Bruce Creighton

What Happens If The Dollar Loses Reserve Currency Status?

Inflation vs Wage Growth: Are You Falling Behind?

Inflation and wage growth are at odds in today’s economy. Learn how rising prices affect your earnings and what you can do to stay ahead financially.

AFFILIATE DISCLOSURE:

This article contains affiliate links. We may receive a commission for purchases made through these links, at no extra cost to you. We only recommend products and services we believe will genuinely help you achieve your financial goals.

Introduction: The Battle Between Inflation vs Wage Growth

In recent years, many individuals have noticed something unsettling: their paycheck doesn’t seem to stretch as far as it once did. Whether it’s the rising cost of groceries, gasoline, or housing, prices are climbing faster than the pay raises many workers receive. This phenomenon has left millions wondering: are we falling behind in the fight between inflation and wage growth?

As inflation continues to rise, it erodes purchasing power—meaning the same amount of money buys fewer goods and services. On the other hand, wage growth has been sluggish, and many workers have seen their salaries barely keep up with the rising costs of living. In this post, we’ll break down the relationship between inflation and wage growth, how it affects you, and what you can do to stay financially strong in the face of these challenges.

Understanding Inflation and Wage Growth

What Is Inflation?

Inflation is the rate at which the general level of prices for goods and services rises, eroding purchasing power. It means that the money you earn today will buy less than it did a year ago. In the U.S., inflation is often measured by the Consumer Price Index (CPI), which tracks the cost of a basket of goods and services over time. A high inflation rate means a significant increase in prices, while a low rate means prices are rising slowly or not at all.

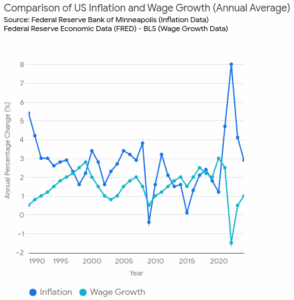

As of 2023, the CPI showed inflation at approximately 6.5%, an alarming rate compared to historical averages. This marked a sharp increase from the relatively low inflation rates seen in the previous decade. Inflation affects virtually every aspect of the economy, from the cost of everyday necessities to long-term investments and savings. It’s a crucial indicator to track, especially when compared to your wage growth. Learn more at Investopedia – What is the Consumer Price Index (CPI) and Federal Reserve – Inflation

What Is Wage Growth?

Wage growth refers to the rate at which wages or salaries increase over time. Ideally, wages should rise in tandem with inflation, allowing workers to maintain their purchasing power. However, if wage growth lags behind inflation, workers experience a reduction in their real income—what they can actually afford to buy.

In the U.S., wage growth has been relatively sluggish in recent years, especially when compared to the rising costs of living. For instance, in 2023, the average wage growth rate was approximately 4.5%, whereas inflation was pushing around 6.5%. This means that for many workers, their real income was effectively shrinking, making it harder to cover expenses and save for future goals.

Why Is This Relationship Important?

The interaction between inflation and wage growth is critical because it directly impacts your financial wellbeing. If inflation outpaces wage growth, it can lead to a decrease in your standard of living. Simply put: if your wages don’t grow as quickly as the cost of living, you’re effectively losing money.

Inflation vs Wage Growth: A Closer Look

How Inflation Affects Your Purchasing Power

When inflation increases, the prices of everyday goods and services—such as food, gas, and rent—go up. This can create a significant financial strain, especially for individuals living paycheck to paycheck. If your wage increase doesn’t match the pace of inflation, you may find yourself unable to afford the same things you did the previous year.

For example, in 2023, U.S. inflation was reported at around 6.5%, while average wage growth hovered closer to 4.5%. That’s a significant gap, and it means workers are not keeping up with rising costs.

For instance, grocery prices have risen dramatically, with food prices increasing by 8-10% in some sectors over the last year. This means that for families, the cost of a typical grocery bill can be hundreds of dollars higher annually, creating a strain on their finances. Additionally, higher gasoline prices and housing costs are making it even more difficult for individuals to make ends meet.

The Impact on Savings and Retirement

Inflation doesn’t just affect your day-to-day spending; it can also impact your long-term financial goals. For instance, inflation erodes the value of your savings. If your savings account yields a 1% return, but inflation is 4%, you’re effectively losing money in real terms. The purchasing power of your nest egg is shrinking, making it harder to save for retirement, a home, or your children’s education.

Inflation also impacts the value of fixed-income investments, like bonds. While bonds can offer a steady stream of income, inflation can erode the purchasing power of those payments, reducing the returns investors get over time.

Are You Falling Behind? How to Know If Inflation is Outpacing Your Wage Growth

Understanding the Numbers

To truly understand whether you’re falling behind in the inflation vs wage growth battle, it’s essential to track both metrics. You need to ask yourself: Is my wage increase enough to cover rising prices?

Here’s how you can evaluate your situation:

-

Compare your salary increase to the inflation rate: If your wages are increasing by 3% annually, but inflation is 6%, your real purchasing power is decreasing.

-

Track your spending: Keep a close eye on rising costs in categories such as food, housing, and transportation. If these prices are increasing faster than your wage, it’s time to reconsider your budget or look for ways to increase your income.

-

Focus on long-term financial goals: If your salary is stagnant, focus on building wealth through other means such as investments or starting a side business to make up for lost purchasing power.

Actionable Tips: How to Stay Ahead of Inflation

1. Negotiate Your Salary

If you’re concerned that your wage growth isn’t keeping up with inflation, the first step is to ask for a raise. Many employers are open to negotiating salaries, especially if you can demonstrate your value to the company. Here are a few strategies to increase your chances:

-

Do your research: Use tools like Glassdoor and Payscale to find out the average salary for your position in your area.

-

Prepare your case: Be ready to explain your accomplishments and how they have benefited the company.

-

Show the market rate: If your current pay is lower than the market average, use this information to strengthen your argument.

2. Invest to Combat Inflation

One of the best ways to protect yourself from inflation is by investing. Inflation erodes the value of cash, but investments—especially in assets like stocks, real estate, and bonds—tend to outpace inflation over the long term. Here are a few investment options to consider:

-

Stocks and ETFs: Historically, the stock market has provided returns that outpace inflation.

-

Real estate: Property values generally increase with inflation, providing a hedge against rising prices.

-

Precious metals: Gold and silver are often seen as safe havens during times of high inflation.

3. Reduce Your Expenses

If your salary isn’t keeping up with inflation, reducing your expenses can help you maintain your financial stability. Here are a few strategies:

-

Cut discretionary spending: Consider reducing costs on things like dining out, entertainment, and subscriptions.

-

Shop smarter: Use coupons, look for sales, and buy in bulk to save on everyday expenses.

-

Refinance loans: Lower your interest rates on mortgages, student loans, and credit cards to free up more cash.

4. Diversify Your Income

Building multiple streams of income can provide financial resilience when inflation erodes the value of your paycheck. Here are some ideas:

-

Start a side business: Whether it’s freelance work, selling handmade goods, or offering services, a side business can boost your income.

-

Invest in dividend-paying stocks: These stocks provide a steady stream of passive income.

-

Rent out property: If you have an extra room or property, consider renting it out for additional income.

Internal Links & Resources

-

Who Really Controls the Money? A Look at Central Banks: Understanding how central banks influence the economy and wage growth.

-

The Debt Myth: Why Government Borrowing Isn’t Like a Household Budget: A breakdown of how government spending and monetary policy can affect inflation and wages.

Conclusion: How to Protect Yourself from Falling Behind

As inflation continues to outpace wage growth, it’s crucial to take proactive steps to safeguard your financial future. By negotiating your salary, investing wisely, reducing expenses, and diversifying your income, you can stay ahead of the curve and maintain your purchasing power. While the economic landscape may seem daunting, there are plenty of opportunities to adapt and thrive financially.

Frequently Asked Questions

-

How does inflation affect my daily expenses?

Inflation raises the cost of everyday goods and services, making it harder to maintain your standard of living. -

Can I keep up with inflation through wage growth alone?

It’s possible, but it requires constant wage increases that match or exceed inflation. In practice, this can be difficult. -

What’s the best way to protect my savings from inflation?

Invest in assets like stocks, bonds, or real estate that historically outperform inflation. -

How can I measure if my wage growth is enough?

Compare your annual salary increase to the inflation rate to see if you’re maintaining or losing purchasing power. -

Is there a specific industry where wages grow faster than inflation?

Technology and healthcare industries often see faster-than-average wage growth. -

What happens if I don’t adjust my financial plan during inflation?

You may find it more difficult to meet financial goals like saving for retirement or buying a home. -

Are there any government programs to help with inflation?

Programs like Social Security adjustments and certain tax credits may provide relief, but they often don’t keep pace with inflation. -

Should I focus on cutting expenses or increasing income?

A balance of both is ideal, but diversifying your income streams can be more sustainable long-term. -

What’s the best investment to hedge against inflation?

Stocks, real estate, and precious metals are common inflation hedges. -

How can I negotiate a raise to match inflation?

Do research on market rates for your role and present evidence of your contributions and achievements.

Affiliate Disclosure

Affiliate Link Disclosure: TheMoneyQuestion.org may earn a small commission if you make a purchase through one of the links in this article. However, we only recommend products and services that we believe will add value to your financial journey.

Content Disclaimer: The information in this article is for informational purposes only and is not intended to substitute for the advice of a licensed or certified attorney, accountant, financial advisor, or other certified financial professionals. Always seek professional advice before making financial decisions.

What Crypto Hype Means For Everyday Investors

Why Private Banks Create Most of the Money in the Economy

The popular belief that governments, through their central banks, print and control the money supply is largely a myth. Learn how private banks create money, why it matters for your financial life, and how understanding this can empower your personal finance decisions.

AFFILIATE DISCLOSURE:

This article contains affiliate links. We may receive a commission for purchases made through these links, at no extra cost to you. We only recommend products and services we believe will genuinely help you achieve your financial goals.

Introduction: Who Really Controls Money in Our Economy?

Have you ever wondered where money actually comes from? We tend to think of it as something printed by the government, but the reality is far more complex. In fact, private banks create most of the money circulating in the economy today.

This might sound surprising, but once you understand how it works, it can transform the way you think about money, debt, and even your personal finances. In this post, we’ll dive deep into how private banks create money through the lending process, the implications of this for economic stability, and why it matters to you as a consumer. By the end, you’ll have a clearer understanding of the monetary system and its impact on your financial life.

The Role of Banks in the Economy: More Than Just Lenders

How Banks Work

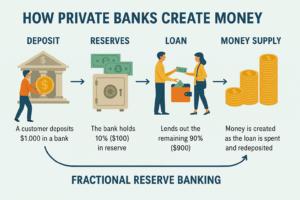

Banks play a crucial role in the economy, but they’re not just places to deposit your paycheck or take out a loan. Private banks, in particular, are the primary entities responsible for creating the vast majority of money in circulation. How? Through a process called fractional reserve banking.

What is Fractional Reserve Banking?

In simple terms, fractional reserve banking allows banks to lend out most of the money deposited by their customers, keeping only a fraction in reserve. This creates money out of thin air, as loans are made that exceed the actual deposits in the bank’s vaults.

For example:

-

You deposit $1,000 into a bank.

-

The bank is required to keep only 10% (or $100) in reserve, which means it can lend out $900.

-

When the bank loans that $900 to someone else, that money is spent and deposited into another bank.

-

The second bank can now lend out 90% of that deposit, and the cycle continues.

This process of lending and re-lending creates money in the form of credit and debt that circulates throughout the economy. As a result, the actual supply of money in the economy can be many times greater than the amount physically printed by the government.

How Do Private Banks Create Money?

Private banks are not just custodians of money; they are active participants in its creation. Here’s a breakdown of how this happens:

1. Deposits Lead to Loans

When you deposit money into a bank, it doesn’t just sit there. The bank uses your deposit as a source of funds to offer loans to others, and in the process, it creates new money.

2. Money Multiplier Effect

The act of lending leads to more deposits being made, which the bank can then lend out again. This “money multiplier” effect causes the supply of money to grow exponentially. The initial deposit creates more than just a one-to-one increase in money supply.

3. Interest Payments and Debt

The money that banks lend is not free. The borrower must pay interest on the loan. This interest is a form of revenue for the bank, but it also means that the economy is operating on a debt-based system. The more money is created, the more debt there is, and the higher the interest payments.

The Consequences of Private Bank Money Creation

While this system allows for economic growth and provides consumers with access to credit, it also has some serious implications:

1. Debt Levels and Economic Cycles

Because private banks create money through debt, the economy becomes heavily reliant on borrowing. As debt levels increase, the risk of economic downturns also rises. When too many people or businesses default on loans, it can lead to financial crises, like the 2008 recession.

2. Inflation and Asset Bubbles

In some cases, the money created by banks leads to inflation, particularly in asset prices like real estate and stocks. When banks lend excessively, demand for these assets rises, which drives up prices, potentially creating asset bubbles.

3. Limited Control Over the Money Supply

Despite the fact that private banks create most of the money, the government and central banks still try to regulate the supply of money through tools like interest rates and reserve requirements. However, because the vast majority of money is created privately, government control over the money supply is limited.

How Does This Impact Your Personal Finances?

Understanding how private banks create money is not just an academic exercise – it has real-world implications for your financial life:

1. Access to Credit

The availability of credit depends largely on the lending policies of private banks. If banks are reluctant to lend, it can be harder for you to get a loan, whether it’s for a car, home, or business. Conversely, if banks are too eager to lend, it can lead to an oversupply of credit and potential financial instability.

2. Interest Rates

Interest rates are influenced by the central bank, but they are also set by private banks based on market conditions and competition. A low-interest rate environment, which happens when banks have easy access to money, can make borrowing more affordable, but it also fuels debt levels.

3. Inflation and Purchasing Power

As banks create more money through loans, inflation can rise, which erodes the purchasing power of your money. For instance, if more money enters the economy, the cost of goods and services may increase. Understanding this can help you make smarter decisions about savings and investing.

4. Wealth Inequality

The way money is created and distributed can also contribute to wealth inequality. Those who can access loans – often the wealthy – are able to benefit from the rising asset prices that are often driven by bank lending. Meanwhile, those who can’t access credit may find themselves left behind.

Trending Question: Can the Creation of Money by Private Banks Lead to Economic Instability?

Many critics argue that the ability of private banks to create money leads to economic instability. They believe this system can encourage irresponsible lending, creating financial bubbles, and contributing to economic crises. Understanding this dynamic is crucial for understanding why policies like Modern Monetary Theory (MMT) and Sovereign Money Systems have been proposed to reform how money is created and controlled.

1. Modern Monetary Theory (MMT)

MMT suggests that governments, particularly sovereign ones, should issue currency directly and spend freely to finance public services, without worrying about balancing the budget. Proponents of MMT argue that a sovereign money system would reduce reliance on private banks and mitigate the risk of financial instability caused by debt-based money creation.

2. Sovereign Money System

In a Sovereign Money System, only the government would have the authority to create money. Under such a system, private banks would no longer be able to create money through loans, which could significantly reduce the risks of inflation and financial instability.

Internal Links:

-

Who Really Controls the Money? A Look at Central Banks

-

This article provides an in-depth look at central banks and their role in the monetary system, complementing the discussion on private banks’ money creation.

-

-

Modern Monetary Theory: Rethinking Economics and Monetary Reform

-

This post explores alternatives to the current monetary system, including MMT, which proposes changes to the way money is created and managed.

-

-

What the Fed’s Move Means For Your Wallet

-

This post explores the implications of central bank actions on personal finances, linking to the discussion of monetary policy and private banks’ role in creating money.

-

External Links:

-

Federal Reserve – How the Federal Reserve Operates (Federal Reserve official site)

-

This official government site offers a clear explanation of how the Federal Reserve System works, its role in regulating money supply, and its relationship with private banks.

-

-

Bank of England – Money Creation in the Modern Economy (Bank of England)

-

A credible and educational source from the Bank of England that explains how money is created in the modern economy, including the role of private banks in the money creation process.

-

- The Bank of International Settlements (BIS) – Money Creation (BIS official publication)

-

The BIS is an international financial institution that provides in-depth reports and studies on money creation, central banking, and its impact on the global economy. This authoritative resource can add credibility to your post.

-

Conclusion: Take Control of Your Financial Future

Understanding that private banks create most of the money in the economy is a powerful insight into how the financial system works. While this system allows for economic growth, it also introduces risks like inflation, asset bubbles, and increased debt levels.

By becoming aware of how money is created and understanding the broader economic forces at play, you can make more informed decisions about your personal finances. Whether it’s understanding how interest rates impact your loans or recognizing the potential risks of an overheated economy, the more you know, the better equipped you’ll be to navigate the complexities of money.

FAQs: Answering Your Burning Questions on Money Creation

-

What is fractional reserve banking, and how does it create money?

-

Fractional reserve banking is where banks hold only a portion of their customer deposits as reserves and lend the rest to borrowers, thus creating new money in the process. This process is called the money multiplier effect.

-

-

How does private bank money creation affect inflation?

-

The creation of money through loans can lead to inflation, especially if too much money is created relative to the supply of goods and services. The more money that is created through lending, the less each unit of currency is worth.

-

-

Why do private banks create money instead of the government?

-

Private banks have the ability to create money through lending, which has become a standard part of the modern banking system. This contrasts with a system where only the government can issue money.

-

-

Can private bank money creation lead to economic crises?

-

Yes, excessive lending can lead to financial bubbles, excessive debt, and instability in the economy.

-

-

How do central banks regulate the money created by private banks?

-

Central banks regulate the money supply through tools like reserve requirements, interest rates, and monetary policy. By adjusting these controls, central banks can increase or decrease the amount of money and credit available.

-

-

What is the difference between sovereign money and fractional reserve banking?

-

Sovereign money is a system where only the government creates money, while fractional reserve banking allows private banks to create money through lending.

-

-

How can I protect myself from inflation caused by money creation?

-

By investing in assets that tend to hold value during inflationary periods, such as stocks, real estate or commodities (i.e. gold, silver).

-

-

Does the government have control over the money supply?

-

The government, through its central bank, can influence the money supply but doesn’t directly control the vast majority of money in circulation, which is created by private banks. It’s important to note the distinction between control and influence — in most developed countries, central banks operate with a degree of independence from the direct political control of the government.

-

-

What are the risks of a debt-based money system?

-

Risks include financial instability, slower economic growth, asset bubbles, and higher levels of national debt. Higher levels of national debt could lead to limited government fiscal flexibility as more government revenue is directed towards interest payments.

-

-

How can I better manage my finances in a debt-driven economy?

-

By creating a comprehensive budget and focusing on paying down high-interest debt, saving consistently, and investing in a diversified portfolio to protect against inflation. In addition, boosting your income and increasing your financial literacy will put you in a better position to manage your finances.

-

Disclosure:

From Gold to Code: The Evolution of Money in the 21st Century

How Interest Rates Actually Work (and Who They Benefit)

AFFILIATE DISCLOSURE:

This article contains affiliate links. We may receive a commission for purchases made through these links, at no extra cost to you. We only recommend products and services we believe will genuinely help you achieve your financial goals.

Understand how interest rates work, who they benefit, and how they impact your financial life in this easy-to-understand guide.

Introduction: Interest Rates Unpacked – The Key to Your Financial World

Interest rates are a fundamental part of financial conversations, but their impact on your daily life often goes unnoticed. Whether you’re buying a home, taking out a loan, investing in savings accounts, or simply managing debt, interest rates shape your financial reality. But how exactly do they work, and more importantly, who stands to benefit from them?

In this comprehensive guide, we’ll explore the mechanics of interest rates, how they are set, and most importantly, who benefits when they rise or fall. By the end of this article, you’ll have a clear understanding of how interest rates work and how you can use that knowledge to improve your financial decisions. Let’s dive into the world of interest rates!

What Are Interest Rates? A Simple Definition

In simple terms, an interest rate is the price of borrowing money, or the return on money you invest. It is expressed as a percentage of the loan amount or deposit. When you borrow money, the lender charges you an interest rate for the privilege of using their funds. Conversely, when you lend money (by depositing funds in a savings account or purchasing bonds), you earn interest as a return.

Types of Interest Rates:

-

Fixed Interest Rates: These remain the same for the entire loan term, providing predictability in monthly payments.

-

Variable Interest Rates: These fluctuate based on market conditions and may change during the term of the loan.

-

Nominal Interest Rates: The stated rate, without factoring in inflation.

-

Real Interest Rates: Adjusted for inflation, representing the true cost or benefit of borrowing or lending.

How Do Interest Rates Affect Your Finances?

Interest rates have a wide-ranging impact on personal finance. Whether you’re borrowing money, saving it, or investing, the rate applied to your financial products directly affects how much you pay or earn.

1. Borrowing Costs:

-

Mortgages and Car Loans: If you’re purchasing a home or car, a lower interest rate will reduce your monthly payments and the total amount you pay over the life of the loan. Conversely, higher interest rates make these loans more expensive.

-

Credit Cards and Personal Loans: Interest rates are often higher for credit cards and personal loans. This means borrowing on these terms can quickly accumulate debt if not paid off promptly.

2. Savings and Investments:

-

Savings Accounts and Certificates of Deposit (CDs): When interest rates rise, the returns on savings accounts, money market accounts, and CDs tend to increase, offering savers better rewards for holding their money in these products.

-

Bonds: If interest rates go up, the price of existing bonds tends to fall. New bonds are issued with higher yields, which can make older, lower-yielding bonds less attractive to investors.

3. The Economy:

-

Central Bank Decisions: Central banks, such as the Federal Reserve in the U.S., play a significant role in determining interest rates. By raising or lowering rates, they aim to control inflation and stimulate or slow down economic growth.

Who Benefits from High or Low Interest Rates?

Understanding who stands to gain from high or low interest rates is essential in knowing how they affect your finances.

1. Borrowers:

-

Low Interest Rates: When interest rates are low, borrowing is cheaper. This benefits individuals and businesses that need loans for homes, cars, or other ventures. You will pay less in interest, and the total cost of the loan decreases.

-

High Interest Rates: High interest rates can be a significant burden on borrowers. Monthly payments on loans and credit cards increase, making it harder for consumers to manage debt.

2. Savers and Investors:

-

Low Interest Rates: For savers, low interest rates mean lower returns on savings accounts and fixed-income investments like bonds. This can be frustrating, especially if you rely on interest income for financial security.

-

High Interest Rates: Savers and conservative investors benefit from high interest rates. Your savings grow faster, and fixed-income investments such as bonds or CDs offer more attractive returns.

3. Financial Institutions:

-

Low Interest Rates: Banks and financial institutions typically face a reduced margin between the interest they charge borrowers and the interest they pay on deposits when interest rates are low.

-

High Interest Rates: On the other hand, banks tend to benefit from higher interest rates, as they can charge more for loans and offer more favorable terms on their financial products.

How Do Central Banks Set Interest Rates?

Interest rates are not solely determined by market forces. Central banks, like the Federal Reserve in the U.S., have significant influence over short-term interest rates. Central banks set a benchmark interest rate, such as the Federal Funds Rate, which is the rate at which commercial banks lend to each other. This rate impacts everything from mortgages to business loans to credit card interest.

Why Do Central Banks Raise or Lower Rates?

-

To Control Inflation: Central banks raise interest rates when inflation is too high. Higher rates reduce borrowing and spending, cooling off the economy and helping keep inflation in check.

-

To Stimulate Growth: During times of economic downturn, central banks may lower interest rates to encourage borrowing and investment, boosting spending and job creation.

The Federal Reserve’s decisions have wide-reaching implications for the financial markets and individual borrowers. For example, the Federal Reserve’s actions during the 2008 financial crisis and the COVID-19 pandemic demonstrate how interest rates can be used to stabilize the economy by making borrowing cheaper for businesses and consumers.

External Link: Federal Reserve – Interest Rates – Learn about the Federal Reserve’s policies on setting interest rates and their impact on the economy.

How Do Interest Rates Impact the Stock Market?

Interest rates also play a crucial role in the stock market. While stocks are often seen as an investment that yields capital gains, they can also be sensitive to interest rate changes.

-

Rising Interest Rates: When interest rates rise, it becomes more expensive for companies to borrow money, and consumer spending may decrease. As a result, company profits can decline, leading to lower stock prices. Investors may shift their investments into bonds or other fixed-income products that offer more favorable returns.

-

Falling Interest Rates: Conversely, lower interest rates make borrowing cheaper for businesses and consumers, encouraging spending and investment. This can boost profits for companies, leading to higher stock prices.

Interest rates are often seen as a barometer of economic health. During times of low rates, investors may be more willing to take on risk by investing in stocks. However, higher rates often push investors toward safer assets, like bonds.

External Link: Investopedia – How Interest Rates Affect the Stock Market – Learn how interest rates influence the stock market and the broader economy.

Trending Question: Why Are Interest Rates So Low During Economic Crises?

It’s common to see interest rates drop during economic crises, such as the 2008 financial crisis or the 2020 COVID-19 pandemic. You might wonder why central banks lower rates in such times.

Answer:

During times of economic crisis, central banks typically lower interest rates to stimulate the economy. The goal is to make borrowing cheaper for businesses and consumers, encouraging investment, spending, and job creation. By reducing the cost of borrowing, central banks hope to keep the economy from slipping into a deeper recession.

In times of crisis, lower interest rates can provide businesses with the liquidity needed to survive and continue operations, and consumers may be more likely to purchase homes or take out loans for essential expenses.

How to Use Interest Rates to Your Advantage

Understanding interest rates allows you to make smarter financial decisions. Here are some strategies for navigating interest rates in your personal finances:

1. Shop Around for Loans and Credit Cards:

-

Always compare interest rates before committing to a loan or credit card. Even a small difference in the rate can save you hundreds or thousands of dollars in the long run.

2. Refinance High-Interest Loans:

-

If you have existing loans with high interest rates, consider refinancing them to lower rates. This can reduce your monthly payments and help you pay off your debt faster.

3. Pay Off Debt Faster:

-

If interest rates are high on your credit card or personal loans, try to pay them off as quickly as possible. Paying down debt faster reduces the amount of interest you pay overall.

4. Maximize Your Savings During High-Interest Periods:

-

When interest rates rise, consider moving your savings into high-yield savings accounts, CDs, or bonds to earn a higher return.

5. Keep an Eye on Central Bank Announcements:

-

Stay informed about central bank decisions, as these can signal changes in the interest rate environment. Understanding these shifts can help you make better decisions on loans, investments, and savings.

Conclusion: Mastering Interest Rates to Improve Your Financial Life

Interest rates play a crucial role in your financial life, impacting everything from how much you pay for loans to how much you earn on your savings. By understanding how interest rates work and how they are influenced by central banks, you can make more informed financial decisions. Whether you’re borrowing money, saving for the future, or investing in the stock market, mastering interest rates is a key to achieving your financial goals.

FAQ: Everything You Need to Know About Interest Rates

-

What is the difference between a fixed and variable interest rate?

-

A fixed rate stays the same throughout the loan term, while a variable rate changes based on market conditions.

-

-

How do interest rates affect my credit score?

-

Interest rates themselves don’t directly impact your credit score, but high-interest debt that’s not managed well can hurt your score.

-

-

How do interest rates affect inflation?

-

Higher interest rates reduce borrowing and spending, which helps keep inflation in check. Lower rates encourage spending, which can increase inflation.

-

-

What is a good interest rate for a mortgage?

-

A good mortgage rate depends on your credit score, the loan term, and market conditions. Lower rates are generally better.

-

-

What happens if interest rates rise after I take out a fixed-rate loan?

-

Your loan’s rate remains unchanged, but the cost of borrowing for new loans will be higher for others.

-

-

Should I wait for lower interest rates to buy a house?

-

If rates are rising, it may be wise to act sooner. However, it’s always essential to consider your financial readiness.

-

-

Can I negotiate my interest rate on loans?

-

Yes, many lenders are open to negotiation, especially if you have a good credit score.

-

-

Why do interest rates matter for personal finance?

-

Interest rates affect everything from how much you pay for loans to how much your savings will grow.

-

-

How often do interest rates change?

-

Interest rates can change frequently based on central bank policies and economic conditions.

-

-

How do interest rates affect the stock market?

-

Rising rates can hurt stocks, while falling rates may boost them.

Affiliate Disclosure

This article may contain affiliate links. If you click on a link and make a purchase, we may earn a small commission at no extra cost to you. This helps support our mission to provide valuable, free content. Thank you for your support!

How Government Policy Shapes the Prices You Pay Every Day

AFFILIATE DISCLOSURE:

This article contains affiliate links. We may receive a commission for purchases made through these links, at no extra cost to you. We only recommend products and services we believe will genuinely help you achieve your financial goals.

Learn how government policies influence the prices of everyday goods and services. Understand the economic forces shaping your spending.

Introduction

Do you ever wonder why the prices of everyday items, from groceries to gas, seem to fluctuate unexpectedly? It may seem like these price changes happen randomly, but they are often the direct result of government policies. Whether it’s through taxation, regulations, or monetary decisions, policies made at the national and global level significantly impact the prices you pay for goods and services.

Understanding the interplay between government policies and prices is crucial to managing your personal finances. It helps you become a more informed consumer and empowers you to make decisions that protect your purchasing power. In this article, we’ll dive deep into how different policies—both economic and monetary—shape the costs of goods and services. We’ll explore how fiscal and monetary policies, trade regulations, and other governmental decisions affect everything from the cost of your morning coffee to the price of your monthly rent. By the end, you’ll have a clearer picture of why things cost what they do and how you can navigate these changes effectively.

How Government Policy Impacts Prices

Government policies play a critical role in determining the prices you pay for almost everything. From taxes to trade tariffs, regulations to subsidies, the actions of policymakers can either drive prices up or keep them lower than they might otherwise be.

1. Fiscal Policy and Its Role in Prices

Fiscal policy refers to the use of government spending and taxation to influence the economy. When the government spends more money, it typically increases the demand for goods and services, which can drive up prices. This increase in demand is particularly noticeable when the economy is already running at or near full capacity. Similarly, higher taxes can reduce consumers’ disposable income and decrease demand, potentially reducing inflationary pressure.

Example:

When governments enact stimulus packages, like the ones seen during the COVID-19 pandemic, they inject more money into the economy. While this helps people and businesses weather economic downturns, it can also drive up the cost of goods and services as demand outpaces supply. For instance, the government sent direct payments to individuals, which resulted in people spending more on consumer goods, thus raising prices in some sectors.

Impact on Everyday Consumers:

If the government increases its spending on infrastructure or social programs, businesses may raise prices to keep up with increased demand for their products or services. This could be reflected in higher costs for everyday items, such as food, gas, and even housing.

2. Monetary Policy and Inflation

Monetary policy is managed by a country’s central bank (e.g., the U.S. Federal Reserve), and it affects the prices of goods and services by controlling the money supply and interest rates. Central banks use monetary policy to achieve stable prices, full employment, and moderate long-term interest rates. They do this by adjusting interest rates, which in turn affects the cost of borrowing.

How It Works:

-

Lowering interest rates makes borrowing cheaper for businesses and consumers, which encourages spending and investment. This increased demand can cause inflation, or rising prices, especially in industries like housing and automobiles.

-

Raising interest rates makes borrowing more expensive and slows down consumer spending. This can help control inflation but might also slow economic growth.

Example:

In 2020, the Federal Reserve slashed interest rates to near-zero levels to stimulate spending and help the economy recover from the pandemic’s impact. While this decision was critical for economic recovery, it also contributed to rising prices in certain sectors, like real estate, as more people took advantage of low mortgage rates.

Impact on Everyday Consumers:

When interest rates are low, many people may take out loans to buy homes, cars, or even invest in businesses. Increased demand from these activities leads to higher prices in the housing market and automotive industries. If you’re looking to make a large purchase or refinance debt, understanding the state of monetary policy can help you time your financial decisions effectively.

3. Trade Policies and Their Effect on Prices

Government trade policies—such as tariffs, quotas, and trade agreements—also have a significant effect on the prices of imported goods. When a country imposes tariffs or taxes on foreign products, it raises the price of those goods for consumers. The cost increases as manufacturers pass along the tariff charges, and this often affects the availability and affordability of products.

Example:

The U.S. implemented a series of tariffs on goods imported from China, particularly on consumer electronics and machinery. These tariffs made products like smartphones, computers, and clothing more expensive. As a result, consumers felt the impact of these price hikes in their daily purchases.

Trade Agreements and Price Stability:

Trade agreements such as NAFTA (now USMCA) and the European Union have helped reduce tariffs and increase the flow of goods, helping keep prices lower than they might otherwise be. These agreements create a competitive environment, which tends to push prices downward and offers consumers a greater variety of goods at lower costs.

Impact on Everyday Consumers:

If you rely on imported goods, any changes to trade policies can directly affect the prices you pay for items such as electronics, clothing, and even food products. Staying informed about changes in trade agreements can help you anticipate price shifts and make more informed buying decisions.

4. Regulatory Policies and Their Impact on Prices

Regulations—ranging from environmental standards to labor laws—can increase the cost of producing goods and services. Companies often pass these costs on to consumers in the form of higher prices. These regulatory changes are designed to protect consumers, workers, and the environment, but they can also have unintended consequences for the prices you pay for everyday items.

Example:

Environmental regulations, such as those requiring companies to reduce carbon emissions, often force businesses to invest in new technology or processes. While this is beneficial for the planet, it may increase production costs, especially in industries like energy, transportation, and manufacturing. The increased costs are then reflected in the prices consumers pay for goods that rely on these industries.

Similarly, labor laws like raising the minimum wage can result in higher operating costs for businesses. To cover these costs, employers may raise the prices of goods and services, particularly in labor-intensive sectors like food service and retail.

Impact on Everyday Consumers:

When businesses face increased regulatory costs, the prices for many common items—like energy, food, and household products—may rise. As a consumer, understanding the regulatory environment can help you prepare for price increases in industries affected by these policies.

The Question: Does Government Spending Drive Inflation?

One common debate in economics is whether government spending is a primary driver of inflation. Many believe that large increases in government spending, especially during economic downturns, can spark inflationary pressures. However, others argue that it’s not the amount of spending itself but the way it’s financed and the economic context in which it occurs.

Government spending can influence inflation, but it depends on factors like the existing level of economic activity, the method of financing, and how much slack there is in the economy. For example, if the economy is operating at full capacity, increased spending is more likely to lead to higher prices. However, if there’s unused capacity (like during a recession), increased government spending might boost economic activity without causing immediate inflationary pressure.

Actionable Tips: How You Can Manage Price Changes

While government policies shape the prices you pay every day, there are several steps you can take to minimize their impact on your budget.

1. Track Price Trends and Adjust Your Budget

Understanding how fiscal and monetary policies affect prices can help you anticipate price hikes and adjust your budget accordingly. Regularly tracking inflation data and price trends can give you a head start in making adjustments to your spending habits.

2. Look for Substitutes and Alternatives

When prices rise on certain goods due to regulatory changes or tariffs, consider switching to less expensive alternatives. For example, if tariffs increase the price of imported electronics, look for domestically manufactured products that may offer similar features at a lower price.

3. Leverage Low-Interest Rates

When interest rates are low, consider refinancing high-interest debt or making large purchases, such as a home or car, while borrowing costs are more affordable. By locking in low rates, you can save money in the long term.

Internal Links:

-

Modern Monetary Theory: Rethinking Economics and Monetary Reform

Link to an article that explains Modern Monetary Theory (MMT), which discusses how fiscal policy impacts the economy and prices. -

Who Really Controls the Money? A Look at Central Banks

This post can tie into how central banks manage monetary policy, including how it impacts inflation and interest rates.

External Links:

-

Federal Reserve – Monetary Policy

This is a trusted government source where readers can learn more about how the Federal Reserve manages monetary policy and its effect on the economy. -

U.S. Department of Commerce – Economic Data

A government site that provides official economic data, including inflation statistics and trends that help explain price changes related to government policies.

Conclusion: Empowering Yourself Against Price Increases

The prices you pay every day are influenced by a wide range of government policies—some of which you have little control over. However, by understanding how these policies work, you can better anticipate price changes, make smarter financial decisions, and protect your purchasing power. Being proactive about adjusting your budget, seeking out alternatives, and staying informed about economic trends can give you a significant advantage in managing the costs that impact your life.

FAQs:

-

How does fiscal policy affect prices?

Fiscal policy, such as government spending and taxation, can either drive demand for goods and services up or down, influencing prices. -

What is the role of monetary policy in shaping prices?

Monetary policy affects interest rates, which influence borrowing and spending. Lower interest rates tend to increase demand and push prices up. -

How do trade tariffs affect consumer prices?

Trade tariffs raise the cost of imported goods, which can lead to higher prices for consumers who buy these items. -

Do regulatory policies always increase prices?

Not always. While some regulations, like environmental laws, can increase production costs, others may lead to innovation that reduces costs over time. -

Can government spending cause inflation?

Increased government spending can lead to inflation, especially when the economy is near full capacity. However, its impact depends on how the spending is financed and the current state of the economy. -

How can I manage price increases in my budget?

Track price trends, adjust your spending, and seek out less expensive alternatives to keep your budget in balance. -

Why do prices change after a government policy is enacted?

Government policies affect supply and demand dynamics, and when demand increases or supply decreases due to new policies, prices are often affected. -

What are some common examples of price increases due to government policy?

Examples include higher gas prices after tax hikes, more expensive consumer goods due to tariffs, and increased healthcare costs due to regulatory changes. -

How does inflation relate to government policy?

Inflation is often driven by fiscal and monetary policies, which can increase the money supply and demand for goods and services. -

Are there ways to protect my money from inflation?

Investing in inflation-resistant assets like real estate or stocks can help protect your wealth from inflationary pressures.

Affiliate Disclosure:

This post may contain affiliate links, meaning we may earn a commission if you make a purchase using our links, at no extra cost to you. We only recommend products and services that we trust.

The Debt Ceiling Drama: A Broken System or Political Theater?

MMT Myths Debunked: Is It Just Printing Money?

AFFILIATE DISCLOSURE:

This article contains affiliate links. We may receive a commission for purchases made through these links, at no extra cost to you. We only recommend products and services we believe will genuinely help you achieve your financial goals.

Discover the truth behind Modern Monetary Theory (MMT) and its misconceptions. Learn how MMT really works and whether it’s truly about printing money. Continue reading as we clarify MMT myths.

Introduction: The Truth About MMT

In recent years, Modern Monetary Theory (MMT) has captured the attention of economists, politicians, and financial experts alike. This economic framework, which challenges traditional views about money creation, government spending, and taxation, has sparked a heated debate. Despite its growing popularity, MMT is often misunderstood, with many people believing that it’s merely a way for governments to print unlimited amounts of money and inflate the economy.

If you’ve ever wondered if MMT really is just a ploy to print money or if it offers a more sustainable way to manage the economy, this post will help you separate fact from fiction. By the end of this article, you’ll have a better understanding of what MMT actually entails and how it might impact both the economy and your personal finances.

Let’s dig into the myths and uncover the truth behind MMT!

What Is Modern Monetary Theory (MMT)?

To understand the myths surrounding MMT, it’s important to first define what it is. MMT is a school of economic thought that argues sovereign governments with their own currency can never run out of money. Unlike households or businesses, which rely on revenue or borrowing, a nation that issues its own currency can create more money to meet its needs.

The key idea behind MMT is that government spending doesn’t have to be constrained by taxes or borrowing. Instead, the government can issue money to finance public projects, programs, or even social safety nets. The theory suggests that the real limit to government spending is inflation—not the availability of funds. MMT argues that as long as inflation is under control, there is no need to worry about budget deficits.

However, this unconventional approach to fiscal policy has sparked intense controversy. Critics claim that MMT could lead to uncontrollable inflation, excessive government intervention, and reckless monetary policies. So, let’s address the myths and see what MMT really advocates.

Myth #1: MMT Is Just About Printing Money

One of the most pervasive myths surrounding MMT is that it’s all about printing money. Critics often claim that MMT advocates for governments to simply create money at will, leading to runaway inflation.

The Truth:

While MMT allows governments to create money, it doesn’t advocate for printing money without limits. Instead, MMT emphasizes that governments can issue money to fund public projects and services, but only if it’s done in a way that doesn’t disrupt the balance of supply and demand in the economy.

In other words, the government can spend to fund programs like infrastructure, education, or healthcare, but it must do so in a way that avoids creating excess demand that exceeds the economy’s capacity to produce goods and services. If too much money is pumped into the economy without a corresponding increase in production, inflation can occur.

Inflation Control in MMT

MMT proponents argue that inflation can be controlled through fiscal tools such as taxation, savings bonds, or other mechanisms to remove money from the economy when necessary. In this way, MMT doesn’t promote endless money printing but instead focuses on using the right mix of monetary and fiscal policies to ensure economic stability.

Takeaway: MMT is not about reckless money printing. It’s about understanding how money is created in a sovereign economy and using fiscal policies to control inflation.

Myth #2: MMT Will Lead to Hyperinflation

The fear of hyperinflation is often invoked when discussing MMT. Critics argue that if governments start printing money freely, it will inevitably lead to uncontrollable inflation, similar to the hyperinflationary crises experienced by countries like Zimbabwe or Venezuela.

The Truth:

While hyperinflation can occur if money is issued without control, MMT doesn’t advocate for unlimited money creation. MMT focuses on managing the economy’s capacity to handle additional spending. Inflation becomes a concern only when the economy reaches full capacity and more money is created without corresponding increases in production. At that point, the central government must step in and use tools like taxes and bonds to control inflation.

In fact, history provides examples of successful government spending without causing hyperinflation. For example, during World War II, the U.S. government issued large amounts of money to finance the war effort, yet inflation remained relatively stable. This was achieved by managing the money supply in a way that was aligned with the productive capacity of the economy.

Takeaway: Hyperinflation is not an automatic consequence of MMT. Inflation can be controlled with proper fiscal management and economic oversight.

Myth #3: MMT Ignores Debt and Deficits

A common criticism of MMT is that it ignores the importance of government debt and budget deficits. Traditional economic thought holds that governments should aim to balance their budgets and avoid accumulating excessive debt. Critics of MMT argue that the theory promotes irresponsible spending and borrowing.

The Truth:

MMT doesn’t ignore debt or deficits. Instead, it offers a different perspective on how we view them. In MMT, national debt is seen more as a tool for managing the economy than something to be feared. According to MMT, the government is the issuer of currency, so it can always repay its debt in its own money. The real constraint on government spending isn’t debt but inflation.

MMT proponents argue that deficits are only problematic when they lead to inflationary pressures. As long as inflation remains under control, government debt is not an immediate concern. In fact, some MMT proponents suggest that deficits can be used strategically to stimulate the economy, especially during times of recession or economic downturn.

Takeaway: MMT redefines the role of debt and deficits, focusing on managing inflation rather than eliminating debt altogether.

Myth #4: MMT Means Unlimited Government Spending

Another widespread myth is that MMT would result in unlimited government spending without any consequences. This misconception arises from the idea that MMT enables governments to spend without having to worry about deficits or debt. Critics argue that this would lead to excessive government intervention and a bloated public sector.

The Truth:

MMT doesn’t suggest unlimited government spending. It stresses that government spending should be aligned with the economy’s capacity to absorb that spending. If the economy is already operating at full capacity, further government spending would lead to inflation, which could undermine the value of money. The real goal of MMT is to ensure that the economy remains in balance, with spending focused on productive investments that improve long-term economic growth.

Furthermore, MMT advocates for the use of fiscal tools like taxation and bond issuance to manage inflation and ensure that the economy does not overheat. This means that while MMT supports increased government spending, it is not without limits.

Takeaway: MMT does not advocate for unlimited spending. It calls for responsible fiscal policies to manage inflation and ensure sustainable economic growth.

Myth #5: MMT Is a Radical or Unproven Theory

Some critics argue that MMT is a radical theory that has never been tested in the real world. They point to the lack of widespread implementation and the theoretical nature of the approach as reasons to dismiss it.

The Truth:

While MMT is relatively new in mainstream economic discourse, its principles are not entirely without precedent. For example, the U.S. government used deficit spending and money creation during World War II to finance the war effort, resulting in significant economic growth without triggering runaway inflation.

Moreover, MMT draws on ideas that have been explored by economists like John Maynard Keynes, who also emphasized the role of government spending in boosting economic activity. MMT proponents argue that the theory provides a modern framework for adapting these ideas to the current economic landscape.

Takeaway: MMT is based on historical examples of government spending and draws on existing economic principles, making it less radical than it may initially seem.

Real-World Applications of MMT

Let’s explore some practical applications of MMT in the real world. How could this theory be implemented to address contemporary issues like income inequality, infrastructure needs, and social safety nets?

-

Infrastructure Investment:

MMT could be used to finance large-scale infrastructure projects, such as rebuilding roads, bridges, and public transportation systems. By issuing money to fund these projects, the government could stimulate economic growth and create jobs without relying on traditional tax revenue. -

Universal Basic Income (UBI):

MMT provides a framework for funding programs like Universal Basic Income (UBI), which guarantees every citizen a certain amount of money each month. By issuing money, the government could provide a safety net for those in need while avoiding the need for traditional taxation. -

Healthcare and Education:

Under MMT, the government could expand access to healthcare and education by issuing money to finance these services. This would allow the government to meet the needs of its citizens without raising taxes or borrowing excessively. -

Full Employment:

MMT advocates for the concept of a “job guarantee,” where the government acts as an employer of last resort, providing jobs to those who are willing and able to work. This would reduce unemployment and create economic stability.

Conclusion: Is MMT the Key to Financial Freedom?

Modern Monetary Theory challenges many of the traditional economic principles that govern how we think about government spending, taxes, and money creation. While MMT has been criticized as a reckless way to print money and create debt, the reality is more nuanced. MMT emphasizes the importance of managing inflation and aligning government spending with the economy’s productive capacity.

Whether or not MMT will become a cornerstone of future economic policy remains to be seen. However, understanding the myths and facts behind this theory is crucial for anyone who wants to make informed decisions about their finances and understand the broader economic context in which these policies are debated.

Takeaway: MMT isn’t about printing money without limits; it’s about using fiscal policies to ensure that government spending promotes economic growth without triggering inflation. Understanding MMT can give you deeper insights into the financial policies that affect your life.

FAQ: Common Questions About MMT

-

What is Modern Monetary Theory (MMT)?

MMT is an economic theory that suggests governments with their own currency can create money to finance spending without relying on taxes or borrowing, as long as inflation is controlled. -

Does MMT mean the government can print unlimited money?

No, MMT advocates for money creation in line with the economy’s productive capacity and inflation control, not unchecked money printing. -

Will MMT lead to hyperinflation?

Hyperinflation can occur if money creation exceeds economic capacity. MMT emphasizes managing inflation through fiscal tools like taxes and savings bonds. -

How does MMT affect taxes?

MMT suggests that taxes are not primarily for revenue but for controlling inflation and ensuring the economy does not overheat. -

Can MMT work in real life?

MMT is based on historical examples of government spending and deficit financing, making it more feasible than critics suggest. -

Does MMT eliminate the need for a balanced budget?

MMT redefines the role of a balanced budget, focusing on inflation control rather than eliminating deficits. -

Could MMT fund universal healthcare or UBI?

Yes, MMT provides a framework for funding social programs like Universal Basic Income or universal healthcare. -

How does MMT relate to the national debt?

In MMT, debt is seen as a tool for managing the economy, not as a source of concern in and of itself. -

Is MMT radical or untested?

While MMT is relatively new, it builds on existing economic principles and has been used successfully in past economic crises. -

How can MMT help with economic recovery?

MMT provides a framework for funding recovery efforts without the usual concerns about budget deficits or debt.

References and Links:

-

Modern Monetary Theory (MMT) – A Primer – Brookings Institution

-

Understanding the Basics of Modern Monetary Theory – Investopedia

Affiliate Disclosure:

Some of the links in this article may be affiliate links, meaning we may earn a small commission at no extra cost to you. We only recommend products and services that we trust and believe will add value to your financial journey.

Recession Warnings and What You Can Actually Do About It

Understand recession warnings, what they mean for you, and actionable steps to protect your finances in uncertain economic times.

Introduction: Recession Warnings – Should You Be Worried?

In today’s economy, the word “recession” often causes panic. Whether it’s the latest news reports about inflation, unemployment rates, or government debt, it’s easy to feel overwhelmed by the idea of an economic downturn. However, while a recession can be a serious concern, there’s a lot you can do to safeguard your financial future.

In this post, we’ll break down the warning signs of a recession, what they mean for your finances, and, most importantly, what practical steps you can take to not just survive but thrive—regardless of what the economy is doing.

What Is a Recession? Understanding the Basics

Before diving into recession warnings, let’s first define what a recession is. A recession is generally characterized as a period of economic decline, often measured by two consecutive quarters of negative GDP growth. Other signs may include rising unemployment, a slowdown in consumer spending, and a drop in business investment.

Common Causes of Recessions

-

High Inflation: When prices rise too quickly, central banks might raise interest rates to curb inflation, which can slow down the economy.

-

Financial Crises: Bank failures or a stock market crash can trigger a recession.

-

Global Events: Natural disasters, pandemics, and geopolitical tensions can all cause economic disruption.

-

Debt Levels: When debt becomes unsustainable, it can lead to an economic collapse.

Recession Warnings: How to Identify Economic Trouble Ahead

Knowing the signs of a recession can give you an edge when it comes to preparing for potential financial challenges. Here are some key recession warnings to keep an eye on:

1. Inverted Yield Curve

The yield curve, which plots the interest rates of bonds of various maturities, is one of the most reliable recession indicators. An inverted yield curve occurs when short-term interest rates are higher than long-term rates, which often signals that investors are pessimistic about the future.

Action Tip: Stay informed by monitoring the yield curve, which is regularly reported in financial news outlets. It can be a signal to reassess your investments.

2. Rising Unemployment Rates

When companies begin to slow hiring or lay off workers, it’s a warning sign that the economy might be in trouble. Rising unemployment typically occurs as companies adjust to slower consumer demand.

Action Tip: If you’re concerned about job security, focus on improving your skills, building a solid professional network, and diversifying your income streams.

3. Declining Consumer Confidence

Consumer confidence is a measure of how optimistic people feel about the economy. A drop in consumer confidence often leads to reduced spending, which can contribute to a recession.

Action Tip: Be mindful of your own spending habits. If you notice that you’re cutting back on discretionary purchases, others may be doing the same.

4. Falling Stock Market

While the stock market is volatile by nature, a prolonged downturn can be a warning that economic conditions are deteriorating.

Action Tip: Consider adjusting your investment strategy. Avoid panic selling and focus on long-term goals, especially if you’re investing for retirement.

5. Declining Business Investment

If companies are cutting back on capital expenditures or postponing expansion plans, it can be a sign that they’re preparing for a slowdown.

Action Tip: Watch the news for reports on corporate earnings and spending trends. If businesses are tightening their belts, it may be wise to review your financial plan.

What Can You Do About It? Practical Steps to Protect Your Finances

While economic downturns are beyond our control, there are proactive steps you can take to protect your finances and even come out stronger. Here’s how:

1. Build an Emergency Fund

One of the most important things you can do during uncertain times is to have cash set aside for emergencies. An emergency fund can cover unexpected expenses like medical bills, car repairs, or job loss.

Actionable Tip: Aim to save at least three to six months’ worth of living expenses in a high-yield savings account. The peace of mind this provides is invaluable.

2. Reduce High-Interest Debt

High-interest debt, such as credit card debt, can quickly spiral out of control during a recession. Focus on paying down high-interest loans to reduce financial stress.

Actionable Tip: Use the debt snowball or debt avalanche method to pay off your debts. Prioritize the highest-interest debts first to save money in the long run.

3. Diversify Your Investments

Diversifying your investments helps minimize risk during economic downturns. A well-balanced portfolio can cushion you against market volatility and help you stay on track with your financial goals.

Actionable Tip: Review your investment portfolio to ensure it’s well-diversified across asset classes (stocks, bonds, real estate, etc.). Consider low-cost index funds or ETFs for broad exposure.

4. Stay Employed – Or Diversify Your Income Streams

If you’re worried about job security, think about ways to make your income more resilient. Whether it’s starting a side hustle, freelancing, or learning new skills, having more than one source of income can protect you during tough times.

Actionable Tip: Identify your strengths and explore freelance opportunities or online businesses that align with your skillset.

5. Cut Back on Unnecessary Spending

When the economy slows down, it’s essential to evaluate your spending habits. Cutting back on unnecessary purchases will help you conserve cash for more important needs.

Actionable Tip: Use budgeting tools like Mint or YNAB to track your expenses and identify areas to reduce spending.

The Controversial Question: Should You Prepare for a Recession?

You may have heard people say that preparing for a recession is just “overreacting” or “paranoid.” But considering the uncertainty of the global economy, it’s better to be prepared than to panic when the signs of a recession become more apparent. By taking proactive steps, you can build financial resilience, regardless of what the economy does.

Conclusion: Taking Charge of Your Financial Future

While it’s easy to feel powerless in the face of economic downturns, the truth is that you have far more control over your financial destiny than you think. By building a solid financial foundation, reducing your debt, diversifying your investments, and focusing on what you can control, you can navigate a recession—or any economic storm—successfully.

FAQs About Recession Warnings and Financial Preparedness

-

What are the signs of a recession?

Recession signs include an inverted yield curve, rising unemployment rates, declining consumer confidence, and falling stock market performance. -

How can I prepare financially for a recession?

Build an emergency fund, reduce high-interest debt, diversify investments, and monitor spending to protect yourself financially. -

Is it better to invest during a recession?

Yes, investing during a recession can offer opportunities to buy assets at lower prices. Focus on long-term growth and diversification. -

Should I pull my money out of the stock market during a recession?

Unless you’re nearing retirement or need immediate cash, it’s generally advisable to stay invested for the long-term and avoid panic selling. -

How does a recession impact my job?

During a recession, layoffs and hiring freezes may occur. To protect yourself, enhance your skills and consider diversifying income streams. -

Is it a good idea to start a business during a recession?

Starting a business can be challenging during a recession, but it can also create opportunities for innovative services and products. -

How do recessions affect interest rates?

During a recession, central banks may lower interest rates to stimulate spending and investment. -

Can I use credit cards during a recession?

You can use credit cards, but it’s essential to pay them off quickly to avoid high-interest charges and build your emergency fund. -

How does a recession affect housing markets?

Recessions may lead to reduced demand in housing, lower property prices, and mortgage rate changes. -

Is it safe to invest in real estate during a recession?

Real estate can still be a good investment during a recession, but it’s important to evaluate the market and location carefully.

Affiliate Disclosure:

Some of the links in this article may be affiliate links, meaning we may earn a small commission at no extra cost to you. We only recommend products and services that we trust and believe will add value to your financial journey.

This comprehensive guide empowers readers to understand recession warnings and take actionable steps to protect their finances.