Understanding the System (Macro)

The Gold Standard Debate: Should We Return to Backed Money?

AFFILIATE DISCLOSURE:

This article contains affiliate links. We may receive a commission for purchases made through these links, at no extra cost to you. We only recommend products and services we believe will genuinely help you achieve your financial goals.

Explore the gold standard debate — should modern economies return to gold-backed money, or is fiat currency the better path forward?

Introduction: Why The Gold Standard Debate Still Matters Today

If there’s one topic that never seems to lose its shine in economic circles, it’s the gold standard debate. From YouTube finance influencers to policymakers and everyday savers, many are asking: Should we bring back money backed by gold?

The question isn’t just about nostalgia for shiny coins or distrust in “paper money.” It cuts to the heart of how value is created, stored, and protected in our financial system. In an age of inflation fears, digital currencies, and mounting government debt, people are searching for a system that feels real again — one grounded in something tangible.

So, should we go back to the gold standard? Or has the world moved beyond it for good?

Let’s unpack the history, arguments, and real-world implications — and see how this debate connects directly to your financial life today.

️ What Was the Gold Standard?

The gold standard was a monetary system where a country’s currency was directly tied to a specific amount of gold. For example, under the U.S. gold standard of the early 20th century, $35 equaled one ounce of gold. That meant every dollar in circulation could theoretically be exchanged for gold held in government vaults.

This system limited how much money could be created. The government couldn’t print more money unless it had more gold to back it up. Supporters say that kept inflation low and disciplined public spending.

Types of Gold Standards:

- Classical Gold Standard (1870–1914): Money was fully convertible to gold, and global trade was stable.

- Gold Exchange Standard (1925–1931): Countries held foreign currencies (like U.S. dollars or British pounds) backed by gold.

- Bretton Woods System (1944–1971): The U.S. dollar was pegged to gold, and other nations pegged their currencies to the dollar.

When President Richard Nixon ended dollar convertibility to gold in 1971, the world entered the era of fiat money — currency not backed by a commodity, but by government decree and economic trust.

⚖️ Fiat Money vs. Gold-Backed Money: What’s the Real Difference?

The debate often boils down to control versus stability.

Feature Gold-Backed Money Fiat Money

Value Basis Linked to a physical commodity (gold) Based on government trust and regulation

Money Supply Control Limited by gold reserves Determined by central banks

Inflation Control Naturally constrained Requires policy discipline

Economic Flexibility Restricted (limited stimulus) Highly flexible

Historical Stability Long-term stable prices Prone to inflation and crises

Crisis Response Slow — limited tools Quick — central banks can print money

Fiat systems allow nations to respond to crises like COVID-19 or financial crashes by injecting liquidity. But critics argue this power often leads to debt bubbles, currency devaluation, and inequality.

“Gold Standard vs. Fiat Money Comparison Template”

Use this simple template to compare how each system affects you personally.

Reflect and fill in your own observations.

Category Gold Standard System Fiat System (Today’s Money) Your Reflection

Money Creation Backed by physical gold reserves Created digitally or through lending _______________

Inflation Impact Historically low Often higher, depends on policy _______________

Savings Power Stable value over time Subject to erosion by inflation _______________

Debt and Borrowing Limited government borrowing High debt flexibility _______________

Economic Growth Slower but steadier Faster but volatile _______________

Financial Stability Hard money discipline Dependent on trust and regulation _______________

Personal Comfort Level Tangible security Policy-driven confidence _______________

Tip: Use this template as part of your personal financial education journal — track how your beliefs about money evolve as you understand the system better.

The Case For the Gold Standard

Advocates believe that returning to gold-backed money could restore trust and discipline in the economy. Here are the key arguments:

1. Inflation Control

Because money creation would be limited by gold reserves, governments couldn’t inflate away debt or overspend.

2. Fiscal Discipline

The gold standard forces governments to live within their means — reducing reckless deficit spending and long-term debt accumulation.

3. Stable Value

Over centuries, gold has retained its value better than any fiat currency. This stability can restore confidence for savers and investors.

4. Global Trust

A universal gold-based system could stabilize international exchange rates and reduce speculative currency wars.

As economist Milton Friedman once said:

“Inflation is taxation without legislation.”

The gold standard, in theory, prevents that kind of hidden tax.

The Case Against the Gold Standard

Critics argue that while gold may shine, it can also trap economies in rigidity.

1. Limited Flexibility

In times of crisis, such as the Great Depression, the gold standard prevented central banks from increasing the money supply to revive the economy.

2. Deflation Risk

When money supply can’t expand, prices fall — leading to wage cuts, job losses, and economic stagnation.

3. Resource Dependence

Economic growth would depend on mining more gold — not innovation or productivity.

4. Unequal Gold Distribution

Countries rich in gold (like the U.S. post–World War II) would dominate, leaving others vulnerable to external shocks.

5. Not Fit for the Digital Age

Modern economies rely on electronic transfers, derivatives, and dynamic credit systems — not physical metal locked in vaults.

A Balanced View: Could a Partial Gold Standard Work?

Some economists propose a hybrid system — where currencies are partially backed by gold, digital assets, or a commodity basket.

This could combine the stability of hard assets with the flexibility of fiat systems.

For example:

- The International Monetary Fund (IMF) has explored “Special Drawing Rights” (SDRs) as a diversified reserve currency.

- Central banks could issue digital currencies (CBDCs) with fractional gold backing to maintain public confidence.

Such innovations could represent a “Gold Standard 2.0” — not a step backward, but an evolution toward responsible money creation.

Trending Question: Would Returning to the Gold Standard Stop Inflation?

This is one of the most common questions driving the gold standard debate with strong arguments on both sides.

In theory, yes — tying money to gold would limit inflation by limiting the money supply and imposing fiscal discipline. But in practice, it is not guaranteed to stop inflation and could limit economic growth and increase unemployment during downturns resulting in economic instability and a loss of monetary policy flexibility to manage it.

The U.S. Congressional Research Service (CRS) notes that the Great Depression worsened because the gold standard restricted government action (source: crsreports.congress.gov).

Meanwhile, the Federal Reserve explains that fiat flexibility has helped stabilize output and prices since 1971 (federalreserve.gov).

So, while gold backing could discipline policy, it’s not a magic cure. The real solution lies in responsible governance, not just shiny metal.

What It Means for You: How This Debate Impacts Your Finances

Even if we never return to a gold standard, understanding this debate helps you make smarter decisions.

✅ 1. Inflation Awareness

Knowing how fiat systems work helps you protect your savings with inflation-hedged assets (like TIPS, real estate, or diversified ETFs).

✅ 2. Diversified Investing

Gold can be part of a balanced portfolio — not because of nostalgia, but as a hedge against monetary uncertainty.

✅ 3. Debt Perspective

In fiat systems, debt is a feature, not a flaw. Understanding this lets you navigate credit systems and government borrowing logically.

✅ 4. Critical Thinking

When politicians or influencers promise “sound money” through gold, you’ll be able to ask: How would that affect jobs, liquidity, and growth?

To deepen your understanding:

Internal Links (TheMoneyQuestion.org)

- Who Really Controls the Money? A Look at Central Banks

- The Debt Myth: Why Government Borrowing Isn’t Like a Household Budget

External Links

-

Federal Reserve History – The End of the Gold Standard https://www.federalreservehistory.org/essays/gold-standard

Overview from the Federal Reserve on why the U.S. ended gold convertibility in 1971 and the long-term economic implications. -

Congressional Research Service (CRS) – Returning to the Gold Standard: Historical and Policy Perspectives

https://crsreports.congress.gov/product/pdf/R/R43890

A nonpartisan U.S. government analysis explaining the potential effects of reinstating a gold-backed monetary system. -

Investopedia – What Is the Gold Standard?

→ https://www.investopedia.com/terms/g/goldstandard.asp

Educational reference summarizing the gold standard’s history, advantages, and disadvantages in accessible language.

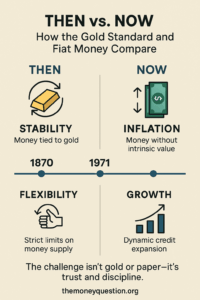

“Then vs. Now: How the Gold Standard and Fiat Money Compare”

Sections:

- Visual timeline (1870 → 1971 → Today)

- Icons for stability, inflation, flexibility, and growth

- Key takeaway: “The challenge isn’t gold or paper — it’s trust and discipline.”

- Add footer: themoneyquestion.org

Key Takeaways

- The gold standard offered stability, but limited flexibility.

- Fiat money offers flexibility, but risks inflation and overspending.

- The best system may blend discipline with innovation.

- Understanding money’s foundation empowers smarter financial choices.

Conclusion: Beyond the Gold Standard Debate

The gold standard debate isn’t just academic — it’s about who controls money, and how that control affects your life.

Whether we back currency with gold, digital code, or trust, the key issue remains accountability.

If citizens understand money creation, demand transparency, and make informed personal choices, the system becomes stronger — whatever form it takes.

Gold isn’t the answer. But the discipline it represents might be the one lesson modern money still needs.

FAQs: The Gold Standard Debate

1. What was the purpose of the gold standard?

The gold standard aimed to ensure monetary stability by tying each unit of currency to a fixed quantity of gold. This limited governments from creating money arbitrarily and helped control inflation. It also made international trade smoother because exchange rates were predictable and trusted.

2. Why did the U.S. abandon the gold standard?

The U.S. left the gold standard in 1971 when President Nixon ended convertibility to preserve economic flexibility. Global trade imbalances and postwar spending made it impossible to maintain fixed gold prices. Moving to fiat money allowed the government and Federal Reserve to respond more effectively to inflation, unemployment, and recession pressures.

3. Would a return to gold stop inflation permanently?

A gold-backed system could reduce inflation by limiting the money supply, but it wouldn’t eliminate it entirely. Prices also depend on productivity, wages, and global demand. Historically, gold standards have sometimes caused deflation, which can be just as harmful as inflation.

4. Is gold-backed money safer than fiat money?

Gold-backed money can feel safer because its value is linked to a tangible asset rather than government trust. However, this safety comes at the cost of flexibility — governments can’t easily stimulate growth or respond to crises. Fiat systems rely on policy discipline instead of metal reserves for stability.

5. Can digital currencies be gold-backed?

Yes, several new technologies allow for digital currencies partially backed by gold. Central Bank Digital Currencies (CBDCs) or stablecoins could use gold reserves to ensure value stability while allowing digital efficiency. This hybrid model combines traditional trust with modern innovation.

6. What caused the Great Depression under the gold standard?

During the Great Depression, the gold standard limited how much money governments could create to boost their economies. As prices and wages fell, deflation deepened the downturn. Countries that left the gold standard earlier — like the U.K. — recovered faster than those that stayed tied to it.

7. Does any country use the gold standard today?

No major economy operates on the gold standard today; all use fiat money issued by central banks. However, countries like Switzerland and Singapore maintain strong gold reserves as part of their financial security strategy. Gold remains an important reserve asset, even without direct convertibility.

8. Should investors buy gold now?

Gold can be a good diversification tool, especially during times of inflation or market uncertainty. Financial advisors often recommend allocating 5–10% of your portfolio to gold or similar assets. It’s not about betting on a gold standard comeback — it’s about hedging against fiat volatility.

9. What are the pros of fiat money?

Fiat money gives governments and central banks the flexibility to manage the economy, fund public programs, and respond to crises. It allows for credit expansion and innovation, which drive growth. The challenge is maintaining discipline so that flexibility doesn’t lead to runaway inflation.

10. What’s the biggest takeaway from the gold standard debate?

The real question isn’t whether we should return to gold — it’s whether we can create a responsible and transparent monetary system. Sound money depends more on good governance and informed citizens than on any metal. Understanding both systems empowers you to make better financial and policy judgments.

Affiliate Disclosure

Some links on this page may be affiliate links. This means we may earn a small commission at no extra cost to you if you purchase through them.

Disclaimer: The content provided is for informational purposes only and is not a substitute for professional financial or legal advice.

Money Creation – Why Banks Don’t Just Lend Out Existing Money

AFFILIATE DISCLOSURE:

This article contains affiliate links. We may receive a commission for purchases made through these links, at no extra cost to you. We only recommend products and services we believe will genuinely help you achieve your financial goals.

Why Banks Don’t Just Lend Out Existing Money (And How They Really Create It)

Discover the surprising truth about money creation! Learn how private banks generate most of the money in our economy and how this impacts your financial life.

Have you ever wondered where all the money in the economy comes from? It’s a question that often sparks curiosity and sometimes even confusion. Many assume that banks act like giant warehouses, lending out the money deposited by their customers. But the reality is far more intriguing and has significant implications for your financial well-being.

Forget the image of banks simply shuffling existing funds. The truth is, private banks are the primary creators of new money in our modern economy. This might sound counterintuitive or even a little shocking, but understanding this fundamental principle is crucial for anyone wanting to truly grasp how our financial system works and make smarter money decisions.

This long-form guide will demystify the process of money creation, explaining it in clear, straightforward language. We’ll delve into the mechanics behind it, explore its impact on everything from inflation to loan availability, and empower you with the knowledge to navigate the financial landscape with greater confidence.

Debunking the Myth: Banks as Mere Intermediaries

For a long time, the popular understanding of banking was that institutions collected deposits and then lent those same deposits out to borrowers. This “loanable funds” theory paints a picture of banks as intermediaries, connecting savers with borrowers. While deposits are certainly important to banks, this model doesn’t fully explain how the vast majority of money enters our economy.

Mini Case Study: Imagine Sarah deposits $1,000 into her savings account at First National Bank. According to the simple intermediary view, the bank would then lend out a portion of that $1,000 to Mark who wants to start a small business. However, the reality is that when the bank approves Mark’s loan, it doesn’t necessarily take that $1,000 directly from Sarah’s deposit. Instead, it creates a new deposit in Mark’s account – essentially, new money comes into existence.

The Bank of England, in its seminal paper “Money creation in the modern economy,” explicitly states: “Commercial banks create money by making new loans.” https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy.pdf This isn’t just theoretical; it’s how the system fundamentally operates.

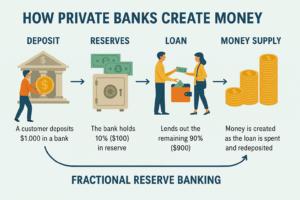

The Magic of Fractional Reserve Banking and Loan Creation

So, how exactly do banks create money out of seemingly thin air? The key lies in the system of fractional reserve banking. Under this system, banks are required to hold only a fraction of their deposits in reserve (either in their vaults or at the central bank). This fraction is known as the reserve requirement, set by the central bank (in Canada, this was historically in place but is no longer a strict requirement in the same way, though banks still maintain reserves for operational and regulatory reasons).

Mini Case Study: Let’s say, for simplicity, a hypothetical reserve requirement is 10%. If First National Bank receives a $100 deposit, it is only obligated to keep $10 in reserve. The remaining $90 can then be lent out. When this $90 is lent to another customer, it becomes a new deposit in their account, effectively increasing the total amount of money in the economy.

This process can repeat itself. The borrower who received the $90 might deposit it into another bank, which can then lend out a portion of that deposit, and so on. This is known as the multiplier effect, where an initial deposit can lead to a larger overall increase in the money supply.

What Limits Money Creation by Private Banks?

While private banks have the power to create money, this power isn’t unlimited. Several factors constrain their ability to do so:

- Demand for Loans: Banks can only create money if there are individuals and businesses willing and able to borrow. If loan demand is low, money creation will be limited.

- Creditworthiness of Borrowers: Banks need to assess the risk of borrowers defaulting on their loans. They will only create money (issue loans) to those they deem likely to repay.

- Profitability: Banks are profit-seeking entities. They will only extend loans if they believe they can earn a sufficient return through interest payments.

- Capital Requirements: Regulatory bodies often set capital requirements, which dictate the amount of capital banks must hold relative to their assets (including loans). These requirements act as a buffer against losses and can limit the amount of lending a bank can undertake. You can learn more about capital requirements from the Bank for International Settlements (BIS): https://www.bis.org/bcbs/basel3.htm

- Central Bank Influence: The central bank plays a crucial role in influencing the overall money supply and credit conditions through various tools, such as setting interest rates and conducting open market operations (buying and selling government securities).

Mini Case Study: During an economic downturn, even if banks have the capacity to lend, businesses and individuals might be hesitant to take on new debt due to uncertainty about the future. This reduced demand for loans would naturally limit the amount of new money created by the banking system.

The Role of the Central Bank: Steering the Monetary Ship

While private banks create most of the money, the central bank (like the Bank of Canada) plays a vital role in overseeing the monetary system and ensuring its stability. The central bank does not typically create physical currency in the way private banks create digital money through loans, but it controls the supply of physical currency and bank reserves.

The central bank’s key functions include:

- Setting Monetary Policy: Influencing interest rates and credit conditions to achieve macroeconomic goals like price stability and full employment.

- Issuing Banknotes and Coins: Providing the physical currency in circulation.

- Acting as a Lender of Last Resort: Providing liquidity to banks facing financial difficulties.

- Supervising and Regulating Banks: Ensuring the safety and soundness of the banking system.

Understanding the distinct but interconnected roles of private banks and the central bank is essential for a complete picture of money creation.

Download Your Free Guide: Want a quick reference to the key terms and concepts discussed? Download our free “Understanding Money Creation: Key Concepts Checklist” to reinforce your learning!

Understanding Money Creation: Key Concepts Checklist

TheMoneyQuestion.org

- Fractional Reserve Banking: [ ]

- Loan Creation: [ ]

- Multiplier Effect: [ ]

- Reserve Requirement: [ ]

- Capital Requirements: [ ]

- Central Bank’s Role: [ ]

<footer><p style=”text-align:center;”>themoneyquestion.org</p></footer>

Why Does This Matter to You? Understanding the Implications

Grasping how money is created has several important implications for your financial life:

- Inflation: When banks create more money, and if the supply of goods and services doesn’t keep pace, it can lead to inflation – a general increase in prices and a decrease in the purchasing power of your money. Understanding this link can help you make informed decisions about saving and investing.

- Mini Case Study: Imagine a period where there’s a surge in lending and new money creation, but factories are facing supply chain issues, limiting the production of goods. The increased money chasing a limited supply of goods can lead to higher prices for everyday items like groceries and gasoline.

- Economic Cycles: The availability of credit and the rate of money creation can significantly influence economic booms and busts. During economic expansions, increased lending can fuel investment and consumption. Conversely, during recessions, reduced lending can exacerbate the downturn.

- Interest Rates: The process of money creation is closely linked to interest rates. When demand for loans is high, or when the central bank tightens monetary policy, interest rates tend to rise, making borrowing more expensive for individuals and businesses. This impacts everything from mortgage payments to business investment.

- Mini Case Study: If you’re considering taking out a loan for a new car, understanding the current interest rate environment, which is influenced by money creation and central bank policy, is crucial for determining the overall cost of your loan.

- Financial Literacy: By understanding the fundamentals of money creation, you become a more informed participant in the economy. You can better interpret financial news, understand the potential impact of government policies, and make more strategic financial decisions for yourself and your family.

Related Article: To further explore the role of central banks, read our article on “[Understanding Central Bank Interest Rate Hikes and Their Impact](insert internal link to relevant TMQ article here)”.

Trending Question Answered: Does the Government Print All the Money?

A common misconception is that the government printing presses are responsible for creating most of the money in the economy. While the government (through the central bank) does print physical currency (banknotes and coins), this constitutes a relatively small fraction of the total money supply. The vast majority of money in modern economies exists in digital form as bank deposits, created by private banks when they issue loans.

The printing of physical currency is primarily to meet public demand for cash. The amount of physical currency in circulation is influenced by factors like consumer spending habits and the level of economic activity. The central bank carefully manages the supply of physical currency to ensure there is enough to meet demand without causing instability in the financial system.

Actionable Tips: How to Navigate a Money-Creating Economy

Now that you have a better understanding of how money is created, here are some actionable tips to help you navigate this environment effectively:

- Manage Your Debt Wisely: In an economy where credit is readily available (and creates new money), it’s crucial to be mindful of your borrowing. Understand the terms of your loans, avoid unnecessary debt, and strive to maintain a healthy debt-to-income ratio.

- Mini Case Study: Maria took out a low-interest personal loan to consolidate some higher-interest credit card debt. By understanding the power of credit and using it strategically, she reduced her monthly payments and improved her overall financial situation.

- Invest for the Long Term: Given the potential for inflation in a money-creating economy, consider investing in assets that have the potential to outpace inflation over the long term, such as stocks, real estate, and diversified investment funds.

- Build an Emergency Fund: Economic conditions can fluctuate, and job security isn’t always guaranteed. Having a well-funded emergency fund can provide a financial cushion during unexpected events, reducing the need to take on debt during vulnerable times.

- Continuously Improve Your Financial Literacy: The more you understand about how the financial system works, the better equipped you’ll be to make informed decisions and adapt to changing economic conditions. Stay curious, read reputable financial resources, and seek out educational opportunities.

- Consider Inflation in Your Financial Planning: When setting financial goals, such as retirement planning, factor in the potential impact of inflation on the future cost of living.

Freebie Alert! Download our “Debt Management Checklist” to help you assess your current debt situation and develop a plan to manage it effectively.

Debt Management Checklist

TheMoneyQuestion.org

- List all outstanding debts (including interest rates and minimum payments): [ ]

- Calculate your debt-to-income ratio: [ ]

- Identify high-interest debts to prioritize for repayment: [ ]

- Explore debt consolidation or balance transfer options: [ ]

- Create a debt repayment plan and track your progress: [ ]

- Review your credit report for any errors: [ ]

Here are some affiliate products and services that can help you take control of your finances in a money-creating economy:

- Personal Finance Tracking Software (e.g., Mint, Personal Capital):

- Description: These platforms allow you to link your bank accounts, credit cards, and investment accounts to get a holistic view of your financial situation.

- Value to Reader: Helps you track your spending, monitor your net worth, and identify areas where you can save more money, crucial in managing your finances effectively.

- Call to Action: Sign up for [Personal Finance Software Name] today and gain better visibility into your financial life!

- Online Brokerage Account (e.g., Vanguard, Fidelity, Interactive Brokers):

- Description: Provides a platform to invest in stocks, bonds, ETFs, and other securities.

- Value to Reader: Enables you to grow your wealth over the long term and potentially outpace inflation, a key strategy in a money-creating economy.

- Call to Action: Start investing in your future – open an account with [Brokerage Name] now!

- Credit Monitoring Service (e.g., Equifax, TransUnion):

- Description: Monitors your credit report for changes and alerts you to potential fraud or errors.

- Value to Reader: Helps you maintain a good credit score, which is essential for accessing loans and favorable interest rates in a credit-driven economy.

- Call to Action: Protect your credit – enroll in [Credit Monitoring Service] for peace of mind.

- Financial Education Courses (e.g., Coursera, Udemy):

- Description: Offers a wide range of courses on personal finance, investing, and economics.

- Value to Reader: Empowers you with the knowledge and skills to make informed financial decisions in a complex economic environment.

- Call to Action: Invest in your financial literacy – explore the courses available on [Online Education Platform]!

- Budgeting Apps (e.g., YNAB, PocketGuard):

- Description: Tools designed to help you create and stick to a budget.

- Value to Reader: Essential for managing your spending and ensuring you’re not overextending yourself in a credit-based economy.

- Call to Action: Take control of your spending – download [Budgeting App Name] and start budgeting today!

Conclusion: Empowering Your Financial Future Through Understanding

Understanding that private banks create most of the money in the economy might seem like an abstract concept, but its implications for your financial life are very real. By grasping this fundamental principle, you can better understand the forces that shape inflation, interest rates, and economic cycles.

This knowledge empowers you to make more informed decisions about managing your debt, saving and investing for the future, and navigating the financial landscape with greater confidence. Continue to learn, stay informed, and take proactive steps to secure your financial well-being in this dynamic economic environment.

Frequently Asked Questions (FAQ)

- If banks create money by lending, where does the money come from to repay the loan? When a borrower repays a loan, the corresponding deposit in their account is reduced, effectively “destroying” the money that was created when the loan was issued. Interest payments compensate the bank for the risk and cost of lending.

- Does the government control how much money banks can create? While private banks create the initial deposits through lending, the central bank influences the overall amount of lending and money creation through tools like reserve requirements (historically), capital requirements, and interest rate adjustments.

- Is it dangerous that private banks have the power to create money? The system has inherent risks, such as the potential for excessive lending leading to asset bubbles and financial instability. This is why regulation and central bank oversight are crucial to maintaining a stable financial system.

- How does inflation relate to banks creating money? If banks create too much money relative to the amount of goods and services available in the economy, it can lead to an increase in demand that outpaces supply, causing prices to rise (inflation).

- Can banks create unlimited amounts of money? No, banks are constrained by factors like the demand for loans, the creditworthiness of borrowers, profitability considerations, capital requirements, and the influence of the central bank.

- What is the difference between the money created by banks and the money printed by the government? Banks create digital money in the form of deposits when they make loans. The government (through the central bank) prints physical currency (banknotes and coins), which is a smaller portion of the overall money supply and is primarily used for transactions.

- How do central bank interest rate changes affect money creation by private banks? When the central bank raises interest rates, borrowing becomes more expensive, which can reduce the demand for loans and thus slow down the rate of money creation by private banks.

- Why don’t banks just create a lot of money for themselves? Banks are heavily regulated and must adhere to capital requirements. Creating excessive amounts of money without sufficient capital backing would put them at risk of failure and violate regulatory standards. Their profit comes primarily from the interest charged on loans, not from simply creating money for their own accounts.

- How does the money creation process differ in different countries? The fundamental principle of private banks creating money through lending is similar across most modern economies that utilize fractional reserve banking. However, the specific regulations and tools used by central banks to influence money creation can vary.

- As an individual, how can I protect myself from the potential negative effects of money creation and inflation? By managing debt responsibly, investing strategically in assets that can outpace inflation, building an emergency fund, and continuously improving your financial literacy.

Affiliate Disclosure: Please note that some of the links above may be affiliate links, and I may earn a commission if you make a purchase through these links. This helps support TheMoneyQuestion.org and allows us to continue providing valuable content to you. We only recommend products and services that we believe can genuinely benefit our readers.

What Happens If The Dollar Loses Reserve Currency Status?

Disclosure: This post may contain affiliate links. If you click through and make a purchase, The Money Question may earn a small commission at no additional cost to you. We only recommend products and services we genuinely believe in. See our full disclaimer for details.

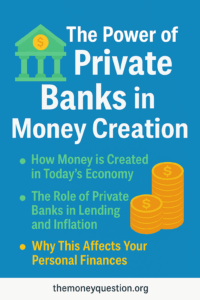

Why Private Banks Create Most of the Money in the Economy

The popular belief that governments, through their central banks, print and control the money supply is largely a myth. Learn how private banks create money, why it matters for your financial life, and how understanding this can empower your personal finance decisions.

AFFILIATE DISCLOSURE:

This article contains affiliate links. We may receive a commission for purchases made through these links, at no extra cost to you. We only recommend products and services we believe will genuinely help you achieve your financial goals.

Introduction: Who Really Controls Money in Our Economy?

Have you ever wondered where money actually comes from? We tend to think of it as something printed by the government, but the reality is far more complex. In fact, private banks create most of the money circulating in the economy today.

This might sound surprising, but once you understand how it works, it can transform the way you think about money, debt, and even your personal finances. In this post, we’ll dive deep into how private banks create money through the lending process, the implications of this for economic stability, and why it matters to you as a consumer. By the end, you’ll have a clearer understanding of the monetary system and its impact on your financial life.

The Role of Banks in the Economy: More Than Just Lenders

How Banks Work

Banks play a crucial role in the economy, but they’re not just places to deposit your paycheck or take out a loan. Private banks, in particular, are the primary entities responsible for creating the vast majority of money in circulation. How? Through a process called fractional reserve banking.

What is Fractional Reserve Banking?

In simple terms, fractional reserve banking allows banks to lend out most of the money deposited by their customers, keeping only a fraction in reserve. This creates money out of thin air, as loans are made that exceed the actual deposits in the bank’s vaults.

For example:

-

You deposit $1,000 into a bank.

-

The bank is required to keep only 10% (or $100) in reserve, which means it can lend out $900.

-

When the bank loans that $900 to someone else, that money is spent and deposited into another bank.

-

The second bank can now lend out 90% of that deposit, and the cycle continues.

This process of lending and re-lending creates money in the form of credit and debt that circulates throughout the economy. As a result, the actual supply of money in the economy can be many times greater than the amount physically printed by the government.

How Do Private Banks Create Money?

Private banks are not just custodians of money; they are active participants in its creation. Here’s a breakdown of how this happens:

1. Deposits Lead to Loans

When you deposit money into a bank, it doesn’t just sit there. The bank uses your deposit as a source of funds to offer loans to others, and in the process, it creates new money.

2. Money Multiplier Effect

The act of lending leads to more deposits being made, which the bank can then lend out again. This “money multiplier” effect causes the supply of money to grow exponentially. The initial deposit creates more than just a one-to-one increase in money supply.

3. Interest Payments and Debt

The money that banks lend is not free. The borrower must pay interest on the loan. This interest is a form of revenue for the bank, but it also means that the economy is operating on a debt-based system. The more money is created, the more debt there is, and the higher the interest payments.

The Consequences of Private Bank Money Creation

While this system allows for economic growth and provides consumers with access to credit, it also has some serious implications:

1. Debt Levels and Economic Cycles

Because private banks create money through debt, the economy becomes heavily reliant on borrowing. As debt levels increase, the risk of economic downturns also rises. When too many people or businesses default on loans, it can lead to financial crises, like the 2008 recession.

2. Inflation and Asset Bubbles

In some cases, the money created by banks leads to inflation, particularly in asset prices like real estate and stocks. When banks lend excessively, demand for these assets rises, which drives up prices, potentially creating asset bubbles.

3. Limited Control Over the Money Supply

Despite the fact that private banks create most of the money, the government and central banks still try to regulate the supply of money through tools like interest rates and reserve requirements. However, because the vast majority of money is created privately, government control over the money supply is limited.

How Does This Impact Your Personal Finances?

Understanding how private banks create money is not just an academic exercise – it has real-world implications for your financial life:

1. Access to Credit

The availability of credit depends largely on the lending policies of private banks. If banks are reluctant to lend, it can be harder for you to get a loan, whether it’s for a car, home, or business. Conversely, if banks are too eager to lend, it can lead to an oversupply of credit and potential financial instability.

2. Interest Rates

Interest rates are influenced by the central bank, but they are also set by private banks based on market conditions and competition. A low-interest rate environment, which happens when banks have easy access to money, can make borrowing more affordable, but it also fuels debt levels.

3. Inflation and Purchasing Power

As banks create more money through loans, inflation can rise, which erodes the purchasing power of your money. For instance, if more money enters the economy, the cost of goods and services may increase. Understanding this can help you make smarter decisions about savings and investing.

4. Wealth Inequality

The way money is created and distributed can also contribute to wealth inequality. Those who can access loans – often the wealthy – are able to benefit from the rising asset prices that are often driven by bank lending. Meanwhile, those who can’t access credit may find themselves left behind.

Trending Question: Can the Creation of Money by Private Banks Lead to Economic Instability?

Many critics argue that the ability of private banks to create money leads to economic instability. They believe this system can encourage irresponsible lending, creating financial bubbles, and contributing to economic crises. Understanding this dynamic is crucial for understanding why policies like Modern Monetary Theory (MMT) and Sovereign Money Systems have been proposed to reform how money is created and controlled.

1. Modern Monetary Theory (MMT)

MMT suggests that governments, particularly sovereign ones, should issue currency directly and spend freely to finance public services, without worrying about balancing the budget. Proponents of MMT argue that a sovereign money system would reduce reliance on private banks and mitigate the risk of financial instability caused by debt-based money creation.

2. Sovereign Money System

In a Sovereign Money System, only the government would have the authority to create money. Under such a system, private banks would no longer be able to create money through loans, which could significantly reduce the risks of inflation and financial instability.

Internal Links:

-

Who Really Controls the Money? A Look at Central Banks

-

This article provides an in-depth look at central banks and their role in the monetary system, complementing the discussion on private banks’ money creation.

-

-

Modern Monetary Theory: Rethinking Economics and Monetary Reform

-

This post explores alternatives to the current monetary system, including MMT, which proposes changes to the way money is created and managed.

-

-

What the Fed’s Move Means For Your Wallet

-

This post explores the implications of central bank actions on personal finances, linking to the discussion of monetary policy and private banks’ role in creating money.

-

External Links:

-

Federal Reserve – How the Federal Reserve Operates (Federal Reserve official site)

-

This official government site offers a clear explanation of how the Federal Reserve System works, its role in regulating money supply, and its relationship with private banks.

-

-

Bank of England – Money Creation in the Modern Economy (Bank of England)

-

A credible and educational source from the Bank of England that explains how money is created in the modern economy, including the role of private banks in the money creation process.

-

- The Bank of International Settlements (BIS) – Money Creation (BIS official publication)

-

The BIS is an international financial institution that provides in-depth reports and studies on money creation, central banking, and its impact on the global economy. This authoritative resource can add credibility to your post.

-

Conclusion: Take Control of Your Financial Future

Understanding that private banks create most of the money in the economy is a powerful insight into how the financial system works. While this system allows for economic growth, it also introduces risks like inflation, asset bubbles, and increased debt levels.

By becoming aware of how money is created and understanding the broader economic forces at play, you can make more informed decisions about your personal finances. Whether it’s understanding how interest rates impact your loans or recognizing the potential risks of an overheated economy, the more you know, the better equipped you’ll be to navigate the complexities of money.

FAQs: Answering Your Burning Questions on Money Creation

-

What is fractional reserve banking, and how does it create money?

-

Fractional reserve banking is where banks hold only a portion of their customer deposits as reserves and lend the rest to borrowers, thus creating new money in the process. This process is called the money multiplier effect.

-

-

How does private bank money creation affect inflation?

-

The creation of money through loans can lead to inflation, especially if too much money is created relative to the supply of goods and services. The more money that is created through lending, the less each unit of currency is worth.

-

-

Why do private banks create money instead of the government?

-

Private banks have the ability to create money through lending, which has become a standard part of the modern banking system. This contrasts with a system where only the government can issue money.

-

-

Can private bank money creation lead to economic crises?

-

Yes, excessive lending can lead to financial bubbles, excessive debt, and instability in the economy.

-

-

How do central banks regulate the money created by private banks?

-

Central banks regulate the money supply through tools like reserve requirements, interest rates, and monetary policy. By adjusting these controls, central banks can increase or decrease the amount of money and credit available.

-

-

What is the difference between sovereign money and fractional reserve banking?

-

Sovereign money is a system where only the government creates money, while fractional reserve banking allows private banks to create money through lending.

-

-

How can I protect myself from inflation caused by money creation?

-

By investing in assets that tend to hold value during inflationary periods, such as stocks, real estate or commodities (i.e. gold, silver).

-

-

Does the government have control over the money supply?

-

The government, through its central bank, can influence the money supply but doesn’t directly control the vast majority of money in circulation, which is created by private banks. It’s important to note the distinction between control and influence — in most developed countries, central banks operate with a degree of independence from the direct political control of the government.

-

-

What are the risks of a debt-based money system?

-

Risks include financial instability, slower economic growth, asset bubbles, and higher levels of national debt. Higher levels of national debt could lead to limited government fiscal flexibility as more government revenue is directed towards interest payments.

-

-

How can I better manage my finances in a debt-driven economy?

-

By creating a comprehensive budget and focusing on paying down high-interest debt, saving consistently, and investing in a diversified portfolio to protect against inflation. In addition, boosting your income and increasing your financial literacy will put you in a better position to manage your finances.

-

Disclosure:

From Gold to Code: The Evolution of Money in the 21st Century

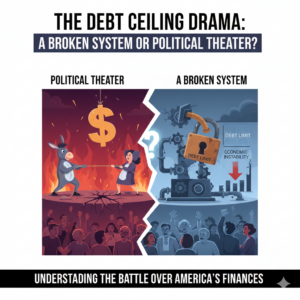

The Debt Ceiling Drama: A Broken System or Political Theater?

MMT Myths Debunked: Is It Just Printing Money?

AFFILIATE DISCLOSURE:

This article contains affiliate links. We may receive a commission for purchases made through these links, at no extra cost to you. We only recommend products and services we believe will genuinely help you achieve your financial goals.

Discover the truth behind Modern Monetary Theory (MMT) and its misconceptions. Learn how MMT really works and whether it’s truly about printing money. Continue reading as we clarify MMT myths.

Introduction: The Truth About MMT

In recent years, Modern Monetary Theory (MMT) has captured the attention of economists, politicians, and financial experts alike. This economic framework, which challenges traditional views about money creation, government spending, and taxation, has sparked a heated debate. Despite its growing popularity, MMT is often misunderstood, with many people believing that it’s merely a way for governments to print unlimited amounts of money and inflate the economy.

If you’ve ever wondered if MMT really is just a ploy to print money or if it offers a more sustainable way to manage the economy, this post will help you separate fact from fiction. By the end of this article, you’ll have a better understanding of what MMT actually entails and how it might impact both the economy and your personal finances.

Let’s dig into the myths and uncover the truth behind MMT!

What Is Modern Monetary Theory (MMT)?

To understand the myths surrounding MMT, it’s important to first define what it is. MMT is a school of economic thought that argues sovereign governments with their own currency can never run out of money. Unlike households or businesses, which rely on revenue or borrowing, a nation that issues its own currency can create more money to meet its needs.

The key idea behind MMT is that government spending doesn’t have to be constrained by taxes or borrowing. Instead, the government can issue money to finance public projects, programs, or even social safety nets. The theory suggests that the real limit to government spending is inflation—not the availability of funds. MMT argues that as long as inflation is under control, there is no need to worry about budget deficits.

However, this unconventional approach to fiscal policy has sparked intense controversy. Critics claim that MMT could lead to uncontrollable inflation, excessive government intervention, and reckless monetary policies. So, let’s address the myths and see what MMT really advocates.

Myth #1: MMT Is Just About Printing Money

One of the most pervasive myths surrounding MMT is that it’s all about printing money. Critics often claim that MMT advocates for governments to simply create money at will, leading to runaway inflation.

The Truth:

While MMT allows governments to create money, it doesn’t advocate for printing money without limits. Instead, MMT emphasizes that governments can issue money to fund public projects and services, but only if it’s done in a way that doesn’t disrupt the balance of supply and demand in the economy.

In other words, the government can spend to fund programs like infrastructure, education, or healthcare, but it must do so in a way that avoids creating excess demand that exceeds the economy’s capacity to produce goods and services. If too much money is pumped into the economy without a corresponding increase in production, inflation can occur.

Inflation Control in MMT

MMT proponents argue that inflation can be controlled through fiscal tools such as taxation, savings bonds, or other mechanisms to remove money from the economy when necessary. In this way, MMT doesn’t promote endless money printing but instead focuses on using the right mix of monetary and fiscal policies to ensure economic stability.

Takeaway: MMT is not about reckless money printing. It’s about understanding how money is created in a sovereign economy and using fiscal policies to control inflation.

Myth #2: MMT Will Lead to Hyperinflation

The fear of hyperinflation is often invoked when discussing MMT. Critics argue that if governments start printing money freely, it will inevitably lead to uncontrollable inflation, similar to the hyperinflationary crises experienced by countries like Zimbabwe or Venezuela.

The Truth:

While hyperinflation can occur if money is issued without control, MMT doesn’t advocate for unlimited money creation. MMT focuses on managing the economy’s capacity to handle additional spending. Inflation becomes a concern only when the economy reaches full capacity and more money is created without corresponding increases in production. At that point, the central government must step in and use tools like taxes and bonds to control inflation.

In fact, history provides examples of successful government spending without causing hyperinflation. For example, during World War II, the U.S. government issued large amounts of money to finance the war effort, yet inflation remained relatively stable. This was achieved by managing the money supply in a way that was aligned with the productive capacity of the economy.

Takeaway: Hyperinflation is not an automatic consequence of MMT. Inflation can be controlled with proper fiscal management and economic oversight.

Myth #3: MMT Ignores Debt and Deficits

A common criticism of MMT is that it ignores the importance of government debt and budget deficits. Traditional economic thought holds that governments should aim to balance their budgets and avoid accumulating excessive debt. Critics of MMT argue that the theory promotes irresponsible spending and borrowing.

The Truth:

MMT doesn’t ignore debt or deficits. Instead, it offers a different perspective on how we view them. In MMT, national debt is seen more as a tool for managing the economy than something to be feared. According to MMT, the government is the issuer of currency, so it can always repay its debt in its own money. The real constraint on government spending isn’t debt but inflation.

MMT proponents argue that deficits are only problematic when they lead to inflationary pressures. As long as inflation remains under control, government debt is not an immediate concern. In fact, some MMT proponents suggest that deficits can be used strategically to stimulate the economy, especially during times of recession or economic downturn.

Takeaway: MMT redefines the role of debt and deficits, focusing on managing inflation rather than eliminating debt altogether.

Myth #4: MMT Means Unlimited Government Spending

Another widespread myth is that MMT would result in unlimited government spending without any consequences. This misconception arises from the idea that MMT enables governments to spend without having to worry about deficits or debt. Critics argue that this would lead to excessive government intervention and a bloated public sector.

The Truth:

MMT doesn’t suggest unlimited government spending. It stresses that government spending should be aligned with the economy’s capacity to absorb that spending. If the economy is already operating at full capacity, further government spending would lead to inflation, which could undermine the value of money. The real goal of MMT is to ensure that the economy remains in balance, with spending focused on productive investments that improve long-term economic growth.

Furthermore, MMT advocates for the use of fiscal tools like taxation and bond issuance to manage inflation and ensure that the economy does not overheat. This means that while MMT supports increased government spending, it is not without limits.

Takeaway: MMT does not advocate for unlimited spending. It calls for responsible fiscal policies to manage inflation and ensure sustainable economic growth.

Myth #5: MMT Is a Radical or Unproven Theory

Some critics argue that MMT is a radical theory that has never been tested in the real world. They point to the lack of widespread implementation and the theoretical nature of the approach as reasons to dismiss it.

The Truth:

While MMT is relatively new in mainstream economic discourse, its principles are not entirely without precedent. For example, the U.S. government used deficit spending and money creation during World War II to finance the war effort, resulting in significant economic growth without triggering runaway inflation.

Moreover, MMT draws on ideas that have been explored by economists like John Maynard Keynes, who also emphasized the role of government spending in boosting economic activity. MMT proponents argue that the theory provides a modern framework for adapting these ideas to the current economic landscape.

Takeaway: MMT is based on historical examples of government spending and draws on existing economic principles, making it less radical than it may initially seem.

Real-World Applications of MMT

Let’s explore some practical applications of MMT in the real world. How could this theory be implemented to address contemporary issues like income inequality, infrastructure needs, and social safety nets?

-

Infrastructure Investment:

MMT could be used to finance large-scale infrastructure projects, such as rebuilding roads, bridges, and public transportation systems. By issuing money to fund these projects, the government could stimulate economic growth and create jobs without relying on traditional tax revenue. -

Universal Basic Income (UBI):

MMT provides a framework for funding programs like Universal Basic Income (UBI), which guarantees every citizen a certain amount of money each month. By issuing money, the government could provide a safety net for those in need while avoiding the need for traditional taxation. -

Healthcare and Education:

Under MMT, the government could expand access to healthcare and education by issuing money to finance these services. This would allow the government to meet the needs of its citizens without raising taxes or borrowing excessively. -

Full Employment:

MMT advocates for the concept of a “job guarantee,” where the government acts as an employer of last resort, providing jobs to those who are willing and able to work. This would reduce unemployment and create economic stability.

Conclusion: Is MMT the Key to Financial Freedom?

Modern Monetary Theory challenges many of the traditional economic principles that govern how we think about government spending, taxes, and money creation. While MMT has been criticized as a reckless way to print money and create debt, the reality is more nuanced. MMT emphasizes the importance of managing inflation and aligning government spending with the economy’s productive capacity.

Whether or not MMT will become a cornerstone of future economic policy remains to be seen. However, understanding the myths and facts behind this theory is crucial for anyone who wants to make informed decisions about their finances and understand the broader economic context in which these policies are debated.

Takeaway: MMT isn’t about printing money without limits; it’s about using fiscal policies to ensure that government spending promotes economic growth without triggering inflation. Understanding MMT can give you deeper insights into the financial policies that affect your life.

FAQ: Common Questions About MMT

-

What is Modern Monetary Theory (MMT)?

MMT is an economic theory that suggests governments with their own currency can create money to finance spending without relying on taxes or borrowing, as long as inflation is controlled. -

Does MMT mean the government can print unlimited money?

No, MMT advocates for money creation in line with the economy’s productive capacity and inflation control, not unchecked money printing. -

Will MMT lead to hyperinflation?

Hyperinflation can occur if money creation exceeds economic capacity. MMT emphasizes managing inflation through fiscal tools like taxes and savings bonds. -

How does MMT affect taxes?

MMT suggests that taxes are not primarily for revenue but for controlling inflation and ensuring the economy does not overheat. -

Can MMT work in real life?

MMT is based on historical examples of government spending and deficit financing, making it more feasible than critics suggest. -

Does MMT eliminate the need for a balanced budget?

MMT redefines the role of a balanced budget, focusing on inflation control rather than eliminating deficits. -

Could MMT fund universal healthcare or UBI?

Yes, MMT provides a framework for funding social programs like Universal Basic Income or universal healthcare. -

How does MMT relate to the national debt?

In MMT, debt is seen as a tool for managing the economy, not as a source of concern in and of itself. -

Is MMT radical or untested?

While MMT is relatively new, it builds on existing economic principles and has been used successfully in past economic crises. -

How can MMT help with economic recovery?

MMT provides a framework for funding recovery efforts without the usual concerns about budget deficits or debt.

References and Links:

-

Modern Monetary Theory (MMT) – A Primer – Brookings Institution

-

Understanding the Basics of Modern Monetary Theory – Investopedia

Affiliate Disclosure:

Some of the links in this article may be affiliate links, meaning we may earn a small commission at no extra cost to you. We only recommend products and services that we trust and believe will add value to your financial journey.

Is Inflation Always Bad? What MMT Says About Price Stability

Central Banks 101: Why They’re More Powerful Than Presidents

AFFILIATE DISCLOSURE:

This article contains affiliate links. We may receive a commission for purchases made through these links, at no extra cost to you. We only recommend products and services we believe will genuinely help you achieve your financial goals.

Central banks wield more power than presidents in shaping the economy. Discover why their decisions influence your financial life more than you may realize.

Introduction

In the world of economics, the decisions made by central banks are often more impactful than those of elected political leaders like presidents. While the role of politicians in shaping fiscal policies is widely recognized, the subtle, yet far-reaching influence of central banks remains an enigma for many. So, what makes central banks so powerful? And why do they have such a profound effect on your financial life?

This post will take you through the ins and outs of central banking, exploring the role these institutions play in managing the economy, why their influence is often more powerful than that of presidents, and how their decisions impact everything from inflation to your interest rates. By the end, you’ll have a clearer understanding of how central banks operate and why their actions matter to you.

What Are Central Banks?

To understand why central banks hold more power than presidents, it’s essential to know what central banks are and how they function. Central banks are the primary financial institutions that oversee a country’s monetary system. These institutions regulate a nation’s money supply, set interest rates, and maintain economic stability. While each country has its own central bank (e.g., the Federal Reserve in the U.S., the European Central Bank in Europe, the Bank of England in the U.K.), these institutions generally have similar functions.

Here are the core functions of a central bank:

- Monetary Policy Management

Central banks control the country’s money supply and set interest rates. Their primary goal is to stabilize inflation and promote sustainable economic growth. They adjust the money supply by buying or selling government bonds, which influences the interest rates in the market. Lower interest rates can stimulate spending and investment, while higher interest rates can slow down an overheated economy.

- Lender of Last Resort

During times of financial crisis, central banks act as lenders of last resort. When banks face liquidity shortages (the inability to access cash to meet their obligations), the central bank can provide loans to these banks to prevent widespread panic and keep the financial system stable.

- Currency Issuance

Central banks are responsible for issuing the country’s currency. They control how much money is in circulation and have the authority to print new money when needed, thus directly influencing the money supply.

- Managing Government Debt

Central banks often act as bankers for the government. They manage the issuance and payment of government debt (such as bonds) and assist in managing the country’s overall fiscal health by influencing national debt levels.

Why Central Banks Hold More Power Than Presidents

Now that we understand what central banks do, let’s explore why these institutions wield more power than presidents when it comes to shaping the economy.

- Control Over Monetary Policy

While presidents can propose and influence fiscal policies such as taxation and government spending, central banks have exclusive control over monetary policy — arguably the more powerful tool for managing the economy.

Monetary policy influences the money supply, interest rates, and inflation, all of which directly impact economic activity. For example:

- Interest rates: When central banks adjust interest rates, they influence the cost of borrowing. Lower rates encourage borrowing and spending, while higher rates encourage saving and reduce borrowing. This can affect everything from mortgage rates to the cost of credit card debt.

- Money supply: Central banks control how much money is in circulation. By printing more money or reducing the supply, they can control inflation and stabilize the economy.

By adjusting these variables, central banks can help manage economic cycles, control inflation, and support employment. In contrast, a president’s influence over fiscal policy is less direct and often slower to take effect.

- Independence from Political Influence

One of the primary reasons central banks are more powerful than presidents is their independence. Most central banks operate independently from government influence, meaning they don’t have to answer to political pressures when making economic decisions.

For instance, the Federal Reserve in the U.S. has a mandate to make decisions based on economic data and long-term financial stability, rather than the political goals of the sitting president. This gives central banks the ability to take a longer-term view and make decisions that may not always be politically popular but are necessary for the stability of the economy.

This independence allows central banks to enact policies that may go against the short-term interests of elected officials, who are often focused on winning votes rather than managing long-term economic health. A president, on the other hand, is limited by the electoral cycle and the need to satisfy their constituents.

- Global Impact

Central banks don’t just affect domestic economies — they also have a profound impact on global markets. The decisions made by the Federal Reserve, for example, can influence currency values worldwide, affecting international trade, investment flows, and global financial markets.

When the Federal Reserve changes interest rates or takes other actions, it often causes ripple effects across the globe. A rate hike by the Fed, for example, can cause the U.S. dollar to strengthen, which can influence the exchange rates of other countries’ currencies, impacting trade relationships and the global supply chain.

Presidents, while they influence trade policy and international relations, do not have the same ability to directly manipulate global economic conditions through monetary policy.

- Long-Term Economic Stability

Central banks are primarily concerned with maintaining long-term economic stability. Their tools — such as interest rate adjustments, quantitative easing, and money supply regulation — are designed to influence the economy in a way that fosters long-term growth, job creation, and price stability.

Presidents, on the other hand, often face pressure to act quickly to address immediate concerns, such as high unemployment or economic downturns. While their policies can have a significant impact, they typically don’t have the same tools to directly influence macroeconomic stability as central banks do.

For example, during the 2008 financial crisis, the Federal Reserve took aggressive actions to stabilize the financial system, such as lowering interest rates and implementing quantitative easing. While the government provided fiscal stimulus, it was the Federal Reserve’s actions that ultimately helped restore stability to the financial markets.

The Impact of Central Bank Decisions on Your Daily Life

Given their extensive influence over the economy, central banks’ decisions can directly affect your personal finances. Here are a few ways their actions impact you:

- Interest Rates and Borrowing Costs

Central banks’ decisions about interest rates directly affect the cost of borrowing. When interest rates are low, it becomes cheaper to borrow money for things like mortgages, car loans, and student loans. On the other hand, when interest rates rise, the cost of borrowing increases, which can reduce consumer spending and slow down economic growth.

If you have a mortgage or other loans, it’s crucial to stay informed about interest rate changes. A decision by the central bank to raise rates can make your existing debt more expensive, while a rate cut can lower your monthly payments.

- Inflation and the Cost of Living

Central banks play a crucial role in controlling inflation — the rate at which prices for goods and services increase. If inflation is too high, the value of money decreases, which means you can buy less with the same amount. Central banks can raise interest rates or use other tools to slow inflation.

However, if inflation is too low, it can signal weak demand in the economy, which can lead to job losses and wage stagnation. Central banks aim to keep inflation at a manageable level to ensure the purchasing power of money remains stable.

- Asset Prices

The policies of central banks can significantly influence asset prices, including stocks, bonds, and real estate. For example, when interest rates are low, it can drive up the prices of stocks and real estate as investors seek higher returns in other markets. Conversely, when interest rates rise, asset prices may fall as investors seek safer, higher-yielding assets.

How to Protect Yourself from the Influence of Central Banks

Given their power, it’s important to understand how to protect yourself from the economic consequences of central bank decisions. Here are some tips:

- Diversify Your Investments

Since central bank policies can affect various asset classes differently, it’s essential to diversify your investments. By spreading your investments across different sectors, industries, and asset types, you can reduce the risk of significant losses due to changes in interest rates or inflation.

- Monitor Interest Rate Changes

Stay informed about central bank interest rate changes, as these will affect borrowing costs and the value of your investments. Keeping an eye on Federal Reserve announcements or those of your country’s central bank can help you adjust your financial strategies accordingly.

- Prepare for Inflation

Inflation erodes the purchasing power of your savings. To protect against inflation, consider investing in assets that tend to perform well when inflation rises, such as real estate, commodities, and Treasury Inflation-Protected Securities (TIPS).

Conclusion: The Undeniable Power of Central Banks

Central banks play a vital and often unseen role in shaping the global economy. Through their control of monetary policy, interest rates, and money supply, they wield more power than elected officials like presidents. Their ability to stabilize financial markets, control inflation, and influence global trade makes them key players in maintaining economic stability.

While the average person may not fully understand the intricate workings of central banks, it’s important to recognize their influence and how their decisions affect your financial life. By staying informed and understanding their power, you can make better financial decisions and protect your wealth in an ever-changing economic environment.

Frequently Asked Questions (FAQ)

- What is the main function of central banks?

Central banks manage the country’s money supply, interest rates, and inflation to ensure economic stability. - Why are central banks more powerful than presidents?

Central banks control monetary policy, which has a more direct and lasting impact on the economy than fiscal policies set by presidents. - How do central banks affect inflation?

Central banks regulate inflation by adjusting interest rates and controlling the money supply. - How do central banks impact interest rates?

Central banks raise or lower interest rates to influence borrowing costs and economic activity. - Can presidents control central banks?

No, central banks are typically independent institutions designed to operate free from political pressures. - How do central banks influence the global economy?

Central banks, such as the Federal Reserve, can affect global currency values, trade, and investment flows through their monetary policies. - What is quantitative easing?

Quantitative easing is a policy where a central bank buys government bonds or other financial assets to increase the money supply and stimulate economic activity. - How can central banks prevent a financial crisis?

Central banks can inject liquidity into the financial system and lower interest rates to prevent or mitigate financial crises. - Why is central bank independence important?

Independence ensures that central banks can make long-term decisions based on economic data, not political pressures. - How can I protect my finances from central bank decisions?

Stay informed about interest rates, diversify your investments, and consider assets that perform well during inflationary periods.

Affiliate Disclosure

Some of the links in this article may be affiliate links, which means I may earn a commission if you click through and make a purchase. This comes at no additional cost to you, and it helps support the maintenance of this website. Please note that I only recommend products or services that I believe will add value to my readers.

How Governments Create Money — And Why It’s Not Like Your Budget

AFFILIATE DISCLOSURE:

This article contains affiliate links. We may receive a commission for purchases made through these links, at no extra cost to you. We only recommend products and services we believe will genuinely help you achieve your financial goals.

Explore how governments create money and why it differs from managing a household budget. Understand the mechanics behind modern monetary systems in this easy-to-follow guide.

Introduction

When you hear the phrase “money doesn’t grow on trees,” it’s easy to assume that money is limited in all its forms. The idea of scarcity is woven deeply into our personal finance habits—after all, if you don’t earn money, you can’t spend it. But what if I told you that governments don’t operate the same way? What if I told you that they have the ability to create money without needing to “earn” it first? This is a concept that confuses many people because it’s so different from how we think about money on an individual level.

In this article, we’ll explore how governments create money, why it’s not like managing your personal budget, and what this means for both the economy and your financial life. Understanding the dynamics behind government money creation can help you navigate the world of personal finance with greater confidence. You’ll also gain insight into why governments run deficits, how they control inflation, and why sovereign Debt is not as straightforward as household debt. Ready to dive into the mechanics of money creation? Let’s go!

How Governments Create Money: The Basics

What is Money Creation?

At the most basic level, money creation refers to the process by which a government, typically through its central bank, issues new money to support its spending. This money can take many forms, including physical cash (like bills and coins) or digital money that flows through the banking system.

You may be familiar with the concept of money being tied to valuable assets like gold, but in today’s world, most money is fiat, meaning it’s not backed by anything tangible like gold or silver. Instead, its value comes from the trust that people and institutions place in the government that issues it. For example, the U.S. dollar is considered valuable not because it’s backed by gold but because people believe in the U.S. government’s ability to repay debts and manage the economy.

In short, money creation today is more about authority and policy than physical resources.

The Central Bank’s Role in Money Creation

The central bank is a key player in the money creation process. For instance, in the U.S., the Federal Reserve (or “Fed”) is responsible for managing the money supply. The central bank controls how much money is available in the economy and uses various tools to influence the economy, such as adjusting interest rates and purchasing government bonds.

While the central bank doesn’t physically print cash (this is done by the U.S. Treasury), it has the power to create money through electronic means, essentially increasing the money supply. This is an important distinction: while individuals or businesses need to earn money, the government, through its central bank, can create more money when needed.

Government Spending and the Money Supply

When the government spends money, it doesn’t need to rely solely on taxes or borrowing to fund its expenses. Instead, the central bank can increase the money supply, which can then be used for public spending. This is especially crucial in times of economic downturn, when the government may need to stimulate the economy by increasing spending.

In simpler terms, the government can create money in a way that allows it to spend more without first collecting taxes or taking on Debt. However, this doesn’t mean that governments are free to print money endlessly without consequences. Inflation is a key factor to consider when creating more money, and central banks manage inflation through various policy measures.

Why Government Money Creation Is Not Like Your Household Budget

- Governments Don’t Need to “Earn” Money