Connecting the Dots (Bridge Content)

Inflation vs Wage Growth: Are You Falling Behind?

Inflation and wage growth are at odds in today’s economy. Learn how rising prices affect your earnings and what you can do to stay ahead financially.

AFFILIATE DISCLOSURE:

This article contains affiliate links. We may receive a commission for purchases made through these links, at no extra cost to you. We only recommend products and services we believe will genuinely help you achieve your financial goals.

Introduction: The Battle Between Inflation vs Wage Growth

In recent years, many individuals have noticed something unsettling: their paycheck doesn’t seem to stretch as far as it once did. Whether it’s the rising cost of groceries, gasoline, or housing, prices are climbing faster than the pay raises many workers receive. This phenomenon has left millions wondering: are we falling behind in the fight between inflation and wage growth?

As inflation continues to rise, it erodes purchasing power—meaning the same amount of money buys fewer goods and services. On the other hand, wage growth has been sluggish, and many workers have seen their salaries barely keep up with the rising costs of living. In this post, we’ll break down the relationship between inflation and wage growth, how it affects you, and what you can do to stay financially strong in the face of these challenges.

Understanding Inflation and Wage Growth

What Is Inflation?

Inflation is the rate at which the general level of prices for goods and services rises, eroding purchasing power. It means that the money you earn today will buy less than it did a year ago. In the U.S., inflation is often measured by the Consumer Price Index (CPI), which tracks the cost of a basket of goods and services over time. A high inflation rate means a significant increase in prices, while a low rate means prices are rising slowly or not at all.

As of 2023, the CPI showed inflation at approximately 6.5%, an alarming rate compared to historical averages. This marked a sharp increase from the relatively low inflation rates seen in the previous decade. Inflation affects virtually every aspect of the economy, from the cost of everyday necessities to long-term investments and savings. It’s a crucial indicator to track, especially when compared to your wage growth. Learn more at Investopedia – What is the Consumer Price Index (CPI) and Federal Reserve – Inflation

What Is Wage Growth?

Wage growth refers to the rate at which wages or salaries increase over time. Ideally, wages should rise in tandem with inflation, allowing workers to maintain their purchasing power. However, if wage growth lags behind inflation, workers experience a reduction in their real income—what they can actually afford to buy.

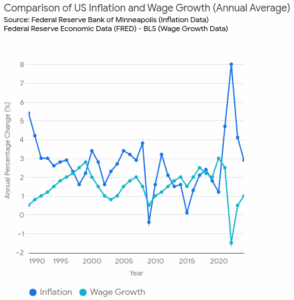

In the U.S., wage growth has been relatively sluggish in recent years, especially when compared to the rising costs of living. For instance, in 2023, the average wage growth rate was approximately 4.5%, whereas inflation was pushing around 6.5%. This means that for many workers, their real income was effectively shrinking, making it harder to cover expenses and save for future goals.

Why Is This Relationship Important?

The interaction between inflation and wage growth is critical because it directly impacts your financial wellbeing. If inflation outpaces wage growth, it can lead to a decrease in your standard of living. Simply put: if your wages don’t grow as quickly as the cost of living, you’re effectively losing money.

Inflation vs Wage Growth: A Closer Look

How Inflation Affects Your Purchasing Power

When inflation increases, the prices of everyday goods and services—such as food, gas, and rent—go up. This can create a significant financial strain, especially for individuals living paycheck to paycheck. If your wage increase doesn’t match the pace of inflation, you may find yourself unable to afford the same things you did the previous year.

For example, in 2023, U.S. inflation was reported at around 6.5%, while average wage growth hovered closer to 4.5%. That’s a significant gap, and it means workers are not keeping up with rising costs.

For instance, grocery prices have risen dramatically, with food prices increasing by 8-10% in some sectors over the last year. This means that for families, the cost of a typical grocery bill can be hundreds of dollars higher annually, creating a strain on their finances. Additionally, higher gasoline prices and housing costs are making it even more difficult for individuals to make ends meet.

The Impact on Savings and Retirement

Inflation doesn’t just affect your day-to-day spending; it can also impact your long-term financial goals. For instance, inflation erodes the value of your savings. If your savings account yields a 1% return, but inflation is 4%, you’re effectively losing money in real terms. The purchasing power of your nest egg is shrinking, making it harder to save for retirement, a home, or your children’s education.

Inflation also impacts the value of fixed-income investments, like bonds. While bonds can offer a steady stream of income, inflation can erode the purchasing power of those payments, reducing the returns investors get over time.

Are You Falling Behind? How to Know If Inflation is Outpacing Your Wage Growth

Understanding the Numbers

To truly understand whether you’re falling behind in the inflation vs wage growth battle, it’s essential to track both metrics. You need to ask yourself: Is my wage increase enough to cover rising prices?

Here’s how you can evaluate your situation:

-

Compare your salary increase to the inflation rate: If your wages are increasing by 3% annually, but inflation is 6%, your real purchasing power is decreasing.

-

Track your spending: Keep a close eye on rising costs in categories such as food, housing, and transportation. If these prices are increasing faster than your wage, it’s time to reconsider your budget or look for ways to increase your income.

-

Focus on long-term financial goals: If your salary is stagnant, focus on building wealth through other means such as investments or starting a side business to make up for lost purchasing power.

Actionable Tips: How to Stay Ahead of Inflation

1. Negotiate Your Salary

If you’re concerned that your wage growth isn’t keeping up with inflation, the first step is to ask for a raise. Many employers are open to negotiating salaries, especially if you can demonstrate your value to the company. Here are a few strategies to increase your chances:

-

Do your research: Use tools like Glassdoor and Payscale to find out the average salary for your position in your area.

-

Prepare your case: Be ready to explain your accomplishments and how they have benefited the company.

-

Show the market rate: If your current pay is lower than the market average, use this information to strengthen your argument.

2. Invest to Combat Inflation

One of the best ways to protect yourself from inflation is by investing. Inflation erodes the value of cash, but investments—especially in assets like stocks, real estate, and bonds—tend to outpace inflation over the long term. Here are a few investment options to consider:

-

Stocks and ETFs: Historically, the stock market has provided returns that outpace inflation.

-

Real estate: Property values generally increase with inflation, providing a hedge against rising prices.

-

Precious metals: Gold and silver are often seen as safe havens during times of high inflation.

3. Reduce Your Expenses

If your salary isn’t keeping up with inflation, reducing your expenses can help you maintain your financial stability. Here are a few strategies:

-

Cut discretionary spending: Consider reducing costs on things like dining out, entertainment, and subscriptions.

-

Shop smarter: Use coupons, look for sales, and buy in bulk to save on everyday expenses.

-

Refinance loans: Lower your interest rates on mortgages, student loans, and credit cards to free up more cash.

4. Diversify Your Income

Building multiple streams of income can provide financial resilience when inflation erodes the value of your paycheck. Here are some ideas:

-

Start a side business: Whether it’s freelance work, selling handmade goods, or offering services, a side business can boost your income.

-

Invest in dividend-paying stocks: These stocks provide a steady stream of passive income.

-

Rent out property: If you have an extra room or property, consider renting it out for additional income.

Internal Links & Resources

-

Who Really Controls the Money? A Look at Central Banks: Understanding how central banks influence the economy and wage growth.

-

The Debt Myth: Why Government Borrowing Isn’t Like a Household Budget: A breakdown of how government spending and monetary policy can affect inflation and wages.

Conclusion: How to Protect Yourself from Falling Behind

As inflation continues to outpace wage growth, it’s crucial to take proactive steps to safeguard your financial future. By negotiating your salary, investing wisely, reducing expenses, and diversifying your income, you can stay ahead of the curve and maintain your purchasing power. While the economic landscape may seem daunting, there are plenty of opportunities to adapt and thrive financially.

Frequently Asked Questions

-

How does inflation affect my daily expenses?

Inflation raises the cost of everyday goods and services, making it harder to maintain your standard of living. -

Can I keep up with inflation through wage growth alone?

It’s possible, but it requires constant wage increases that match or exceed inflation. In practice, this can be difficult. -

What’s the best way to protect my savings from inflation?

Invest in assets like stocks, bonds, or real estate that historically outperform inflation. -

How can I measure if my wage growth is enough?

Compare your annual salary increase to the inflation rate to see if you’re maintaining or losing purchasing power. -

Is there a specific industry where wages grow faster than inflation?

Technology and healthcare industries often see faster-than-average wage growth. -

What happens if I don’t adjust my financial plan during inflation?

You may find it more difficult to meet financial goals like saving for retirement or buying a home. -

Are there any government programs to help with inflation?

Programs like Social Security adjustments and certain tax credits may provide relief, but they often don’t keep pace with inflation. -

Should I focus on cutting expenses or increasing income?

A balance of both is ideal, but diversifying your income streams can be more sustainable long-term. -

What’s the best investment to hedge against inflation?

Stocks, real estate, and precious metals are common inflation hedges. -

How can I negotiate a raise to match inflation?

Do research on market rates for your role and present evidence of your contributions and achievements.

Affiliate Disclosure

Affiliate Link Disclosure: TheMoneyQuestion.org may earn a small commission if you make a purchase through one of the links in this article. However, we only recommend products and services that we believe will add value to your financial journey.

Content Disclaimer: The information in this article is for informational purposes only and is not intended to substitute for the advice of a licensed or certified attorney, accountant, financial advisor, or other certified financial professionals. Always seek professional advice before making financial decisions.

Disclosure: This post may contain affiliate links. If you click through and make a purchase, The Money Question may earn a small commission at no additional cost to you. We only recommend products and services we genuinely believe in. See our full disclaimer for details.

What Crypto Hype Means For Everyday Investors

How Interest Rates Actually Work (and Who They Benefit)

AFFILIATE DISCLOSURE:

This article contains affiliate links. We may receive a commission for purchases made through these links, at no extra cost to you. We only recommend products and services we believe will genuinely help you achieve your financial goals.

Understand how interest rates work, who they benefit, and how they impact your financial life in this easy-to-understand guide.

Introduction: Interest Rates Unpacked – The Key to Your Financial World

Interest rates are a fundamental part of financial conversations, but their impact on your daily life often goes unnoticed. Whether you’re buying a home, taking out a loan, investing in savings accounts, or simply managing debt, interest rates shape your financial reality. But how exactly do they work, and more importantly, who stands to benefit from them?

In this comprehensive guide, we’ll explore the mechanics of interest rates, how they are set, and most importantly, who benefits when they rise or fall. By the end of this article, you’ll have a clear understanding of how interest rates work and how you can use that knowledge to improve your financial decisions. Let’s dive into the world of interest rates!

What Are Interest Rates? A Simple Definition

In simple terms, an interest rate is the price of borrowing money, or the return on money you invest. It is expressed as a percentage of the loan amount or deposit. When you borrow money, the lender charges you an interest rate for the privilege of using their funds. Conversely, when you lend money (by depositing funds in a savings account or purchasing bonds), you earn interest as a return.

Types of Interest Rates:

-

Fixed Interest Rates: These remain the same for the entire loan term, providing predictability in monthly payments.

-

Variable Interest Rates: These fluctuate based on market conditions and may change during the term of the loan.

-

Nominal Interest Rates: The stated rate, without factoring in inflation.

-

Real Interest Rates: Adjusted for inflation, representing the true cost or benefit of borrowing or lending.

How Do Interest Rates Affect Your Finances?

Interest rates have a wide-ranging impact on personal finance. Whether you’re borrowing money, saving it, or investing, the rate applied to your financial products directly affects how much you pay or earn.

1. Borrowing Costs:

-

Mortgages and Car Loans: If you’re purchasing a home or car, a lower interest rate will reduce your monthly payments and the total amount you pay over the life of the loan. Conversely, higher interest rates make these loans more expensive.

-

Credit Cards and Personal Loans: Interest rates are often higher for credit cards and personal loans. This means borrowing on these terms can quickly accumulate debt if not paid off promptly.

2. Savings and Investments:

-

Savings Accounts and Certificates of Deposit (CDs): When interest rates rise, the returns on savings accounts, money market accounts, and CDs tend to increase, offering savers better rewards for holding their money in these products.

-

Bonds: If interest rates go up, the price of existing bonds tends to fall. New bonds are issued with higher yields, which can make older, lower-yielding bonds less attractive to investors.

3. The Economy:

-

Central Bank Decisions: Central banks, such as the Federal Reserve in the U.S., play a significant role in determining interest rates. By raising or lowering rates, they aim to control inflation and stimulate or slow down economic growth.

Who Benefits from High or Low Interest Rates?

Understanding who stands to gain from high or low interest rates is essential in knowing how they affect your finances.

1. Borrowers:

-

Low Interest Rates: When interest rates are low, borrowing is cheaper. This benefits individuals and businesses that need loans for homes, cars, or other ventures. You will pay less in interest, and the total cost of the loan decreases.

-

High Interest Rates: High interest rates can be a significant burden on borrowers. Monthly payments on loans and credit cards increase, making it harder for consumers to manage debt.

2. Savers and Investors:

-

Low Interest Rates: For savers, low interest rates mean lower returns on savings accounts and fixed-income investments like bonds. This can be frustrating, especially if you rely on interest income for financial security.

-

High Interest Rates: Savers and conservative investors benefit from high interest rates. Your savings grow faster, and fixed-income investments such as bonds or CDs offer more attractive returns.

3. Financial Institutions:

-

Low Interest Rates: Banks and financial institutions typically face a reduced margin between the interest they charge borrowers and the interest they pay on deposits when interest rates are low.

-

High Interest Rates: On the other hand, banks tend to benefit from higher interest rates, as they can charge more for loans and offer more favorable terms on their financial products.

How Do Central Banks Set Interest Rates?

Interest rates are not solely determined by market forces. Central banks, like the Federal Reserve in the U.S., have significant influence over short-term interest rates. Central banks set a benchmark interest rate, such as the Federal Funds Rate, which is the rate at which commercial banks lend to each other. This rate impacts everything from mortgages to business loans to credit card interest.

Why Do Central Banks Raise or Lower Rates?

-

To Control Inflation: Central banks raise interest rates when inflation is too high. Higher rates reduce borrowing and spending, cooling off the economy and helping keep inflation in check.

-

To Stimulate Growth: During times of economic downturn, central banks may lower interest rates to encourage borrowing and investment, boosting spending and job creation.

The Federal Reserve’s decisions have wide-reaching implications for the financial markets and individual borrowers. For example, the Federal Reserve’s actions during the 2008 financial crisis and the COVID-19 pandemic demonstrate how interest rates can be used to stabilize the economy by making borrowing cheaper for businesses and consumers.

External Link: Federal Reserve – Interest Rates – Learn about the Federal Reserve’s policies on setting interest rates and their impact on the economy.

How Do Interest Rates Impact the Stock Market?

Interest rates also play a crucial role in the stock market. While stocks are often seen as an investment that yields capital gains, they can also be sensitive to interest rate changes.

-

Rising Interest Rates: When interest rates rise, it becomes more expensive for companies to borrow money, and consumer spending may decrease. As a result, company profits can decline, leading to lower stock prices. Investors may shift their investments into bonds or other fixed-income products that offer more favorable returns.

-

Falling Interest Rates: Conversely, lower interest rates make borrowing cheaper for businesses and consumers, encouraging spending and investment. This can boost profits for companies, leading to higher stock prices.

Interest rates are often seen as a barometer of economic health. During times of low rates, investors may be more willing to take on risk by investing in stocks. However, higher rates often push investors toward safer assets, like bonds.

External Link: Investopedia – How Interest Rates Affect the Stock Market – Learn how interest rates influence the stock market and the broader economy.

Trending Question: Why Are Interest Rates So Low During Economic Crises?

It’s common to see interest rates drop during economic crises, such as the 2008 financial crisis or the 2020 COVID-19 pandemic. You might wonder why central banks lower rates in such times.

Answer:

During times of economic crisis, central banks typically lower interest rates to stimulate the economy. The goal is to make borrowing cheaper for businesses and consumers, encouraging investment, spending, and job creation. By reducing the cost of borrowing, central banks hope to keep the economy from slipping into a deeper recession.

In times of crisis, lower interest rates can provide businesses with the liquidity needed to survive and continue operations, and consumers may be more likely to purchase homes or take out loans for essential expenses.

How to Use Interest Rates to Your Advantage

Understanding interest rates allows you to make smarter financial decisions. Here are some strategies for navigating interest rates in your personal finances:

1. Shop Around for Loans and Credit Cards:

-

Always compare interest rates before committing to a loan or credit card. Even a small difference in the rate can save you hundreds or thousands of dollars in the long run.

2. Refinance High-Interest Loans:

-

If you have existing loans with high interest rates, consider refinancing them to lower rates. This can reduce your monthly payments and help you pay off your debt faster.

3. Pay Off Debt Faster:

-

If interest rates are high on your credit card or personal loans, try to pay them off as quickly as possible. Paying down debt faster reduces the amount of interest you pay overall.

4. Maximize Your Savings During High-Interest Periods:

-

When interest rates rise, consider moving your savings into high-yield savings accounts, CDs, or bonds to earn a higher return.

5. Keep an Eye on Central Bank Announcements:

-

Stay informed about central bank decisions, as these can signal changes in the interest rate environment. Understanding these shifts can help you make better decisions on loans, investments, and savings.

Conclusion: Mastering Interest Rates to Improve Your Financial Life

Interest rates play a crucial role in your financial life, impacting everything from how much you pay for loans to how much you earn on your savings. By understanding how interest rates work and how they are influenced by central banks, you can make more informed financial decisions. Whether you’re borrowing money, saving for the future, or investing in the stock market, mastering interest rates is a key to achieving your financial goals.

FAQ: Everything You Need to Know About Interest Rates

-

What is the difference between a fixed and variable interest rate?

-

A fixed rate stays the same throughout the loan term, while a variable rate changes based on market conditions.

-

-

How do interest rates affect my credit score?

-

Interest rates themselves don’t directly impact your credit score, but high-interest debt that’s not managed well can hurt your score.

-

-

How do interest rates affect inflation?

-

Higher interest rates reduce borrowing and spending, which helps keep inflation in check. Lower rates encourage spending, which can increase inflation.

-

-

What is a good interest rate for a mortgage?

-

A good mortgage rate depends on your credit score, the loan term, and market conditions. Lower rates are generally better.

-

-

What happens if interest rates rise after I take out a fixed-rate loan?

-

Your loan’s rate remains unchanged, but the cost of borrowing for new loans will be higher for others.

-

-

Should I wait for lower interest rates to buy a house?

-

If rates are rising, it may be wise to act sooner. However, it’s always essential to consider your financial readiness.

-

-

Can I negotiate my interest rate on loans?

-

Yes, many lenders are open to negotiation, especially if you have a good credit score.

-

-

Why do interest rates matter for personal finance?

-

Interest rates affect everything from how much you pay for loans to how much your savings will grow.

-

-

How often do interest rates change?

-

Interest rates can change frequently based on central bank policies and economic conditions.

-

-

How do interest rates affect the stock market?

-

Rising rates can hurt stocks, while falling rates may boost them.

Affiliate Disclosure

This article may contain affiliate links. If you click on a link and make a purchase, we may earn a small commission at no extra cost to you. This helps support our mission to provide valuable, free content. Thank you for your support!

How Government Policy Shapes the Prices You Pay Every Day

AFFILIATE DISCLOSURE:

This article contains affiliate links. We may receive a commission for purchases made through these links, at no extra cost to you. We only recommend products and services we believe will genuinely help you achieve your financial goals.

Learn how government policies influence the prices of everyday goods and services. Understand the economic forces shaping your spending.

Introduction

Do you ever wonder why the prices of everyday items, from groceries to gas, seem to fluctuate unexpectedly? It may seem like these price changes happen randomly, but they are often the direct result of government policies. Whether it’s through taxation, regulations, or monetary decisions, policies made at the national and global level significantly impact the prices you pay for goods and services.

Understanding the interplay between government policies and prices is crucial to managing your personal finances. It helps you become a more informed consumer and empowers you to make decisions that protect your purchasing power. In this article, we’ll dive deep into how different policies—both economic and monetary—shape the costs of goods and services. We’ll explore how fiscal and monetary policies, trade regulations, and other governmental decisions affect everything from the cost of your morning coffee to the price of your monthly rent. By the end, you’ll have a clearer picture of why things cost what they do and how you can navigate these changes effectively.

How Government Policy Impacts Prices

Government policies play a critical role in determining the prices you pay for almost everything. From taxes to trade tariffs, regulations to subsidies, the actions of policymakers can either drive prices up or keep them lower than they might otherwise be.

1. Fiscal Policy and Its Role in Prices

Fiscal policy refers to the use of government spending and taxation to influence the economy. When the government spends more money, it typically increases the demand for goods and services, which can drive up prices. This increase in demand is particularly noticeable when the economy is already running at or near full capacity. Similarly, higher taxes can reduce consumers’ disposable income and decrease demand, potentially reducing inflationary pressure.

Example:

When governments enact stimulus packages, like the ones seen during the COVID-19 pandemic, they inject more money into the economy. While this helps people and businesses weather economic downturns, it can also drive up the cost of goods and services as demand outpaces supply. For instance, the government sent direct payments to individuals, which resulted in people spending more on consumer goods, thus raising prices in some sectors.

Impact on Everyday Consumers:

If the government increases its spending on infrastructure or social programs, businesses may raise prices to keep up with increased demand for their products or services. This could be reflected in higher costs for everyday items, such as food, gas, and even housing.

2. Monetary Policy and Inflation

Monetary policy is managed by a country’s central bank (e.g., the U.S. Federal Reserve), and it affects the prices of goods and services by controlling the money supply and interest rates. Central banks use monetary policy to achieve stable prices, full employment, and moderate long-term interest rates. They do this by adjusting interest rates, which in turn affects the cost of borrowing.

How It Works:

-

Lowering interest rates makes borrowing cheaper for businesses and consumers, which encourages spending and investment. This increased demand can cause inflation, or rising prices, especially in industries like housing and automobiles.

-

Raising interest rates makes borrowing more expensive and slows down consumer spending. This can help control inflation but might also slow economic growth.

Example:

In 2020, the Federal Reserve slashed interest rates to near-zero levels to stimulate spending and help the economy recover from the pandemic’s impact. While this decision was critical for economic recovery, it also contributed to rising prices in certain sectors, like real estate, as more people took advantage of low mortgage rates.

Impact on Everyday Consumers:

When interest rates are low, many people may take out loans to buy homes, cars, or even invest in businesses. Increased demand from these activities leads to higher prices in the housing market and automotive industries. If you’re looking to make a large purchase or refinance debt, understanding the state of monetary policy can help you time your financial decisions effectively.

3. Trade Policies and Their Effect on Prices

Government trade policies—such as tariffs, quotas, and trade agreements—also have a significant effect on the prices of imported goods. When a country imposes tariffs or taxes on foreign products, it raises the price of those goods for consumers. The cost increases as manufacturers pass along the tariff charges, and this often affects the availability and affordability of products.

Example:

The U.S. implemented a series of tariffs on goods imported from China, particularly on consumer electronics and machinery. These tariffs made products like smartphones, computers, and clothing more expensive. As a result, consumers felt the impact of these price hikes in their daily purchases.

Trade Agreements and Price Stability:

Trade agreements such as NAFTA (now USMCA) and the European Union have helped reduce tariffs and increase the flow of goods, helping keep prices lower than they might otherwise be. These agreements create a competitive environment, which tends to push prices downward and offers consumers a greater variety of goods at lower costs.

Impact on Everyday Consumers:

If you rely on imported goods, any changes to trade policies can directly affect the prices you pay for items such as electronics, clothing, and even food products. Staying informed about changes in trade agreements can help you anticipate price shifts and make more informed buying decisions.

4. Regulatory Policies and Their Impact on Prices

Regulations—ranging from environmental standards to labor laws—can increase the cost of producing goods and services. Companies often pass these costs on to consumers in the form of higher prices. These regulatory changes are designed to protect consumers, workers, and the environment, but they can also have unintended consequences for the prices you pay for everyday items.

Example:

Environmental regulations, such as those requiring companies to reduce carbon emissions, often force businesses to invest in new technology or processes. While this is beneficial for the planet, it may increase production costs, especially in industries like energy, transportation, and manufacturing. The increased costs are then reflected in the prices consumers pay for goods that rely on these industries.

Similarly, labor laws like raising the minimum wage can result in higher operating costs for businesses. To cover these costs, employers may raise the prices of goods and services, particularly in labor-intensive sectors like food service and retail.

Impact on Everyday Consumers:

When businesses face increased regulatory costs, the prices for many common items—like energy, food, and household products—may rise. As a consumer, understanding the regulatory environment can help you prepare for price increases in industries affected by these policies.

The Question: Does Government Spending Drive Inflation?

One common debate in economics is whether government spending is a primary driver of inflation. Many believe that large increases in government spending, especially during economic downturns, can spark inflationary pressures. However, others argue that it’s not the amount of spending itself but the way it’s financed and the economic context in which it occurs.

Government spending can influence inflation, but it depends on factors like the existing level of economic activity, the method of financing, and how much slack there is in the economy. For example, if the economy is operating at full capacity, increased spending is more likely to lead to higher prices. However, if there’s unused capacity (like during a recession), increased government spending might boost economic activity without causing immediate inflationary pressure.

Actionable Tips: How You Can Manage Price Changes

While government policies shape the prices you pay every day, there are several steps you can take to minimize their impact on your budget.

1. Track Price Trends and Adjust Your Budget

Understanding how fiscal and monetary policies affect prices can help you anticipate price hikes and adjust your budget accordingly. Regularly tracking inflation data and price trends can give you a head start in making adjustments to your spending habits.

2. Look for Substitutes and Alternatives

When prices rise on certain goods due to regulatory changes or tariffs, consider switching to less expensive alternatives. For example, if tariffs increase the price of imported electronics, look for domestically manufactured products that may offer similar features at a lower price.

3. Leverage Low-Interest Rates

When interest rates are low, consider refinancing high-interest debt or making large purchases, such as a home or car, while borrowing costs are more affordable. By locking in low rates, you can save money in the long term.

Internal Links:

-

Modern Monetary Theory: Rethinking Economics and Monetary Reform

Link to an article that explains Modern Monetary Theory (MMT), which discusses how fiscal policy impacts the economy and prices. -

Who Really Controls the Money? A Look at Central Banks

This post can tie into how central banks manage monetary policy, including how it impacts inflation and interest rates.

External Links:

-

Federal Reserve – Monetary Policy

This is a trusted government source where readers can learn more about how the Federal Reserve manages monetary policy and its effect on the economy. -

U.S. Department of Commerce – Economic Data

A government site that provides official economic data, including inflation statistics and trends that help explain price changes related to government policies.

Conclusion: Empowering Yourself Against Price Increases

The prices you pay every day are influenced by a wide range of government policies—some of which you have little control over. However, by understanding how these policies work, you can better anticipate price changes, make smarter financial decisions, and protect your purchasing power. Being proactive about adjusting your budget, seeking out alternatives, and staying informed about economic trends can give you a significant advantage in managing the costs that impact your life.

FAQs:

-

How does fiscal policy affect prices?

Fiscal policy, such as government spending and taxation, can either drive demand for goods and services up or down, influencing prices. -

What is the role of monetary policy in shaping prices?

Monetary policy affects interest rates, which influence borrowing and spending. Lower interest rates tend to increase demand and push prices up. -

How do trade tariffs affect consumer prices?

Trade tariffs raise the cost of imported goods, which can lead to higher prices for consumers who buy these items. -

Do regulatory policies always increase prices?

Not always. While some regulations, like environmental laws, can increase production costs, others may lead to innovation that reduces costs over time. -

Can government spending cause inflation?

Increased government spending can lead to inflation, especially when the economy is near full capacity. However, its impact depends on how the spending is financed and the current state of the economy. -

How can I manage price increases in my budget?

Track price trends, adjust your spending, and seek out less expensive alternatives to keep your budget in balance. -

Why do prices change after a government policy is enacted?

Government policies affect supply and demand dynamics, and when demand increases or supply decreases due to new policies, prices are often affected. -

What are some common examples of price increases due to government policy?

Examples include higher gas prices after tax hikes, more expensive consumer goods due to tariffs, and increased healthcare costs due to regulatory changes. -

How does inflation relate to government policy?

Inflation is often driven by fiscal and monetary policies, which can increase the money supply and demand for goods and services. -

Are there ways to protect my money from inflation?

Investing in inflation-resistant assets like real estate or stocks can help protect your wealth from inflationary pressures.

Affiliate Disclosure:

This post may contain affiliate links, meaning we may earn a commission if you make a purchase using our links, at no extra cost to you. We only recommend products and services that we trust.

Recession Warnings and What You Can Actually Do About It

Understand recession warnings, what they mean for you, and actionable steps to protect your finances in uncertain economic times.

Introduction: Recession Warnings – Should You Be Worried?

In today’s economy, the word “recession” often causes panic. Whether it’s the latest news reports about inflation, unemployment rates, or government debt, it’s easy to feel overwhelmed by the idea of an economic downturn. However, while a recession can be a serious concern, there’s a lot you can do to safeguard your financial future.

In this post, we’ll break down the warning signs of a recession, what they mean for your finances, and, most importantly, what practical steps you can take to not just survive but thrive—regardless of what the economy is doing.

What Is a Recession? Understanding the Basics

Before diving into recession warnings, let’s first define what a recession is. A recession is generally characterized as a period of economic decline, often measured by two consecutive quarters of negative GDP growth. Other signs may include rising unemployment, a slowdown in consumer spending, and a drop in business investment.

Common Causes of Recessions

-

High Inflation: When prices rise too quickly, central banks might raise interest rates to curb inflation, which can slow down the economy.

-

Financial Crises: Bank failures or a stock market crash can trigger a recession.

-

Global Events: Natural disasters, pandemics, and geopolitical tensions can all cause economic disruption.

-

Debt Levels: When debt becomes unsustainable, it can lead to an economic collapse.

Recession Warnings: How to Identify Economic Trouble Ahead

Knowing the signs of a recession can give you an edge when it comes to preparing for potential financial challenges. Here are some key recession warnings to keep an eye on:

1. Inverted Yield Curve

The yield curve, which plots the interest rates of bonds of various maturities, is one of the most reliable recession indicators. An inverted yield curve occurs when short-term interest rates are higher than long-term rates, which often signals that investors are pessimistic about the future.

Action Tip: Stay informed by monitoring the yield curve, which is regularly reported in financial news outlets. It can be a signal to reassess your investments.

2. Rising Unemployment Rates

When companies begin to slow hiring or lay off workers, it’s a warning sign that the economy might be in trouble. Rising unemployment typically occurs as companies adjust to slower consumer demand.

Action Tip: If you’re concerned about job security, focus on improving your skills, building a solid professional network, and diversifying your income streams.

3. Declining Consumer Confidence

Consumer confidence is a measure of how optimistic people feel about the economy. A drop in consumer confidence often leads to reduced spending, which can contribute to a recession.

Action Tip: Be mindful of your own spending habits. If you notice that you’re cutting back on discretionary purchases, others may be doing the same.

4. Falling Stock Market

While the stock market is volatile by nature, a prolonged downturn can be a warning that economic conditions are deteriorating.

Action Tip: Consider adjusting your investment strategy. Avoid panic selling and focus on long-term goals, especially if you’re investing for retirement.

5. Declining Business Investment

If companies are cutting back on capital expenditures or postponing expansion plans, it can be a sign that they’re preparing for a slowdown.

Action Tip: Watch the news for reports on corporate earnings and spending trends. If businesses are tightening their belts, it may be wise to review your financial plan.

What Can You Do About It? Practical Steps to Protect Your Finances

While economic downturns are beyond our control, there are proactive steps you can take to protect your finances and even come out stronger. Here’s how:

1. Build an Emergency Fund

One of the most important things you can do during uncertain times is to have cash set aside for emergencies. An emergency fund can cover unexpected expenses like medical bills, car repairs, or job loss.

Actionable Tip: Aim to save at least three to six months’ worth of living expenses in a high-yield savings account. The peace of mind this provides is invaluable.

2. Reduce High-Interest Debt

High-interest debt, such as credit card debt, can quickly spiral out of control during a recession. Focus on paying down high-interest loans to reduce financial stress.

Actionable Tip: Use the debt snowball or debt avalanche method to pay off your debts. Prioritize the highest-interest debts first to save money in the long run.

3. Diversify Your Investments

Diversifying your investments helps minimize risk during economic downturns. A well-balanced portfolio can cushion you against market volatility and help you stay on track with your financial goals.

Actionable Tip: Review your investment portfolio to ensure it’s well-diversified across asset classes (stocks, bonds, real estate, etc.). Consider low-cost index funds or ETFs for broad exposure.

4. Stay Employed – Or Diversify Your Income Streams

If you’re worried about job security, think about ways to make your income more resilient. Whether it’s starting a side hustle, freelancing, or learning new skills, having more than one source of income can protect you during tough times.

Actionable Tip: Identify your strengths and explore freelance opportunities or online businesses that align with your skillset.

5. Cut Back on Unnecessary Spending

When the economy slows down, it’s essential to evaluate your spending habits. Cutting back on unnecessary purchases will help you conserve cash for more important needs.

Actionable Tip: Use budgeting tools like Mint or YNAB to track your expenses and identify areas to reduce spending.

The Controversial Question: Should You Prepare for a Recession?

You may have heard people say that preparing for a recession is just “overreacting” or “paranoid.” But considering the uncertainty of the global economy, it’s better to be prepared than to panic when the signs of a recession become more apparent. By taking proactive steps, you can build financial resilience, regardless of what the economy does.

Conclusion: Taking Charge of Your Financial Future

While it’s easy to feel powerless in the face of economic downturns, the truth is that you have far more control over your financial destiny than you think. By building a solid financial foundation, reducing your debt, diversifying your investments, and focusing on what you can control, you can navigate a recession—or any economic storm—successfully.

FAQs About Recession Warnings and Financial Preparedness

-

What are the signs of a recession?

Recession signs include an inverted yield curve, rising unemployment rates, declining consumer confidence, and falling stock market performance. -

How can I prepare financially for a recession?

Build an emergency fund, reduce high-interest debt, diversify investments, and monitor spending to protect yourself financially. -

Is it better to invest during a recession?

Yes, investing during a recession can offer opportunities to buy assets at lower prices. Focus on long-term growth and diversification. -

Should I pull my money out of the stock market during a recession?

Unless you’re nearing retirement or need immediate cash, it’s generally advisable to stay invested for the long-term and avoid panic selling. -

How does a recession impact my job?

During a recession, layoffs and hiring freezes may occur. To protect yourself, enhance your skills and consider diversifying income streams. -

Is it a good idea to start a business during a recession?

Starting a business can be challenging during a recession, but it can also create opportunities for innovative services and products. -

How do recessions affect interest rates?

During a recession, central banks may lower interest rates to stimulate spending and investment. -

Can I use credit cards during a recession?

You can use credit cards, but it’s essential to pay them off quickly to avoid high-interest charges and build your emergency fund. -

How does a recession affect housing markets?

Recessions may lead to reduced demand in housing, lower property prices, and mortgage rate changes. -

Is it safe to invest in real estate during a recession?

Real estate can still be a good investment during a recession, but it’s important to evaluate the market and location carefully.

Affiliate Disclosure:

Some of the links in this article may be affiliate links, meaning we may earn a small commission at no extra cost to you. We only recommend products and services that we trust and believe will add value to your financial journey.

This comprehensive guide empowers readers to understand recession warnings and take actionable steps to protect their finances.

Why Inflation Feels Worse Than the Numbers Say

AFFILIATE DISCLOSURE:

This article contains affiliate links. We may receive a commission for purchases made through these links, at no extra cost to you. We only recommend products and services we believe will genuinely help you achieve your financial goals.

Explore the hidden factors, personal impacts, and practical tips for managing inflation.

Introduction

Inflation is often reported as a simple, quantified number—a percentage change in prices over time. However, for many of us, the reality of inflation can feel much worse than what the official numbers suggest. If you’ve ever felt like your paycheck doesn’t go as far as it used to or that the cost of living is rising faster than the inflation rate reports, you’re not alone. But why does it feel this way? Understanding the deeper, psychological, and practical reasons behind why inflation hits harder than the statistics can help you make smarter financial choices and regain control over your finances.

In this article, we’ll break down the reasons why inflation feels worse than it is, including factors like personal spending habits, lifestyle changes, and the limitations of the Consumer Price Index (CPI). By the end, you’ll not only understand the full scope of inflation but also learn actionable steps to minimize its impact on your personal finances.

What Is Inflation, Really?

Before diving into why inflation can feel worse than it is, let’s first define what inflation actually is.

Inflation is the rate at which the general level of prices for goods and services rises, eroding the purchasing power of currency. Typically, inflation is measured by the Consumer Price Index (CPI), which tracks the prices of a basket of goods and services that represent the typical consumer’s spending habits. These include food, housing, transportation, healthcare, and other common expenses.

But here’s where it gets tricky—while inflation is measured by an index, it doesn’t necessarily reflect your personal experience with rising prices.

Why Does Inflation Feel Worse Than It Is?

- The CPI Doesn’t Reflect Your Unique Spending Habits

The Consumer Price Index is a broad measure that includes a variety of goods and services that might not apply to you. For example, if you don’t drive much, the rising cost of gas may not affect you as much as it does someone who commutes long distances. If you rent, rather than own a home, changes in housing prices may be more noticeable to you than the average person.

Moreover, the CPI assumes that everyone buys the same things in the same amounts, but we all have different lifestyles, needs, and preferences. As a result, your personal inflation rate—what you experience as rising costs—may be much higher than the national average.

- Rising Costs of Everyday Necessities

While the CPI may suggest that inflation is moderate, many of the expenses that hit hardest for everyday people—such as food, housing, and healthcare—have been rising at a faster pace. These essential items make up a large portion of most people’s budgets, and when their prices increase, it has a significant impact on your finances.

- Food: In recent years, the cost of groceries has been rising faster than the general inflation rate. Prices for meat, dairy, and produce are some of the most significant contributors to this.

- Healthcare: Medical expenses, especially insurance premiums and out-of-pocket costs, have been growing well beyond the inflation rate for decades.

- Housing: Home prices and rents have surged in many areas, creating additional pressure on household budgets.

For example, a 2023 survey from the Bureau of Labor Statistics revealed that food prices alone increased by over 10%, far outpacing the general inflation rate.

- The Impact of Supply Chain Disruptions

In the wake of the COVID-19 pandemic, global supply chains were disrupted in unprecedented ways. These disruptions caused shortages of goods and services, leading to price hikes that went beyond what would normally be expected in an inflationary environment. Whether it’s electronics, furniture, or basic raw materials, many industries faced significant delays and cost increases, which, in turn, affected consumer prices.

The Psychological Impact of Inflation

- Perception of Inflation Is Influenced by Your Personal Situation

Even if official inflation figures aren’t as high as they seem, our perception of inflation can be heavily influenced by our personal circumstances. For instance, if you’re living paycheck to paycheck, even a small increase in the cost of essentials like gas or groceries can feel like a significant financial burden.

Psychologists call this the “perception bias,” where individuals are more likely to focus on negative experiences (like a sudden increase in gas prices) rather than the more neutral or positive aspects of their financial lives. This makes inflation feel more oppressive than the raw numbers suggest.

- Inflation Creates Financial Anxiety

Seeing prices rise continuously can create an ongoing sense of financial anxiety. Even if inflation numbers are within a normal range, the constant feeling of “losing ground” can wear on individuals. This psychological pressure often results in a tightening of household budgets, cutting back on discretionary spending, and increasing worry about the future.

Can Inflation Be Controlled? What Can You Do?

- Government Measures to Tackle Inflation

Governments and central banks play a key role in controlling inflation, often by adjusting interest rates or implementing monetary policies. However, these measures take time to filter through the economy and may not immediately ease the pressure that consumers feel in their day-to-day lives.

The Federal Reserve, for instance, may raise interest rates to combat inflation, which in turn increases borrowing costs. This can reduce demand in the economy, slowing down price increases. But it also means higher costs for loans, credit cards, and mortgages, which can add to the financial strain for households.

- How You Can Combat Inflation in Your Personal Finances

There are several practical ways to manage inflation’s impact on your life. Here are a few steps you can take:

- Create a Budget: Focus on tracking your spending and cutting back on non-essential items. A good budget helps you understand where your money is going and how you can prioritize your expenses.

- Diversify Your Investments: Inflation erodes the value of cash, so consider investing in assets that can keep up with or outpace inflation, such as stocks, bonds, or real estate.

- Build an Emergency Fund: Having a cash buffer will give you peace of mind during times of financial stress. Aim for at least three to six months’ worth of living expenses saved in an easily accessible account.

- Explore Alternative Income Streams: Look for ways to earn extra money, such as starting a side business or investing in skills that increase your earning potential.

You can learn more about these strategies in our guide to building an emergency fund.

How to Survive High Inflation: Real-Life Case Study

Take Sarah, a 35-year-old single mom who works full-time as a teacher. Sarah has seen a rise in her grocery bills, gas prices, and child care costs. In addition to this, her rent has gone up by 8% over the past year. Despite these increases, her salary hasn’t changed.

To cope with these inflationary pressures, Sarah has adopted several strategies:

- Cutting Unnecessary Expenses: She stopped dining out as frequently and switched to budget-friendly grocery stores.

- Energy Savings: She invested in energy-efficient appliances to cut her utility bills.

- Flexible Work: She began tutoring on weekends to bring in extra income.

- Debt Management: Sarah refinanced her student loans to lower her monthly payments.

By taking these steps, Sarah managed to maintain her standard of living despite inflation’s impact on her budget.

Conclusion: Inflation May Be Unpredictable, But You Can Control How You Respond

While inflation may feel worse than the numbers suggest, there are strategies you can implement to reduce its impact on your finances. By staying informed, budgeting smartly, and investing wisely, you can take control of your financial future even in times of economic uncertainty.

Remember, inflation is just one piece of the financial puzzle. The real key to financial empowerment is understanding how economic forces work—and how to protect yourself from them. So, the next time you feel the squeeze of inflation, you’ll know that with the right tools, you can stay ahead.

References from Authoritative Sites

- Bureau of Labor Statistics – Consumer Price Index

The U.S. Bureau of Labor Statistics regularly updates the official inflation rate, providing the methodology and data behind the CPI measurement. This official source is critical for understanding how inflation is tracked and reported.

Bureau of Labor Statistics – CPI - Federal Reserve – Understanding Inflation

The Federal Reserve provides detailed explanations on how inflation impacts the economy, what drives inflation, and the role of central banks in managing inflation through monetary policy.

Federal Reserve – Understanding Inflation

Relevant Articles from TheMoneyQuestion.org

- How the Federal Reserve Controls Inflation

A deeper look into the Federal Reserve’s role in managing inflation, interest rates, and monetary policy. This article breaks down how these economic levers work to keep inflation in check and what you can do to navigate the environment. - The Debt Myth: Why Government Borrowing Isn’t Like a Household Budget

Learn why government borrowing and debt don’t follow the same principles as household budgets, and how this relates to inflation and national economic health.

FAQs

- How is inflation measured?

Inflation is typically measured by the Consumer Price Index (CPI), which tracks the average change in prices of a basket of goods and services. - Why does inflation feel worse than it is?

Personal circumstances, rising prices of essential goods, and perception biases all contribute to why inflation can feel more severe than reported figures suggest. - How can I protect my finances from inflation?

Diversify investments, track your budget, and consider building an emergency fund to mitigate the effects of rising prices. - What’s the relationship between inflation and interest rates?

Central banks raise interest rates to combat inflation, which can increase borrowing costs but may also slow down price increases. - Can inflation be controlled?

Governments and central banks take steps, such as adjusting interest rates, to try and control inflation, but these measures take time to be effective. - How does inflation affect my savings?

Inflation erodes the value of money over time, meaning your savings may lose purchasing power if they are not invested in inflation-protected assets. - What is the inflation rate?

The inflation rate is the percentage change in the cost of living over a specific period, typically measured annually. - Why are food prices rising faster than other goods?

Food prices have been rising due to supply chain disruptions, higher labor costs, and increased demand. - Does inflation affect everyone equally?

No, inflation affects individuals differently based on their personal spending habits and income levels. - Is there any way to predict inflation?

While inflation forecasts are available, predicting exact rates is difficult due to the many factors influencing the economy.

Affiliate Disclosure

This article may contain affiliate links to products or services we recommend. If you make a purchase through one of these links, we may earn a small commission at no additional cost to you.

Disclosure: This post may contain affiliate links. If you click through and make a purchase, The Money Question may earn a small commission at no additional cost to you. We only recommend products and services we genuinely believe in. See our full disclaimer for details.

What the Fed’s Move Means for Your Wallet

AFFILIATE DISCLOSURE:

This article contains affiliate links. We may receive a commission for purchases made through these links, at no extra cost to you. We only recommend products and services we believe will genuinely help you achieve your financial goals.

Learn how the Federal Reserve’s moves impact your finances. Understand the effects of rate changes, inflation, and more on your wallet.

Introduction: What Does the Fed’s Move Mean for Your Wallet?

If you’ve ever wondered how decisions made by the Federal Reserve (the Fed) affect your day-to-day finances, you’re not alone. The Fed’s actions, particularly interest rate changes, can have far-reaching consequences for everything from the cost of borrowing money to your savings account’s interest rate. In this article, we’ll break down the latest developments from the Fed and explain how these decisions could directly impact your wallet.

Understanding what the Fed does and how it affects the economy is crucial for anyone wanting to make informed financial decisions. Whether you’re saving for the future, buying a house, or managing debt, the Fed’s moves can play a significant role in your financial journey. We’ll explore what the Fed’s moves mean for your wallet, how they affect you in real terms, and offer practical tips to navigate these changes.

What Exactly Does the Federal Reserve Do?

Before diving into the specifics of how the Fed’s actions affect you, it’s important to understand what the Federal Reserve does. The Fed is the central bank of the United States, and it plays a crucial role in managing the country’s monetary policy. Its primary objectives include:

- Controlling inflation

- Promoting maximum employment

- Stabilizing interest rates

The Fed influences the economy primarily through its control of interest rates. By adjusting the federal funds rate, the Fed can either make borrowing cheaper or more expensive, which in turn affects consumer spending, business investment, and even the value of the dollar. Further reading can be found at Federal Reserve – Monetary Policy

How the Fed’s Moves Affect Your Finances

Interest Rates and Borrowing Costs: The Most Immediate Impact

The most direct way the Fed’s actions affect your wallet is through interest rates. When the Fed changes interest rates, it impacts the cost of borrowing money. For example:

1.Rising Interest Rates

- If the Fed raises interest rates, it becomes more expensive to borrow money. This affects mortgages, car loans, credit cards, and personal loans. If you have an adjustable-rate mortgage or credit card debt, higher rates can lead to higher monthly payments.

2. Falling Interest Rates

- On the flip side, if the Fed cuts rates, borrowing becomes cheaper. This can be great news if you’re in the market for a new home or car loan. It also means lower interest payments on any existing debt that’s tied to variable rates.

The Impact on Savings and Investments

The Fed’s actions also affect how much you earn on savings and investments.

1. Higher Interest Rates

- With higher interest rates, you may earn more on savings accounts, CDs (Certificates of Deposit), and other fixed-income investments. If you’re relying on interest income from your savings, higher rates are a good thing. However, this often comes with the trade-off of higher borrowing costs.

2. Lower Interest Rates

- When the Fed lowers rates, savings accounts and CDs generally offer lower interest rates. This means you’ll earn less on your savings. While this may seem frustrating, it can also encourage people to invest in riskier assets like stocks, as they look for higher returns.

Inflation: How the Fed Tries to Keep Prices in Check

Inflation, the general rise in prices over time, is one of the Fed’s primary concerns. When inflation rises too quickly, it erodes purchasing power, meaning you get less for the same amount of money.

1.The Fed and Inflation

- To control inflation, the Fed may increase interest rates, which reduces consumer spending and investment, helping to slow down the economy and bring inflation back to a manageable level.

2. Inflation and Your Wallet

- When inflation is high, you might notice your grocery bill, gas prices, and even rent are creeping up. The Fed’s moves to counter inflation aim to stabilize the economy, but they can come at a cost, particularly if you’re on a tight budget.

Should You Adjust Your Financial Strategy Based on the Fed’s Moves?

With the Fed’s influence on interest rates and inflation, it’s important to be proactive about your personal finances. Here are some steps to consider:

- Refinance Your Loans If Rates Are Low

If the Fed lowers rates, it could be a good time to refinance your mortgage, auto loan, or student loans. Refinancing at a lower rate can save you money over the life of your loan. However, if the Fed is raising rates, it’s probably better to lock in your current rate rather than take on new debt at a higher interest rate.

- Be Strategic With Your Savings

When interest rates are low, traditional savings accounts aren’t going to provide the returns they once did. Consider alternatives like:

- High-yield savings accounts

- Certificates of Deposit (CDs)

- Bonds or bond funds

If rates are higher, you’ll see more return on your savings, which makes it a great time to park your cash in safe, interest-bearing accounts.

- Consider the Impact of Inflation on Your Budget

In times of rising inflation, you’ll feel the pinch when paying for everyday goods and services. To counter this, look for ways to cut back on non-essential spending, build a bigger emergency fund, and seek out investments that outpace inflation, like stocks, real estate, or precious metals.

What About the Stock Market and Your Investments?

The Fed’s decisions also affect the stock market. When the Fed raises interest rates, it can be bad news for stocks, particularly for growth stocks that rely on cheap borrowing. In contrast, when the Fed lowers rates, it often stimulates the stock market, making it more attractive to investors.

1.Fed Rate Hikes

- Higher rates can make stocks less attractive as borrowing costs rise for companies. This could lead to lower stock prices, particularly in sectors like technology and real estate.

2.Fed Rate Cuts

- Lower rates often boost stock prices as it reduces borrowing costs and stimulates spending. Investors may flock to the stock market, seeking better returns than what’s available in savings accounts or bonds.

A Quick Look at Recent Fed Moves and Their Impact

Let’s consider a recent example of the Fed’s moves:

1. 2022-2023 Interest Rate Hikes

- As inflation surged during 2022 and 2023, the Fed raised interest rates to combat rising prices. This caused mortgage rates to climb, making it more expensive to buy a home. At the same time, stock market volatility increased as investors reacted to the higher cost of borrowing.

2. Post-Pandemic Economic Recovery

- Following the pandemic, the Fed slashed interest rates to record lows to stimulate the economy. This led to a boom in the housing market and a surge in stock prices as borrowing became easier and cheaper.

Conclusion: Staying Ahead of the Fed’s Moves

The Federal Reserve has a profound influence on your financial life, whether it’s through the interest rates on your loans or the returns on your savings. By staying informed about the Fed’s moves, you can make strategic decisions about borrowing, saving, and investing.

As a consumer, being proactive is key. Keep an eye on the Fed’s decisions, assess how they impact your wallet, and adjust your financial strategy accordingly. Understanding these moves is an important part of mastering your money and ensuring a secure financial future.

Relevant links to other posts on themonequestion.org :

- The Debt Myth: Why Government Borrowing Isn’t Like a Household Budget

-

Modern Monetary Theory: Rethinking Economics and Monetary Reform

Frequently Asked Questions

1. What happens if the Fed raises interest rates?

- When the Fed raises interest rates, it typically makes borrowing more expensive. This can affect mortgages, car loans, and credit card debt. However, it can also lead to higher interest rates on savings accounts and CDs.

2. How do interest rates affect my credit card bill?

- If the Fed raises interest rates, the interest rate on your credit card may also increase, meaning you’ll pay more on any outstanding balances.

3. Can the Fed control inflation?

- Yes, the Fed uses interest rates to control inflation. By raising rates, the Fed slows down the economy and reduces consumer spending, which helps bring inflation under control.

4. What should I do if inflation is high?

- When inflation is high, consider cutting back on unnecessary expenses, increasing your savings rate, and investing in assets that tend to outpace inflation, like stocks or real estate.

5. How do Fed rate cuts affect my mortgage?

- If the Fed cuts rates, mortgage rates usually fall, which can make it cheaper to buy a home or refinance your existing mortgage.

6. Should I refinance my loans if the Fed raises rates?

- It may not be a good time to refinance if the Fed is raising rates, as new loans will likely come with higher interest rates.

7. Does the Fed’s move impact my retirement account?

- Yes, the Fed’s moves can affect the stock market and bond market, which can impact your retirement investments.

8. How often does the Fed change interest rates?

- The Fed meets regularly throughout the year to evaluate economic conditions and decide whether interest rates need to be adjusted. These meetings usually occur eight times a year.

9. What does the Fed do to reduce unemployment?

- By lowering interest rates, the Fed makes borrowing cheaper, which stimulates business investment and hiring, helping to reduce unemployment.

10. Can I prepare for a Fed rate hike?

- Yes, you can prepare by paying down high-interest debt, refinancing loans, and reviewing your investment portfolio to ensure it’s aligned with potential interest rate changes.

Affiliate Disclosure

This article may contain affiliate links. If you purchase through them, we may receive a small commission at no extra cost to you. Thank you for supporting TheMoneyQuestion.org!

Understanding Money 101: Master the Basics and Take Control of Your Financial Future

AFFILIATE DISCLOSURE:

This article contains affiliate links. We may receive a commission for purchases made through these links, at no extra cost to you. We only recommend products and services we believe will genuinely help you achieve your financial goals.

Learn how money really works with this clear, beginner-friendly guide. Understanding money 101 starts here—empower your finances today.

Introduction: Why Understanding Money is the First Step to Financial Freedom

Money impacts everything—from where we live to how we eat, travel, and retire. But how many of us truly understand what money is, how it works, and how to make it work for us?

Understanding Money 101 isn’t just about balancing a budget or saving a few dollars. It’s about gaining financial confidence so you can build a life with less stress, more freedom, and greater purpose. Whether you’re just starting your financial journey or ready to level up, this guide will give you the knowledge you need to take control—once and for all.

What is Money, Really?

Understanding the True Nature of Money

At its core, money is a tool. It’s a medium of exchange, a store of value, and a unit of account. But it’s also a social agreement—its value exists because we collectively believe in it.

Functions of Money

- Medium of exchange: Used to buy goods and services

- Store of value: Retains worth over time

- Unit of account: Standardized way to measure value

Modern money is mostly digital. According to the Federal Reserve, over 90% of U.S. dollars exist not as cash, but as digits on a screen.

Authoritative Source: Federal Reserve – What is Money?

How Money is Created and Who Controls It

Money doesn’t come from thin air—but it doesn’t always come from the government either. Most money is created by commercial banks when they issue loans.

Two Types of Money

- Central bank money: Physical cash and reserves

- Bank money (credit money): Created by private banks through lending

Want to go deeper? Check out our article:

Who Really Owns the Central Banks? Let’s Clear Up the Confusion

The Big Question—Is Inflation Inevitable?

“Is inflation always bad, or is it a necessary part of a healthy economy?”

Inflation gets a bad rap, but not all inflation is harmful. A moderate amount is actually a sign of a growing economy. Problems arise when inflation outpaces wages or results from supply shocks and profit-seeking.

Quick Breakdown:

- Mild inflation (1–3%): Normal and manageable

- High inflation (>5%): Can hurt purchasing power

- Deflation: Often worse, leading to economic stagnation

Bureau of Labor Statistics: Understanding Inflation

Understanding Personal Money Management

Start Where You Are—Not Where You Think You Should Be

You don’t need to be rich to manage money well. You need a system. Let’s break it down into core pillars:

Budgeting Basics

- Use the 50/30/20 rule:

-

- 50% needs, 30% wants, 20% savings/debt payoff

- Use a budgeting tool like You Need A Budget (YNAB) or EveryDollar

Try YNAB today to take control of your spending.

H3: Building Savings

- Set up automatic transfers to savings

- Create a 3–6 month emergency fund

- Open a high-yield savings account (like with Ally or SoFi)

We recommend SoFi for high-yield savings with no fees.

Understanding Credit: How to Build and Use it Wisely

Credit isn’t just about loans—it’s your financial reputation.

How Credit Works

- Based on your credit score and credit report

- Used to determine loan eligibility and interest rates

Tips for Better Credit

- Pay bills on time

- Keep credit usage below 30%

- Don’t close old accounts

- Check reports regularly at AnnualCreditReport.com

Try Credit Karma to track your credit progress and get personalized tips.

Investing for Beginners

You Don’t Have to Be Rich to Start Investing

Start small. Start now. Let compound interest do the heavy lifting.

Beginner-Friendly Investment Types

- Index funds: Low-cost and diversified

- Robo-advisors: Tools like Betterment or Wealthfront automate everything

- Retirement accounts: Max out your 401(k) or IRA contributions

Open a Betterment account to start investing automatically with as little as $10.

How to Think About Debt

Not all debt is bad. The key is knowing the difference between helpful and harmful debt.

Types of Debt

- Good debt: Student loans, mortgages (if affordable)

- Bad debt: High-interest credit cards, payday loans

Action Tip: If you have high-interest debt, consider a balance transfer card or debt consolidation loan.

Check out Upgrade for affordable personal loans to help consolidate debt fast.

Build Your Own Financial System (Free Download)

Consistency beats complexity. Use our Free Money Management Checklist to build a weekly and monthly routine.

Download: Financial Empowerment Checklist (PDF)

Internal Resources to Go Deeper

Explore more from our site:

- Understanding Money 101: Your Guide to Managing Finances With Confidence

- Modern Monetary Theory: Rethinking Economics and Monetary Reform

Conclusion: You Don’t Need to Be an Expert—You Just Need a Plan

Understanding money isn’t about mastering complex formulas or becoming a Wall Street guru. It’s about having a clear picture of where you stand, where you want to go, and what tools can help you get there. With the knowledge in this guide, you’re already well ahead of the curve. Keep learning. Stay curious. And always remember—you are the best investment you can make.

FAQ: Understanding Money 101

- What is money in simple terms?

Money is a tool we use to buy things, save for later, and measure value.

- Why is understanding money important?

Because every decision you make in life has a financial impact—from careers to housing and health.

- How is money created?

Most money is created when banks make loans, not by printing bills.

- What’s the difference between credit and debit?

Credit lets you borrow money; debit uses your own money directly.

- How do I start budgeting if I live paycheck to paycheck?

Start with a simple plan like the 50/30/20 rule and track every expense for 30 days.

- Is it better to save or invest?

Do both. Save for short-term needs and emergencies; invest for long-term growth.

- What is compound interest?

It’s interest that earns interest—your money grows faster over time.

- How can I improve my credit score fast?

Pay on time, lower credit usage, and fix any errors on your credit report.

- Is all debt bad?

No. Good debt can help build wealth (like student loans or mortgages). Bad debt drains it.

- Where should I start if I want to learn more about money?

Right here. Bookmark this guide and explore other topics at TheMoneyQuestion.org.

Your Go-To Guide for Virtual Wealth System Resources

| Platform | Best For | Pricing | Perks |

| Shopify | Online stores | From $39/month | Easy setup for e-commerce. |

| Wealthfront | Automated investing | 0.25% annual fee | Hands-off and low-cost. |

| ClickFunnels | Sales funnels | From $127/month | Great for boosting sales. |

| Robinhood | Stock trading | Free, premium optional | Beginner-friendly with no hidden fees. |

| Zapier | Task automation | Free, paid from $20/mo | Connects apps and saves time. |

Key Takeaway: Virtual wealth systems offer tools to help you grow and manage your finances digitally. The right resources can boost your results and simplify your journey.

AFFILIATE DISCLOSURE:

This article contains affiliate links. We may receive a commission for purchases made through these links, at no extra cost to you. We only recommend products and services we believe will genuinely help you achieve your financial goals.

What Exactly Are Virtual Wealth Systems?

- Virtual wealth systems: These are digital platforms designed to help you build and manage wealth online. They cover everything from investing and trading to affiliate marketing and e-commerce. These systems bring together automation, analytics, and educational tools to save you time and energy.