The Gold Standard Debate: Should We Return to Backed Money?

AFFILIATE DISCLOSURE:

This article contains affiliate links. We may receive a commission for purchases made through these links, at no extra cost to you. We only recommend products and services we believe will genuinely help you achieve your financial goals.

Explore the gold standard debate — should modern economies return to gold-backed money, or is fiat currency the better path forward?

Introduction: Why The Gold Standard Debate Still Matters Today

If there’s one topic that never seems to lose its shine in economic circles, it’s the gold standard debate. From YouTube finance influencers to policymakers and everyday savers, many are asking: Should we bring back money backed by gold?

The question isn’t just about nostalgia for shiny coins or distrust in “paper money.” It cuts to the heart of how value is created, stored, and protected in our financial system. In an age of inflation fears, digital currencies, and mounting government debt, people are searching for a system that feels real again — one grounded in something tangible.

So, should we go back to the gold standard? Or has the world moved beyond it for good?

Let’s unpack the history, arguments, and real-world implications — and see how this debate connects directly to your financial life today.

️ What Was the Gold Standard?

The gold standard was a monetary system where a country’s currency was directly tied to a specific amount of gold. For example, under the U.S. gold standard of the early 20th century, $35 equaled one ounce of gold. That meant every dollar in circulation could theoretically be exchanged for gold held in government vaults.

This system limited how much money could be created. The government couldn’t print more money unless it had more gold to back it up. Supporters say that kept inflation low and disciplined public spending.

Types of Gold Standards:

- Classical Gold Standard (1870–1914): Money was fully convertible to gold, and global trade was stable.

- Gold Exchange Standard (1925–1931): Countries held foreign currencies (like U.S. dollars or British pounds) backed by gold.

- Bretton Woods System (1944–1971): The U.S. dollar was pegged to gold, and other nations pegged their currencies to the dollar.

When President Richard Nixon ended dollar convertibility to gold in 1971, the world entered the era of fiat money — currency not backed by a commodity, but by government decree and economic trust.

⚖️ Fiat Money vs. Gold-Backed Money: What’s the Real Difference?

The debate often boils down to control versus stability.

Feature Gold-Backed Money Fiat Money

Value Basis Linked to a physical commodity (gold) Based on government trust and regulation

Money Supply Control Limited by gold reserves Determined by central banks

Inflation Control Naturally constrained Requires policy discipline

Economic Flexibility Restricted (limited stimulus) Highly flexible

Historical Stability Long-term stable prices Prone to inflation and crises

Crisis Response Slow — limited tools Quick — central banks can print money

Fiat systems allow nations to respond to crises like COVID-19 or financial crashes by injecting liquidity. But critics argue this power often leads to debt bubbles, currency devaluation, and inequality.

“Gold Standard vs. Fiat Money Comparison Template”

Use this simple template to compare how each system affects you personally.

Reflect and fill in your own observations.

Category Gold Standard System Fiat System (Today’s Money) Your Reflection

Money Creation Backed by physical gold reserves Created digitally or through lending _______________

Inflation Impact Historically low Often higher, depends on policy _______________

Savings Power Stable value over time Subject to erosion by inflation _______________

Debt and Borrowing Limited government borrowing High debt flexibility _______________

Economic Growth Slower but steadier Faster but volatile _______________

Financial Stability Hard money discipline Dependent on trust and regulation _______________

Personal Comfort Level Tangible security Policy-driven confidence _______________

Tip: Use this template as part of your personal financial education journal — track how your beliefs about money evolve as you understand the system better.

The Case For the Gold Standard

Advocates believe that returning to gold-backed money could restore trust and discipline in the economy. Here are the key arguments:

1. Inflation Control

Because money creation would be limited by gold reserves, governments couldn’t inflate away debt or overspend.

2. Fiscal Discipline

The gold standard forces governments to live within their means — reducing reckless deficit spending and long-term debt accumulation.

3. Stable Value

Over centuries, gold has retained its value better than any fiat currency. This stability can restore confidence for savers and investors.

4. Global Trust

A universal gold-based system could stabilize international exchange rates and reduce speculative currency wars.

As economist Milton Friedman once said:

“Inflation is taxation without legislation.”

The gold standard, in theory, prevents that kind of hidden tax.

The Case Against the Gold Standard

Critics argue that while gold may shine, it can also trap economies in rigidity.

1. Limited Flexibility

In times of crisis, such as the Great Depression, the gold standard prevented central banks from increasing the money supply to revive the economy.

2. Deflation Risk

When money supply can’t expand, prices fall — leading to wage cuts, job losses, and economic stagnation.

3. Resource Dependence

Economic growth would depend on mining more gold — not innovation or productivity.

4. Unequal Gold Distribution

Countries rich in gold (like the U.S. post–World War II) would dominate, leaving others vulnerable to external shocks.

5. Not Fit for the Digital Age

Modern economies rely on electronic transfers, derivatives, and dynamic credit systems — not physical metal locked in vaults.

A Balanced View: Could a Partial Gold Standard Work?

Some economists propose a hybrid system — where currencies are partially backed by gold, digital assets, or a commodity basket.

This could combine the stability of hard assets with the flexibility of fiat systems.

For example:

- The International Monetary Fund (IMF) has explored “Special Drawing Rights” (SDRs) as a diversified reserve currency.

- Central banks could issue digital currencies (CBDCs) with fractional gold backing to maintain public confidence.

Such innovations could represent a “Gold Standard 2.0” — not a step backward, but an evolution toward responsible money creation.

Trending Question: Would Returning to the Gold Standard Stop Inflation?

This is one of the most common questions driving the gold standard debate with strong arguments on both sides.

In theory, yes — tying money to gold would limit inflation by limiting the money supply and imposing fiscal discipline. But in practice, it is not guaranteed to stop inflation and could limit economic growth and increase unemployment during downturns resulting in economic instability and a loss of monetary policy flexibility to manage it.

The U.S. Congressional Research Service (CRS) notes that the Great Depression worsened because the gold standard restricted government action (source: crsreports.congress.gov).

Meanwhile, the Federal Reserve explains that fiat flexibility has helped stabilize output and prices since 1971 (federalreserve.gov).

So, while gold backing could discipline policy, it’s not a magic cure. The real solution lies in responsible governance, not just shiny metal.

What It Means for You: How This Debate Impacts Your Finances

Even if we never return to a gold standard, understanding this debate helps you make smarter decisions.

✅ 1. Inflation Awareness

Knowing how fiat systems work helps you protect your savings with inflation-hedged assets (like TIPS, real estate, or diversified ETFs).

✅ 2. Diversified Investing

Gold can be part of a balanced portfolio — not because of nostalgia, but as a hedge against monetary uncertainty.

✅ 3. Debt Perspective

In fiat systems, debt is a feature, not a flaw. Understanding this lets you navigate credit systems and government borrowing logically.

✅ 4. Critical Thinking

When politicians or influencers promise “sound money” through gold, you’ll be able to ask: How would that affect jobs, liquidity, and growth?

To deepen your understanding:

Internal Links (TheMoneyQuestion.org)

- Who Really Controls the Money? A Look at Central Banks

- The Debt Myth: Why Government Borrowing Isn’t Like a Household Budget

External Links

-

Federal Reserve History – The End of the Gold Standard https://www.federalreservehistory.org/essays/gold-standard

Overview from the Federal Reserve on why the U.S. ended gold convertibility in 1971 and the long-term economic implications. -

Congressional Research Service (CRS) – Returning to the Gold Standard: Historical and Policy Perspectives

https://crsreports.congress.gov/product/pdf/R/R43890

A nonpartisan U.S. government analysis explaining the potential effects of reinstating a gold-backed monetary system. -

Investopedia – What Is the Gold Standard?

→ https://www.investopedia.com/terms/g/goldstandard.asp

Educational reference summarizing the gold standard’s history, advantages, and disadvantages in accessible language.

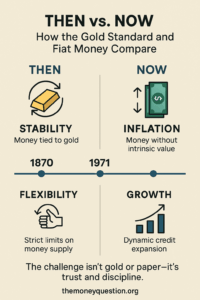

“Then vs. Now: How the Gold Standard and Fiat Money Compare”

Sections:

- Visual timeline (1870 → 1971 → Today)

- Icons for stability, inflation, flexibility, and growth

- Key takeaway: “The challenge isn’t gold or paper — it’s trust and discipline.”

- Add footer: themoneyquestion.org

Key Takeaways

- The gold standard offered stability, but limited flexibility.

- Fiat money offers flexibility, but risks inflation and overspending.

- The best system may blend discipline with innovation.

- Understanding money’s foundation empowers smarter financial choices.

Conclusion: Beyond the Gold Standard Debate

The gold standard debate isn’t just academic — it’s about who controls money, and how that control affects your life.

Whether we back currency with gold, digital code, or trust, the key issue remains accountability.

If citizens understand money creation, demand transparency, and make informed personal choices, the system becomes stronger — whatever form it takes.

Gold isn’t the answer. But the discipline it represents might be the one lesson modern money still needs.

FAQs: The Gold Standard Debate

1. What was the purpose of the gold standard?

The gold standard aimed to ensure monetary stability by tying each unit of currency to a fixed quantity of gold. This limited governments from creating money arbitrarily and helped control inflation. It also made international trade smoother because exchange rates were predictable and trusted.

2. Why did the U.S. abandon the gold standard?

The U.S. left the gold standard in 1971 when President Nixon ended convertibility to preserve economic flexibility. Global trade imbalances and postwar spending made it impossible to maintain fixed gold prices. Moving to fiat money allowed the government and Federal Reserve to respond more effectively to inflation, unemployment, and recession pressures.

3. Would a return to gold stop inflation permanently?

A gold-backed system could reduce inflation by limiting the money supply, but it wouldn’t eliminate it entirely. Prices also depend on productivity, wages, and global demand. Historically, gold standards have sometimes caused deflation, which can be just as harmful as inflation.

4. Is gold-backed money safer than fiat money?

Gold-backed money can feel safer because its value is linked to a tangible asset rather than government trust. However, this safety comes at the cost of flexibility — governments can’t easily stimulate growth or respond to crises. Fiat systems rely on policy discipline instead of metal reserves for stability.

5. Can digital currencies be gold-backed?

Yes, several new technologies allow for digital currencies partially backed by gold. Central Bank Digital Currencies (CBDCs) or stablecoins could use gold reserves to ensure value stability while allowing digital efficiency. This hybrid model combines traditional trust with modern innovation.

6. What caused the Great Depression under the gold standard?

During the Great Depression, the gold standard limited how much money governments could create to boost their economies. As prices and wages fell, deflation deepened the downturn. Countries that left the gold standard earlier — like the U.K. — recovered faster than those that stayed tied to it.

7. Does any country use the gold standard today?

No major economy operates on the gold standard today; all use fiat money issued by central banks. However, countries like Switzerland and Singapore maintain strong gold reserves as part of their financial security strategy. Gold remains an important reserve asset, even without direct convertibility.

8. Should investors buy gold now?

Gold can be a good diversification tool, especially during times of inflation or market uncertainty. Financial advisors often recommend allocating 5–10% of your portfolio to gold or similar assets. It’s not about betting on a gold standard comeback — it’s about hedging against fiat volatility.

9. What are the pros of fiat money?

Fiat money gives governments and central banks the flexibility to manage the economy, fund public programs, and respond to crises. It allows for credit expansion and innovation, which drive growth. The challenge is maintaining discipline so that flexibility doesn’t lead to runaway inflation.

10. What’s the biggest takeaway from the gold standard debate?

The real question isn’t whether we should return to gold — it’s whether we can create a responsible and transparent monetary system. Sound money depends more on good governance and informed citizens than on any metal. Understanding both systems empowers you to make better financial and policy judgments.

Affiliate Disclosure

Some links on this page may be affiliate links. This means we may earn a small commission at no extra cost to you if you purchase through them.

Disclaimer: The content provided is for informational purposes only and is not a substitute for professional financial or legal advice.

Leave a Reply