- Turkey’s economic struggles are linked to government intervention in interest rate policies.

2. Central Bank Independence Under Threat

Populist governments frequently challenge central banks’ autonomy, seeking to align monetary policy with political goals. When central banks lose independence, investor confidence erodes, leading to capital flight and market instability.

3. Stock Market Volatility

Markets dislike uncertainty. Populist policies that impose trade restrictions increase corporate taxation or introduce wealth redistribution measures can trigger sharp market corrections. However, specific sectors like infrastructure, defense, and consumer goods may benefit from populist spending plans.

4. Protectionism and Global Trade Shifts

Economic populism often leads to increased tariffs and trade wars. This affects multinational corporations and industries reliant on global supply chains. The U.S.-China trade war under the Trump administration showcased how protectionist policies could disrupt international trade and investment flows.

How Investors Can Prepare

1. Diversify Across Asset Classes

To hedge against economic uncertainty, investors should diversify their portfolios by including:

- Gold and Commodities: Safe-haven assets that protect against inflation.

- Dividend Stocks: Reliable income-generating investments that withstand economic downturns.

- International Investments: Exposure to markets less affected by populist policies in one country.

2. Monitor Inflation-Protected Securities

Bonds such as Treasury Inflation-Protected Securities (TIPS) in the U.S. or similar instruments in other countries provide protection against inflationary risks.

3. Focus on Defensive Sectors

Consumer staples, utilities, and healthcare stocks perform well during economic turbulence. Investors who are exposed to these sectors should consider ETFs or mutual funds.

4. Stay Updated on Policy Changes

Understanding upcoming policy shifts allows investors to make informed decisions. Subscribing to financial newsletters and market analysis platforms can help track trends in economic populism.

Frequently Asked Questions (FAQs)

- What is economic populism? Economic populism refers to policies that prioritize public interests over elite financial institutions, often through increased government spending and regulation.

- How does economic populism affect inflation? Excessive government spending and money printing can lead to high inflation, reducing purchasing power.

- Are populist policies good for the stock market? Some sectors benefit, but overall, market uncertainty and regulation can create volatility.

- Why do populist governments challenge central banks? They seek control over monetary policy to fund initiatives without opposition from independent institutions.

- How can investors protect themselves from economic populism? Diversifying assets, investing in inflation-protected securities, and focusing on defensive sectors are key strategies.

- What sectors benefit from economic populism? Infrastructure, consumer goods, and defense sectors often see increased government spending.

- Do populist policies always lead to financial crises? Not always, but mismanaged economic policies can contribute to instability and inflation.

- How does protectionism impact global trade? Tariffs and trade restrictions can disrupt supply chains and increase costs for businesses and consumers.

- Can cryptocurrency serve as a hedge against populist policies? Yes, digital assets like Bitcoin are often considered alternatives to traditional currency during economic uncertainty.

- What role does debt play in economic populism? Populist policies often increase national debt, which can lead to higher taxes or inflation over time.

Affiliate Marketing Disclosure

This article may affiliate links. If you purchase through these links, we may earn a commission at no extra cost to you. This helps support our work in providing financial insights.

Universal Basic Income: Can Free Money Save the Economy?

AFFILIATE DISCLOSURE:

This article contains affiliate links. We may receive a commission for purchases made through these links, at no extra cost to you. We only recommend products and services we believe will genuinely help you achieve your financial goals.

Could Universal Basic Income (UBI) be the key to economic stability and financial security? Explore UBI’s potential benefits and risks, its impact on inflation, employment, and economic growth, and whether “free money” could actually work.

Introduction: The UBI Debate

Universal Basic Income (UBI) is one of modern history’s most hotly debated economic policies. At its core, UBI is a government program that provides all citizens with a regular, unconditional amount of money, regardless of employment status or income level. Proponents argue it could reduce poverty, increase financial security, and support economic growth. Critics, however, warn that it could lead to inflation, discourage work, and strain government budgets.

In this article, we’ll examine whether UBI is a viable solution for economic challenges, analyze real-world experiments, and explore the potential consequences of implementing such a system at scale. Additionally, we’ll recommend financial tools and resources that can help individuals manage their income efficiently.

What is Universal Basic Income?

Universal Basic Income (UBI) is a social welfare policy that provides all citizens with a set amount of money at regular intervals without any work requirement. The fundamental characteristics of UBI include:

- Universality: Available to everyone, regardless of employment or financial status.

- Unconditionality: No conditions attached—recipients do not have to work or prove financial need.

- Regularity: Payments are made on a consistent basis (e.g., monthly).

- Cash-based: Unlike food stamps or housing vouchers, UBI is given in cash, allowing recipients to spend as they choose.

It’s crucial to use sound financial management strategies to make the most of any additional income. If you’re receiving extra funds, consider using budgeting tools like YNAB (You Need A Budget) or Personal Capital to track your spending and savings.

Arguments in Favor of UBI

- Poverty Reduction and Economic Security

A key argument for UBI is that it can significantly reduce poverty by providing financial security to all citizens. With a guaranteed income, individuals can cover essential needs like housing, food, and healthcare, reducing homelessness and food insecurity.

- Encouraging Entrepreneurship and Innovation

A guaranteed income can give people the freedom to take risks, start businesses, or pursue creative endeavours without the fear of financial ruin. By reducing economic anxiety, UBI can enable more innovation and economic dynamism.

- Automation and the Future of Work

With automation replacing jobs at an increasing rate, many argue that UBI could provide a necessary financial cushion for workers displaced by technology. If robots and AI take over routine jobs, a universal income could ensure that displaced workers remain economically stable.

- Simplification of Welfare Programs

Many existing welfare programs are complex and bureaucratic, requiring significant government oversight. UBI could replace multiple welfare programs with a single, streamlined system, potentially reducing administrative costs and inefficiencies.

- Boosting Local Economies

Providing people with additional disposable income can lead to increased consumer spending, which in turn would stimulate local businesses and economic growth. A UBI could be an economic stimulus, especially during downturns or recessions.

Arguments Against UBI

- Potential for Inflation

One primary concern is that injecting large amounts of money into the economy could increase prices. If everyone suddenly has more money, demand for goods and services could outpace supply, leading to inflation that diminishes the purchasing power of the UBI itself.

- Work Disincentives

Critics argue that a guaranteed income might discourage people from working. If people can survive without employment, some may choose not to work, potentially reducing productivity and overall economic output.

- Funding Challenges

Implementing a nationwide UBI would require massive government spending. Critics question how it would be funded—whether through higher taxes, redistribution of existing welfare funds, or new revenue sources like wealth or carbon taxes.

- Impact on Traditional Welfare Programs

If UBI replaces welfare programs like food stamps, unemployment benefits, and housing assistance, vulnerable populations could be worse off if the guaranteed income does not meet their specific needs.

- Wealth Redistribution and Political Challenges

Redistributing wealth to fund UBI could face significant political opposition. Some argue that taxation needed to fund UBI might discourage investment and economic growth. In contrast, others believe wealth redistribution is necessary for a more equitable society.

Real-World UBI Experiments

Several countries and regions have tested UBI in limited capacities:

- Finland (2017-2018): A trial of 2,000 unemployed people receiving €560 per month showed improvements in mental well-being but no significant increase in employment.

- United States (Stockton, CA – 2019-2021): A pilot program provided $500 monthly to 125 low-income residents, improving financial security and increasing full-time employment rates.

- Kenya (Ongoing): The charity GiveDirectly is conducting a long-term UBI experiment that provides cash payments to rural villagers. Early findings show increased entrepreneurship and improved living conditions.

Frequently Asked Questions (FAQs)

- What is Universal Basic Income (UBI)?

-

- UBI is a system in which the government provides all citizens with a set amount of money regularly and unconditionally.

- How would UBI be funded?

-

- Possible funding methods include higher taxes, redistribution of welfare funds, or new taxes like wealth or carbon taxes.

- Would UBI replace existing welfare programs?

-

- It depends on implementation. Some proposals suggest replacing welfare, while others propose UBI as a supplement.

- Would UBI cause inflation?

-

- Some economists argue that increasing money supply could lead to inflation, while others believe increased productivity would offset this.

- Has UBI been tested anywhere?

-

- UBI experiments have been conducted in Finland, Stockton (USA), Kenya, and other regions.

- Would people stop working if UBI were implemented?

-

- Studies suggest that most people would continue working, though some might reduce hours to pursue education or caregiving.

- How much money would UBI provide per person?

-

- Proposed amounts vary, but many models suggest $500-$1,000 monthly.

- Would businesses support UBI?

-

- Some business leaders support UBI to maintain consumer spending amid automation.

- Would UBI be universal or targeted?

-

- Some models propose UBI for all citizens, while others suggest limiting it to low-income individuals.

- What are the political challenges of implementing UBI?

- UBI faces opposition due to funding concerns, political ideology, and potential impacts on the labour market.

Affiliate Disclosure

This article may contain affiliate links, meaning we may earn a commission if you click on them and make a purchase. This helps support our work at no additional cost to you.

The Future of Banking: Will We Even Need Banks in 20 Years?

AFFILIATE DISCLOSURE:

This article contains affiliate links. We may receive a commission for purchases made through these links, at no extra cost to you. We only recommend products and services we believe will genuinely help you achieve your financial goals.

As fintech, blockchain, and digital currencies revolutionize financial services, will traditional banks become obsolete? Explore the future of banking and what it means for consumers and businesses.

Introduction

Banking has been a cornerstone of modern economies for centuries, but technology is rapidly reshaping the industry. Many are questioning whether traditional banks will still be necessary in the next two decades with the rise of fintech, blockchain, central bank digital currencies (CBDCs), and decentralized finance (DeFi). Will brick-and-mortar banks become obsolete? Or will they adapt to a new financial landscape? This article explores the forces driving change in banking, the potential risks, and what the future may hold.

The Forces Driving Change in Banking

- The Rise of Fintech

Fintech companies have disrupted the financial sector by offering innovative services that banks once exclusively provided. Mobile banking apps, peer-to-peer lending platforms, robo-advisors, and payment processing solutions have transformed how individuals and businesses handle money. Services like PayPal, Venmo, Square, and Revolut have demonstrated that many traditional banking functions can be executed without legacy institutions.

- Blockchain and Decentralized Finance (DeFi)

Blockchain technology has introduced decentralized finance (DeFi), enabling peer-to-peer transactions without intermediaries. Platforms like Uniswap, Aave, and MakerDAO allow users to borrow, lend, and trade digital assets without relying on traditional banks. If DeFi continues to grow and overcome regulatory challenges, it could significantly reduce the role of banks.

- Central Bank Digital Currencies (CBDCs)

Governments worldwide are exploring CBDCs, digital versions of fiat currency issued directly by central banks. Unlike cryptocurrencies, CBDCs are government-backed, ensuring stability while offering the benefits of digital payments. CBDCs could allow individuals to hold digital money directly with central banks if widely adopted, bypassing commercial banks entirely.

- Artificial Intelligence and Automation

AI-driven financial services are enhancing customer support, fraud detection, credit assessment, and investment management. Chatbots, algorithmic trading, and AI-powered risk analysis reduce the need for human intervention in banking. With continued advancements, AI could make many traditional banking jobs obsolete while improving efficiency and accessibility.

- Big Tech’s Entry into Finance

Companies like Apple, Google, Amazon, and Facebook (Meta) have already entered the financial space with digital wallets, payment systems, and lending services. Apple Pay, Google Pay, and Meta’s financial ambitions demonstrate how technology firms could eventually offer full-fledged banking services, potentially challenging traditional banks.

- Regulatory and Consumer Trust Issues

While technological advancements are reshaping finance, trust and regulation remain significant hurdles. Consumers still rely on traditional banks for security, deposit insurance, and fraud protection. Governments and financial regulators must determine how to oversee new financial models, ensuring consumer protection while fostering innovation.

Will Traditional Banks Survive or Transform?

While banks face mounting challenges, they are not entirely doomed. Instead, they may evolve into more digital, leaner entities that integrate fintech solutions. Some possible future scenarios include:

- Hybrid Banking Models: Traditional banks may partner with fintech firms to offer seamless digital services while maintaining their regulatory advantages.

- Specialized Banking Services: Banks could focus on high-value services like wealth management, business lending, and advisory roles, areas where human expertise remains critical.

- Infrastructure Providers: Banks may shift towards backend infrastructure, supporting fintech and DeFi platforms instead of directly serving customers.

- Regulatory Collaborators: As compliance requirements grow, banks could leverage their regulatory expertise to help new financial technologies navigate legal frameworks.

The Risks and Challenges Ahead

Despite the excitement around financial innovation, several risks and challenges remain:

- Regulatory Uncertainty: DeFi and crypto face significant regulatory scrutiny, which could limit their growth.

- Cybersecurity Threats: Digital banking solutions are vulnerable to hacking and fraud.

- Financial Exclusion: Not everyone can access digital services, making physical banking essential for some populations.

- Economic Stability Risks: If traditional banks decline too quickly, it could disrupt economic stability and financial markets.

What Should Consumers Do to Prepare for the Future of Banking?

- Adopt Digital Banking Tools: Get familiar with fintech apps, mobile banking, and digital wallets.

- Educate Yourself on Blockchain and DeFi: Understand how decentralized finance works and assess potential risks.

- Diversify Financial Holdings: Keep assets in different forms, including cash, digital currencies, and traditional investments.

- Stay Informed on Regulations: Monitor financial regulations to understand how they may impact your money.

- Enhance Financial Literacy: Learn about best practices for personal finance, investment strategies, and digital security.

Conclusion: A Banking Revolution is Coming

The banking industry is undergoing a transformation unlike anything seen before. While traditional banks may not disappear entirely, their role in finance is likely to shift dramatically. As fintech, DeFi, and CBDCs continue to evolve, consumers and businesses must stay informed and adaptable to navigate this changing landscape. The future of banking may be digital, decentralized, and radically different from what we know today.

Frequently Asked Questions (FAQs)

- Will banks exist in 20 years?

- While traditional banks may not disappear entirely, they will evolve into more digital and specialized entities.

- What is DeFi, and can it replace banks?

- DeFi (Decentralized Finance) is a financial system built on blockchain that enables peer-to-peer transactions without intermediaries. While it can reduce reliance on banks, regulatory challenges and security concerns may limit its widespread adoption.

- How do CBDCs impact banks?

- CBDCs could reduce the need for commercial banks by allowing individuals to hold digital currency directly with central banks.

- Are fintech companies safer than banks?

- Fintech companies offer convenience and innovation but may not always have the same regulatory protections as banks, such as deposit insurance.

- What role will AI play in banking?

- AI will enhance fraud detection, customer support, risk assessment, and automation, making banking services more efficient and accessible.

- How secure is digital banking?

- While digital banking is generally secure, cybersecurity risks such as hacking and fraud remain concerns. Strong passwords and two-factor authentication are recommended.

- Can I invest in DeFi safely?

- DeFi investments carry risks, including smart contract vulnerabilities and regulatory uncertainty. Using secure platforms and hardware wallets can help mitigate risks.

- Will physical bank branches disappear?

- While the number of physical branches may decline, some will likely remain to serve customers who require in-person banking services.

- How will big tech companies impact banking?

- Companies like Apple, Google, and Amazon may offer financial services that compete with traditional banks, potentially reshaping the industry.

- How should I prepare for the future of banking?

- Staying informed, diversifying financial holdings, and adopting digital banking tools will help you adapt to the evolving financial landscape.

Affiliate Marketing Disclosure

Some links in this article may be affiliate links, meaning we may earn a commission if you purchase through them. This comes at no additional cost to you and helps support our content.

Universal Basic Income: Pros, Cons, and Its Impact on the Economy

AFFILIATE DISCLOSURE:

This article contains affiliate links. We may receive a commission for purchases made through these links, at no extra cost to you. We only recommend products and services we believe will genuinely help you achieve your financial goals.

Universal Basic Income: A Bold Economic Safety Net or a Costly Gamble?

Explore how Universal Basic Income could reduce poverty, spur entrepreneurship, and respond to automation — but face soaring costs, inflation risks, and political hurdles.

Introduction

Universal Basic Income is a revolutionary economic concept gaining traction worldwide. It proposes that every citizen receives a fixed, unconditional sum of money regularly, regardless of employment status. Proponents argue it could reduce poverty, simplify welfare systems, and adapt to automation-driven job losses. Critics warn of high costs, potential disincentives to work, and inflationary risks.

In this article, we’ll explore:

- What Universal Basic Income is and how it works

- The pros and cons of Universal Basic Income

- Its potential economic impact

- Real-world Universal Basic Income experiments and results

- FAQs and key takeaways

By the end, you’ll understand whether Universal Basic Income could be a viable solution for modern economies.

What Is Universal Basic Income (UBI)?

Universal Basic Income is a government-funded program that provides all citizens (or residents) regular, unconditional cash payments. Unlike traditional welfare, Universal Basic Income has no means-testing or work requirements. Key features include:

- Universal – Every eligible person receives it.

- Unconditional – No restrictions on how it’s spent.

- Regular – Typically distributed monthly.

How Would Universal Basic Income Be Funded?

Potential funding mechanisms include:

- Higher taxes (income, wealth, or VAT increases)

- Cutting existing welfare programs

- Printing money (risks inflation)

- Automation/AI taxes (on companies replacing workers with robots)

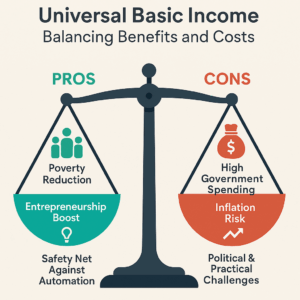

Pros of Universal Basic Income

- Poverty Reduction & Financial Security

- Provides a financial floor, reducing extreme poverty.

- Helps the unemployed, gig workers, and those in unstable jobs.

- Simplified Welfare System

- Replaces complex, bureaucratic welfare programs with direct cash transfers.

- Reduces administrative costs and fraud risks.

- Encourages Entrepreneurship & Creativity

- With basic needs covered, people may take risks (e.g., starting businesses, pursuing education, or starting creative ventures).

- Studies (e.g., Finland’s UBI trial) show improved mental health and well-being.

- Adaptation to Automation & Job Displacement

- As AI and robots replace jobs, UBI could act as a safety net.

- Prevents mass unemployment crises.

- Reduced Income Inequality

- Direct cash transfers help balance wealth distribution.

- Could decrease reliance on predatory loans and debt cycles.

Cons of Universal Basic Income

- High Cost & Funding Challenges

- A $1,000/month UBI for all U.S. adults would cost $3 trillion annually (nearly the entire federal budget).

- Requires major tax reforms or spending cuts.

- Potential Work Disincentives

- Critics argue free money could reduce motivation to work.

- Some studies (e.g., Alaska’s Permanent Fund Dividend) show minimal labour market impact, but long-term effects are unclear.

- Inflation Risk

- If demand surges (due to increased purchasing power), prices could rise, negating UBI’s benefits.

- It must be carefully balanced with monetary policy.

- Possible Reduction in Specialized Welfare

- Replacing targeted aid (e.g., disability, housing subsidies) with UBI might leave vulnerable groups worse off.

- Political & Public Resistance

- Many oppose “free money” on ideological grounds.

- Implementation requires bipartisan support, which is challenging.

Universal Basic Income’s Economic Impact

- Consumer Spending & Economic Growth

- More disposable income → higher consumption → economic stimulation.

- It could boost small businesses and local economies.

- Labor Market Effects

- Positive: Workers may seek better jobs rather than staying in exploitative roles.

- Negative: Some may exit the workforce, shrinking the labour supply.

- Government Budget & Taxation

- Requires massive fiscal restructuring.

- This could lead to higher taxes on corporations and high earners.

- Inflation & Monetary Policy

- If not properly managed, excess money supply could devalue the currency.

- Central banks may need to adjust interest rates accordingly.

Real-World Universal Basic Income Experiments

Several countries and cities have tested UBI with mixed results:

Experiment Findings

Finland (2017-2018) Improved well-being, no significant work disincentive.

Stockton, California (2019-2021) Reduced financial stress and increased full-time employment.

Kenya (Give Directly, ongoing) Boosted entrepreneurship and asset ownership.

Alaska (Permanent Fund Dividend since 1982) No major labour market disruption; popular but not a full UBI.

Most trials show positive short-term effects, but long-term sustainability remains uncertain.

Conclusion

In most serious political and economic proposals for a UBI, the model is not a full replacement for all welfare programs. The consensus among many UBI advocates is that the UBI would likely replace a large chunk of cash-transfer and income-support programs, but that highly-targeted benefits like disability assistance, specialized health care, and potentially housing support would need to be retained to avoid financially harming the most vulnerable citizens.

FAQs About Universal Basic Income

- Has any country fully adopted UBI?

As of late 2025, no country has fully implemented a nationwide UBI system that meets all the criteria (recurring, unconditional cash payments to all individual citizens). However, many countries and regions have explored the concept through:

- Pilot Programs and Trials (e.g. Finland, Canada, Kenya, various cities in the U.S. and Europe) to test the effects of a basic income on specific populations.

- Targeted Guaranteed Basic Income (GBI) programs for certain vulnerable groups, such as the one in Wales for young people leaving care.

- National cash Transfer programs that have some UBI-like features, such as Iran’s national cash transfer to all citizens that replaced subsidies (though this was a replacement for subsidies) or the Alaska Permanent Fund in the U.S., which gives annual dividends from oil revenues to all residents.

- Would UBI replace all welfare programs?

The idea of a UBI replacing all welfare programs is a central and highly debated point in the UBI discussion. There are two main philosophical models for how UBI would interact with existing welfare:

- The Replacement Model (“Big UBI), where UBI is set high enough to cover basic needs and would fully replace nearly all existing means-tested welfare programs (like unemployment insurance, food assistance, housing benefits and most cash transfers)

- The Complementary Model (The “Partial UBI” or UBI+) Here, UBI is set as a moderate, modest level (often below the poverty line) and would supplement the existing welfare system.

- How much would UBI cost taxpayers?

Estimates vary, but funding would likely require higher taxes on corporations, top earners, or new revenue streams. The cost of UBI to taxpayers is one of the most contentious points of the debate, and the answer is highly dependant on two key factors:

- The Gross Cost vs The Net Cost ( the biggest source of confusion)

- The Specific Design of the UBI (the payment amount and how it is funded)

- Would UBI cause inflation?

The consensus among economists is that UBI itself is not inherently inflationary or deflationary; its impact depends entirely on how it is funded and the current state of the economy. If not balanced with productivity growth, yes. Proper monetary policy would be crucial.

- Do people work less under UBI?

The overall effect on the labour market is generally small, but it does cause shifts in who works and why. Most experiments show no significant drop in employment, with some shifting to better jobs or education.

- Could UBI reduce homelessness?

Yes, UBI or targeted guaranteed income programs have shown promise in reducing housing instability and homelessness, particularly when paired with housing service. The core mechanism is addressing the income side of the housing crisis.

Homelessness is fundamentally a lack of housing, but it’s often caused by a lack of money. By providing an unconditional cash floor, UBI helps to stabilize people’s finances, allowing them to afford or save for housing.

- Is UBI socialist?

The question of whether UBI is socialist is complex, as UBI is a policy that is not confined to a single ideology and has been championed by thinkers from across the entire political spectrum. It’s debated—some see it as a market-friendly safety net, others as a redistribution policy.

- How would UBI affect gig workers?

UBI would likely have a profound and positive impact on gig workers by addressing the core issues of financial shortfalls, lack of benefits and low wages. It could provide stability for gig workers facing irregular income.

- Would UBI discourage education?

Unlikely, research and evidence from various pilot programs and studies on UBI suggest that it does not discourage education. In fact, many studies have shown the opposite: UBI can be a powerful tool to promote and support educational attainment and

skills training.

- What’s the biggest obstacle to UBI?

The biggest obstacle to implementing Universal Basic Income is not a single issue, but a combination of political, economic and social challenges. However, if one were to be identified as the most significant, it would be the immense cost and the resulting political feasibility of funding it.

Final Thoughts

Universal Basic Income presents a bold solution to modern economic challenges, from automation to inequality. While trials show promise, large-scale implementation remains complex. If balanced correctly, UBI could reshape economies—but without careful planning, it risks fiscal strain and unintended consequences.

For more on Universal Basic Income, check out the following:

Internal Link:

External Links:

- OECD: Basic Income Policy Option – 2017

- World Bank: Exploring Universal Basic Income

- KELA: Finland’s Basic Income Experiment 2017-2018

Disclosure

Affiliate Link Disclosure: TheMoneyQuestion.org may earn a small commission if you make a purchase through one of the links in this article. However, we only recommend products and services that we believe will add value to your financial journey.

Content Disclaimer: The information in this article is for informational purposes only and is not intended to substitute for the advice of a licensed or certified attorney, accountant, financial advisor, or other certified financial professionals. Always seek professional advice before making financial decisions.

The Pandemic’s Financial Maze: Insights from The Doom Loop

| Aspect | 2008 Crisis | Pandemic Crisis |

| Focus | Banks and mortgages | Economy, jobs, businesses |

| Interest Rates | Gradual cuts | Immediate drop to near-zero |

| Quantitative Easing | Stabilized banks | Broad liquidity injection |

| Bailouts | Banks and automakers | Businesses, states, cities |

| Programs | TARP | PPP, direct loans |

| Outcome | Slow recovery | Quick response, long risks |

The Economy in Chaos: How the Pandemic Started It All

AFFILIATE DISCLOSURE:

This article contains affiliate links. We may receive a commission for purchases made through these links, at no extra cost to you. We only recommend products and services we believe will genuinely help you achieve your financial goals.

When the pandemic hit, it felt like the economy slammed into a brick wall. Businesses shut down, people lost jobs, and everything seemed uncertain. That’s when the Federal Reserve stepped in to prevent an all-out collapse.

- What Did the Fed Do?: The Fed pulled out all the stops to keep things afloat. Interest rates were slashed to nearly zero, making borrowing money cheaper. They introduced quantitative easing (QE), where the Fed started buying assets to pump money into the system and prevent market freezes. Emergency loan programs were also rolled out to help businesses, cities, and financial institutions stay afloat.

- Big Finance’s Role: Big banks and investment firms were key players during this time. They helped stabilize things by distributing loans and offering financial support. But they also added fuel to the fire by relying on risky investments, making the financial system even more fragile.

What’s the Doom Loop All About?

The “doom loop” is the star of the book. It’s a vicious cycle where financial instability forces interventions like bailouts or QE, which then create even more risks down the line.

Low interest rates encourage banks and firms to take on more risk because borrowing is so cheap. A handful of big players controlling massive chunks of the market makes the system fragile. Financial institutions start expecting help whenever things go south, leading to risky behavior and a dependency on government interventions.

Takeaway: The doom loop shows how quick fixes can sometimes make long-term problems worse.

What the Book Does Well

There’s a lot to love about The Doom Loop. It’s well-researched, insightful, and explains tricky concepts in a way that doesn’t feel like a college textbook.

- Complex Topics Made Simple: The authors break down complicated financial policies into something even non-experts can understand. If you’ve ever wondered how QE or bailouts actually work, this book explains it clearly.

- Fair Critique of the Fed: Instead of just bashing the Federal Reserve, the book offers a balanced take. It gives credit where it’s due while pointing out areas where the Fed might’ve dropped the ball.

- Behind the Scenes of Big Finance: The book takes you into the world of big banks and investment firms, showing how their strategies can both stabilize and destabilize the economy.

Where the Book Could Do Better

No book is perfect, and The Doom Loop has a couple of areas where it could have gone further.

- A Little Too Technical at Times: Some parts lean heavily on financial jargon, which could make casual readers feel a bit lost.

- It’s All About the U.S.: While the focus on the U.S. financial system is understandable, it would’ve been great to see more comparisons with how other countries handled the pandemic.

Why It Matters Today

This book isn’t just a recap of what happened; it’s a warning and a guide for what we should watch out for in the future.

- Fixing the System: One big takeaway is that we need better regulations to keep the financial system stable. That means things like stricter rules on how much risk banks can take and more transparency about their practices.

- Breaking the Cycle: The dependency on government bailouts and interventions has created what’s known as a moral hazard. Financial institutions take risks because they expect to be rescued if things go wrong. That needs to change.

- Preparing for the Next Crisis: The pandemic taught us a lot about how fragile our systems are. By learning from what worked—and what didn’t—we can be better prepared for whatever comes next.

Takeaway: The lessons from this book aren’t just for economists or policymakers. They’re for anyone who wants to understand how financial systems impact all of us.

Wrapping It Up

The Doom Loop: The Fed and Big Finance in the Pandemic is an eye-opening look at how the financial world responded to one of the biggest crises of our time. It doesn’t shy away from tough questions and leaves readers with plenty to think about. If you’re curious about how monetary policy and big finance shape the world we live in, this book is a must-read.

FAQs

What exactly is the doom loop?

It’s a cycle where financial instability forces interventions like bailouts, which end up creating even more risks, leading to more instability.

How did the pandemic affect small businesses financially?

The Federal Reserve’s actions, like providing emergency loans and lowering interest rates, helped small businesses access funds to stay afloat during the crisis.

Is this book only about the U.S. financial system?

Yes, it focuses on the U.S., particularly the Federal Reserve and big financial institutions, but its lessons can apply globally.

What are some proposed solutions to avoid another doom loop?

Stricter regulations, transparency, and reducing reliance on government bailouts are key solutions discussed in the book.

Who would benefit most from reading this book?

Anyone interested in finance, economics, or understanding how big institutions shape our economy would find this book insightful.